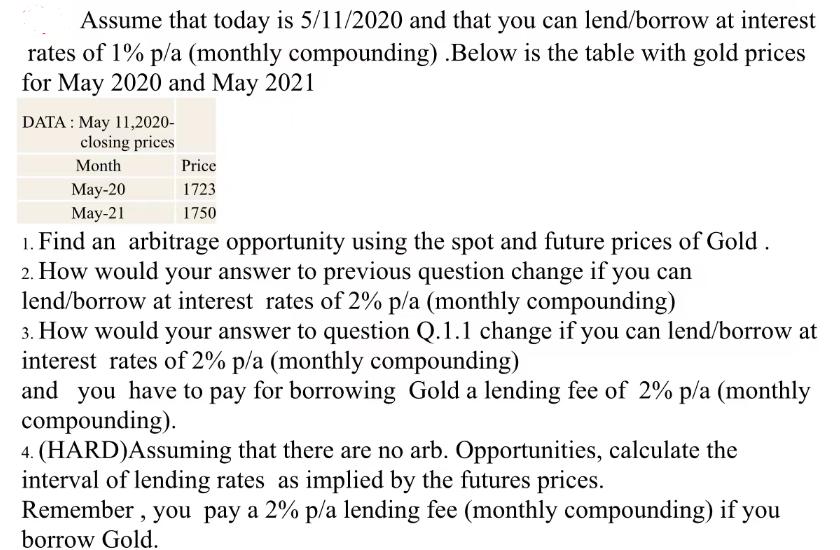

Assume that today is 5/11/2020 and that you can lend/borrow at interest rates of 1% p/a (monthly compounding) .Below is the table with gold

Assume that today is 5/11/2020 and that you can lend/borrow at interest rates of 1% p/a (monthly compounding) .Below is the table with gold prices for May 2020 and May 2021 DATA: May 11,2020- closing prices Month May-20 May-21 Price 1723 1750 1. Find an arbitrage opportunity using the spot and future prices of Gold. 2. How would your answer to previous question change if you can lend/borrow at interest rates of 2% p/a (monthly compounding) 3. How would your answer to question Q.1.1 change if you can lend/borrow at interest rates of 2% p/a (monthly compounding) and you have to pay for borrowing Gold a lending fee of 2% p/a (monthly compounding). 4. (HARD)Assuming that there are no arb. Opportunities, calculate the interval of lending rates as implied by the futures prices. Remember, you pay a 2% p/a lending fee (monthly compounding) if you borrow Gold.

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started