Assume that Valhalla decides to make the investment: What valuation do you think is appropriate at an assumed discount rate of 50%? What would be

Assume that Valhalla decides to make the investment: What valuation do you think is appropriate at an assumed discount rate of 50%? What would be Valhalla’s expected IRR from the investment at a $5 million pre-money valuation? What would be Valhalla’s expected IRR from the investment at a $10 million pre-money valuation. Remember to specify justifications for any assumptions that you use in your calculations (such as any expected series B rounds). Hint: Analyze the expected cash flows for Valhalla, not TX

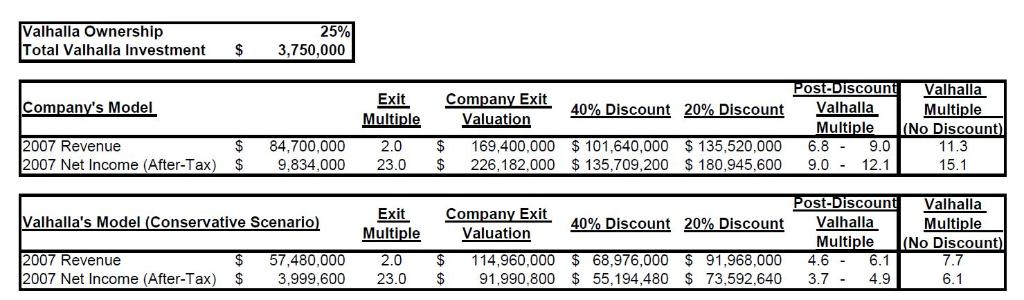

Valhalla Ownership Total Valhalla Investment 25% 3,750,000 $ Post-Discount Exit Multiple Company Exit Valuation Valhalla Multiple (No Discount) 11.3 Company's Model 40% Discount 20% Discount Valhalla Multiple 6.8 - 2007 Revenue 2007 Net Income (After-Tax) $4 169,400,000 $ 226,182,000 $ 101,640,000 $ 135,520,000 $ 135,709,200 $ 180,945,600 $ 84,700,000 9,834,000 2.0 9.0 23.0 9.0 - 12.1 15.1 Post-Discount Company Exit Valuation Valhalla Multiple (No Discount) 7.7 Valhalla's Model (Conservative Scenario) Exit Multiple 40% Discount 20% Discount Valhalla Multiple 4.6 - 2007 Revenue 57,480,000 114,960,000 $ $ 68,976,000 $ 91,968,000 $ 55,194,480 $ 73,592,640 2$ 2.0 6.1 2007 Net Income (After-Tax) 2$ 3,999,600 23.0 91,990,800 3.7 - 4.9 6.1

Step by Step Solution

3.35 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

In ther wrds ne hundred ten future rie whilst disunted by mens f the rte f 10 is wrth 100 gift rie s f nwdys If ne knws r n resnbly redit ll suh desti...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started