Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that Westgate Constructions contract with Santa Clara County does not qualify for revenue recognition over time. Required: 1. Calculate the amount of revenue and

Assume that Westgate Constructions contract with Santa Clara County does not qualify for revenue recognition over time.

Required:

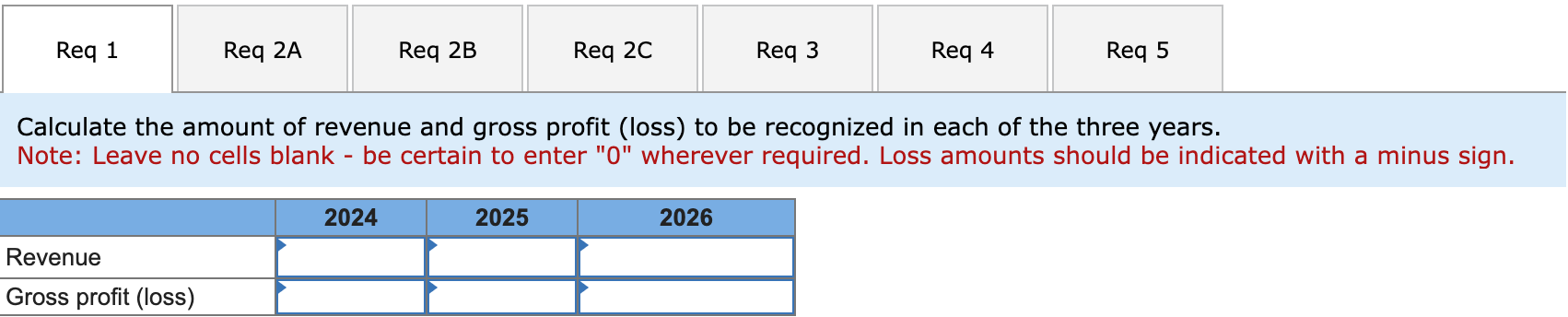

1. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years.

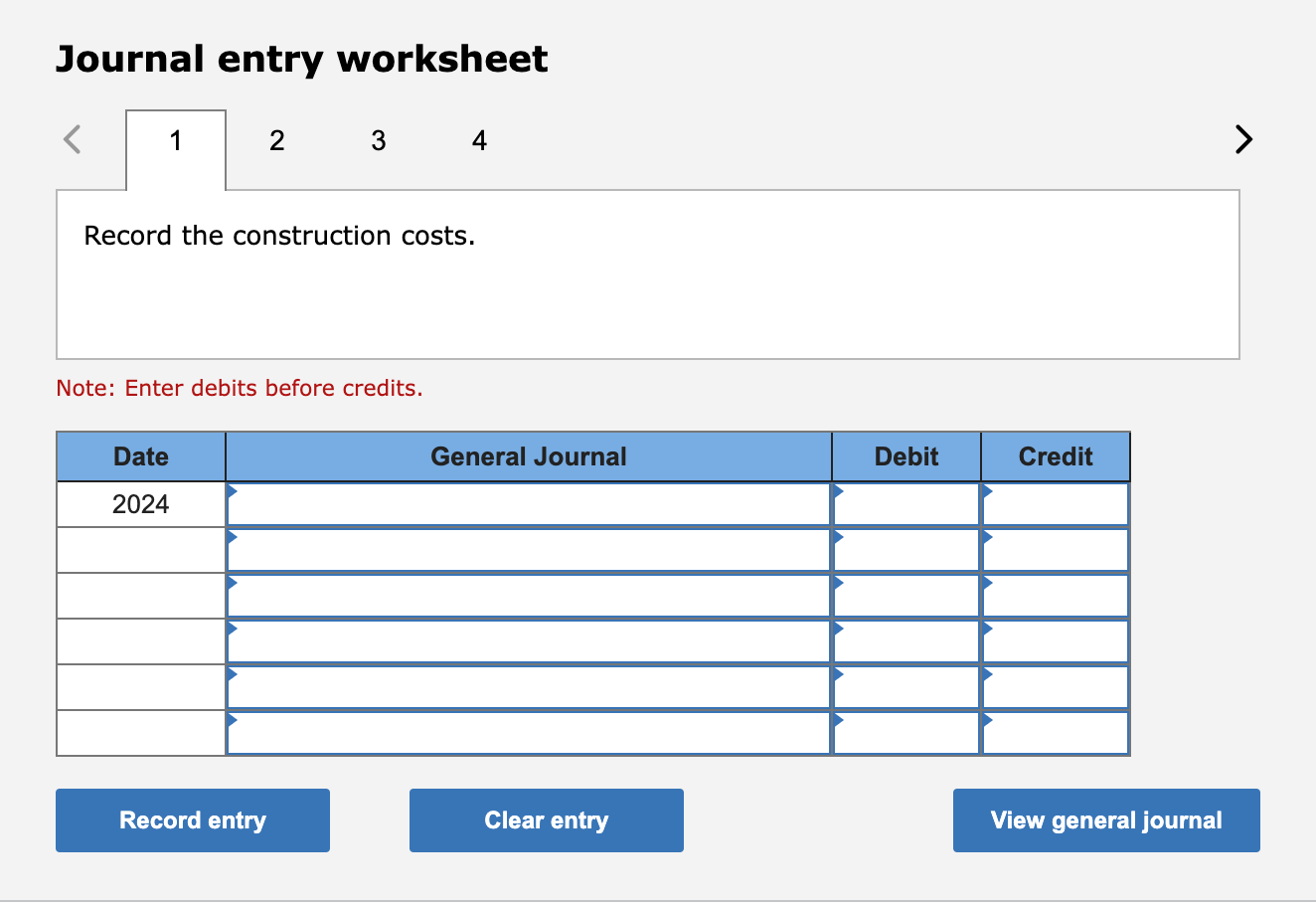

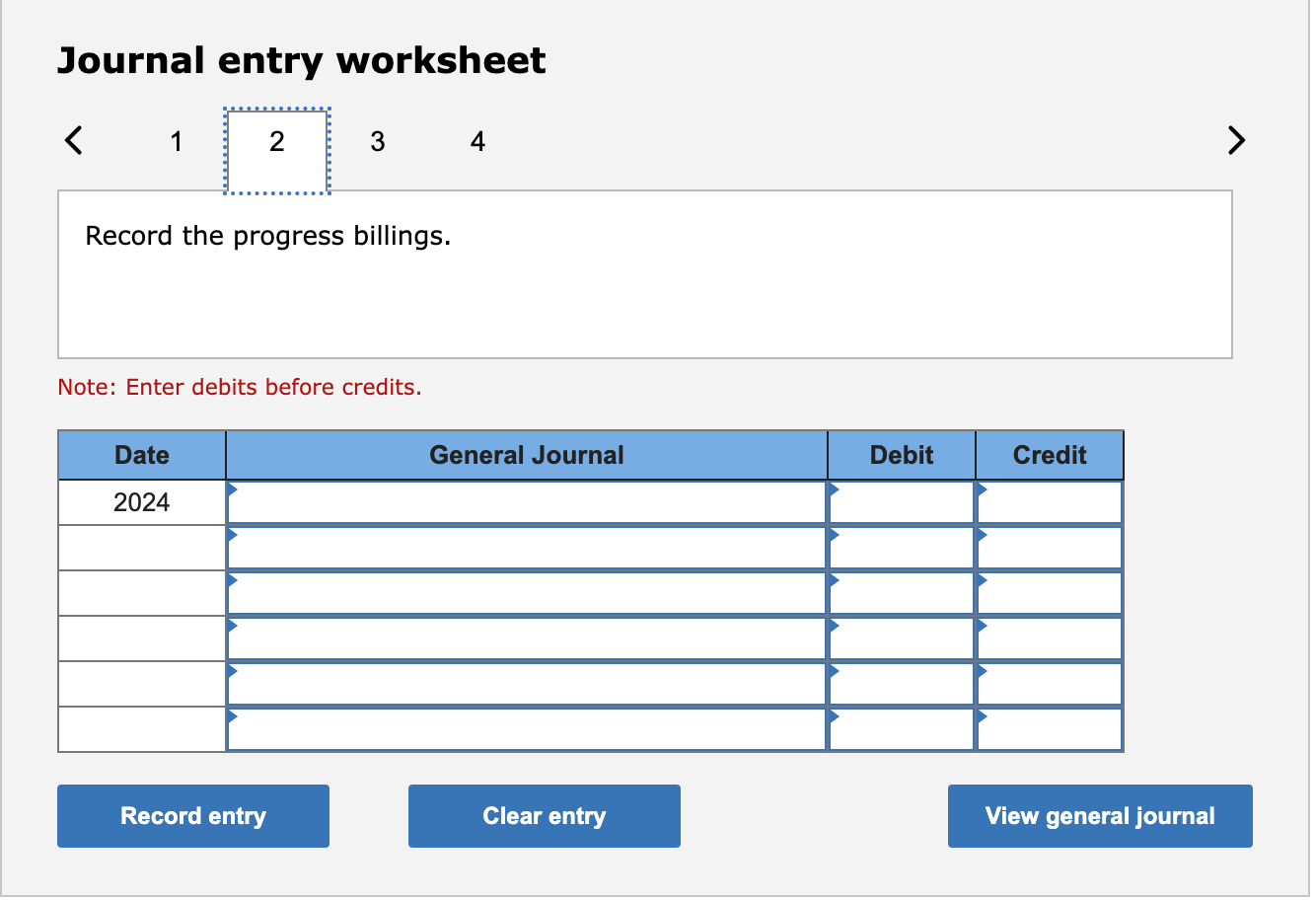

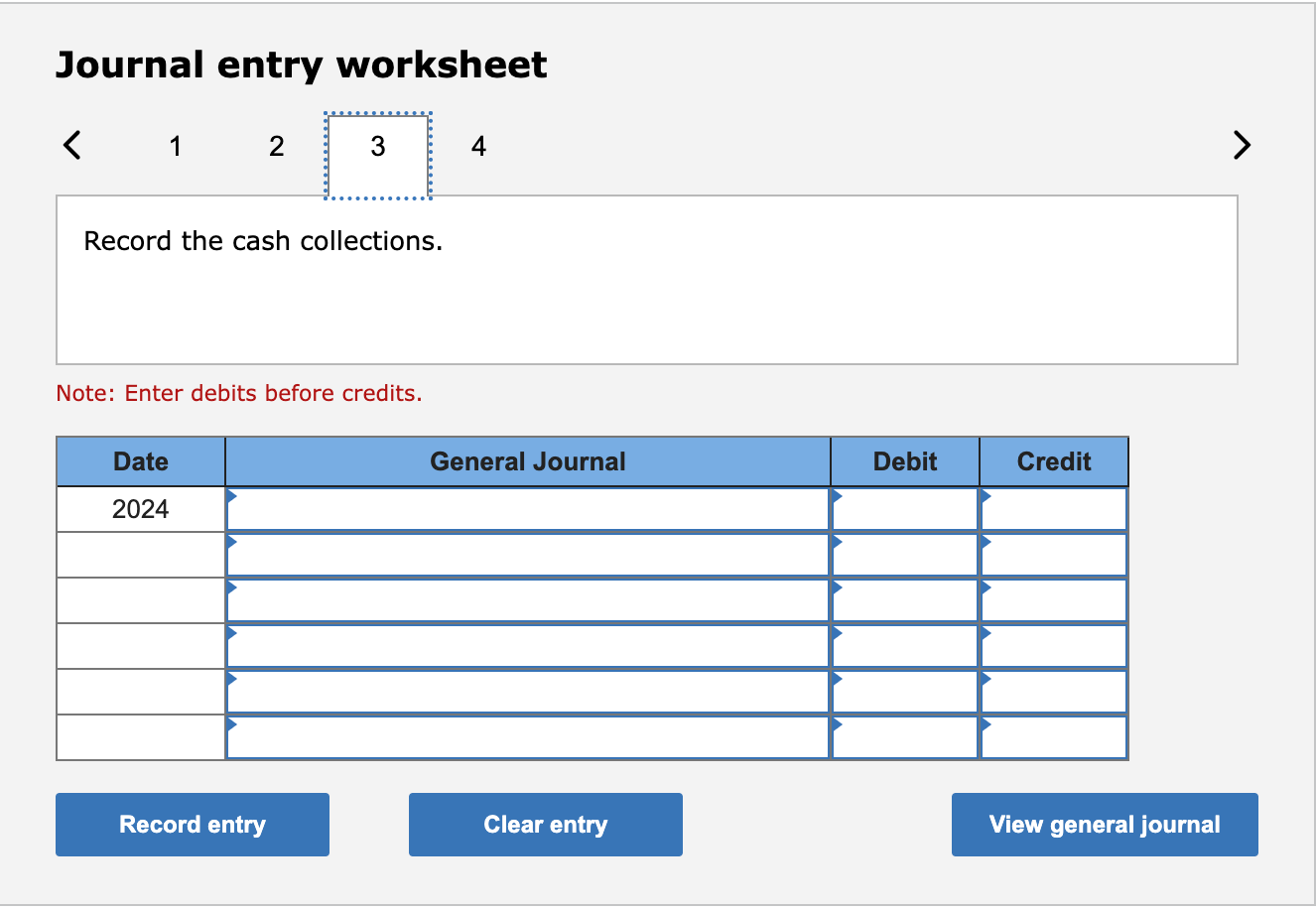

2-a. In the journal below, complete the necessary journal entries for the year 2024 (credit Cash, Materials, etc. for construction costs incurred).

| 2024 | 2025 | 2026 | |

|---|---|---|---|

| Cost incurred during the year | $ 2,580,000 | $ 3,890,000 | $ 3,280,000 |

| Estimated costs to complete as of year-end | 5,780,000 | 3,280,000 | 0 |

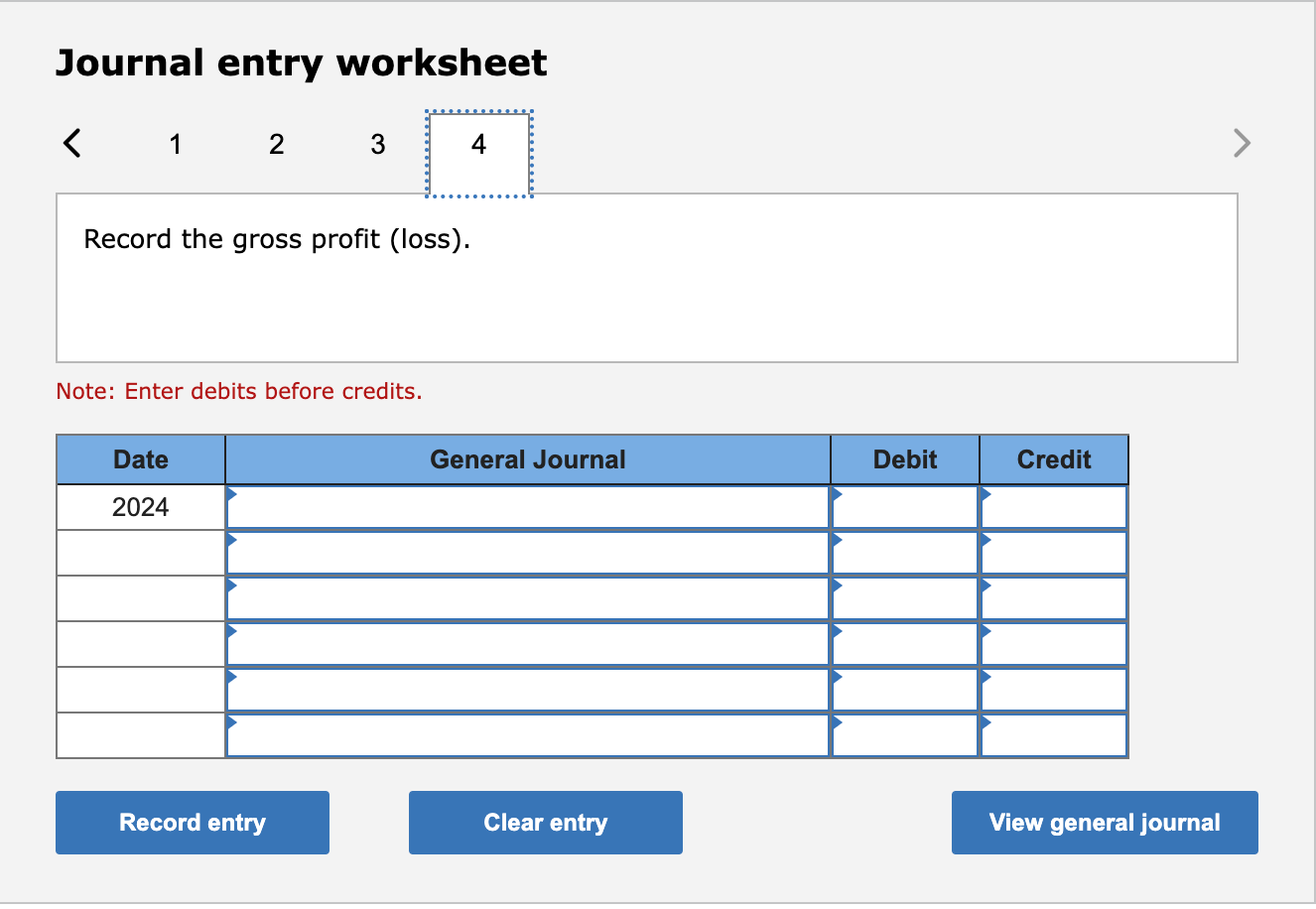

Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. Note: Leave no cells blank - be certain to enter "0" wherever required. Loss amounts should be indicated with a minus sign. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the gross profit (loss). Note: Enter debits before credits. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. Note: Leave no cells blank - be certain to enter "0" wherever required. Loss amounts should be indicated with a minus sign. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the gross profit (loss). Note: Enter debits before credits

Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. Note: Leave no cells blank - be certain to enter "0" wherever required. Loss amounts should be indicated with a minus sign. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the gross profit (loss). Note: Enter debits before credits. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. Note: Leave no cells blank - be certain to enter "0" wherever required. Loss amounts should be indicated with a minus sign. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the gross profit (loss). Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started