Question

3. Assume that there is no arbitrage in the market. A forward contract is available on one ton of a physical asset. The asset

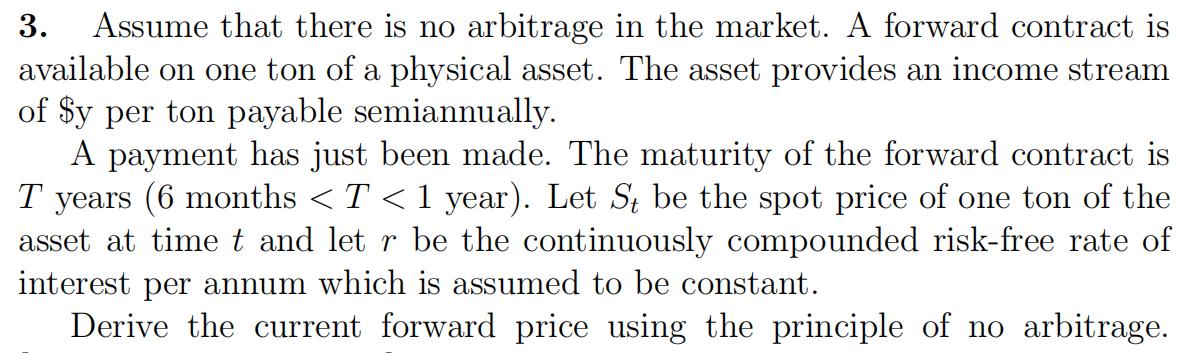

3. Assume that there is no arbitrage in the market. A forward contract is available on one ton of a physical asset. The asset provides an income stream of $y per ton payable semiannually. A payment has just been made. The maturity of the forward contract is T years (6 months < T < 1 year). Let St be the spot price of one ton of the asset at time t and let r be the continuously compounded risk-free rate of interest per annum which is assumed to be constant. Derive the current forward price using the principle of no arbitrage.

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

ANS WER The current forward price is equal to the present value of the income s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

University Physics with Modern Physics

Authors: Hugh D. Young, Roger A. Freedman, A. Lewis Ford

13th edition

321696867, 978-0321696861

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App