Answered step by step

Verified Expert Solution

Question

1 Approved Answer

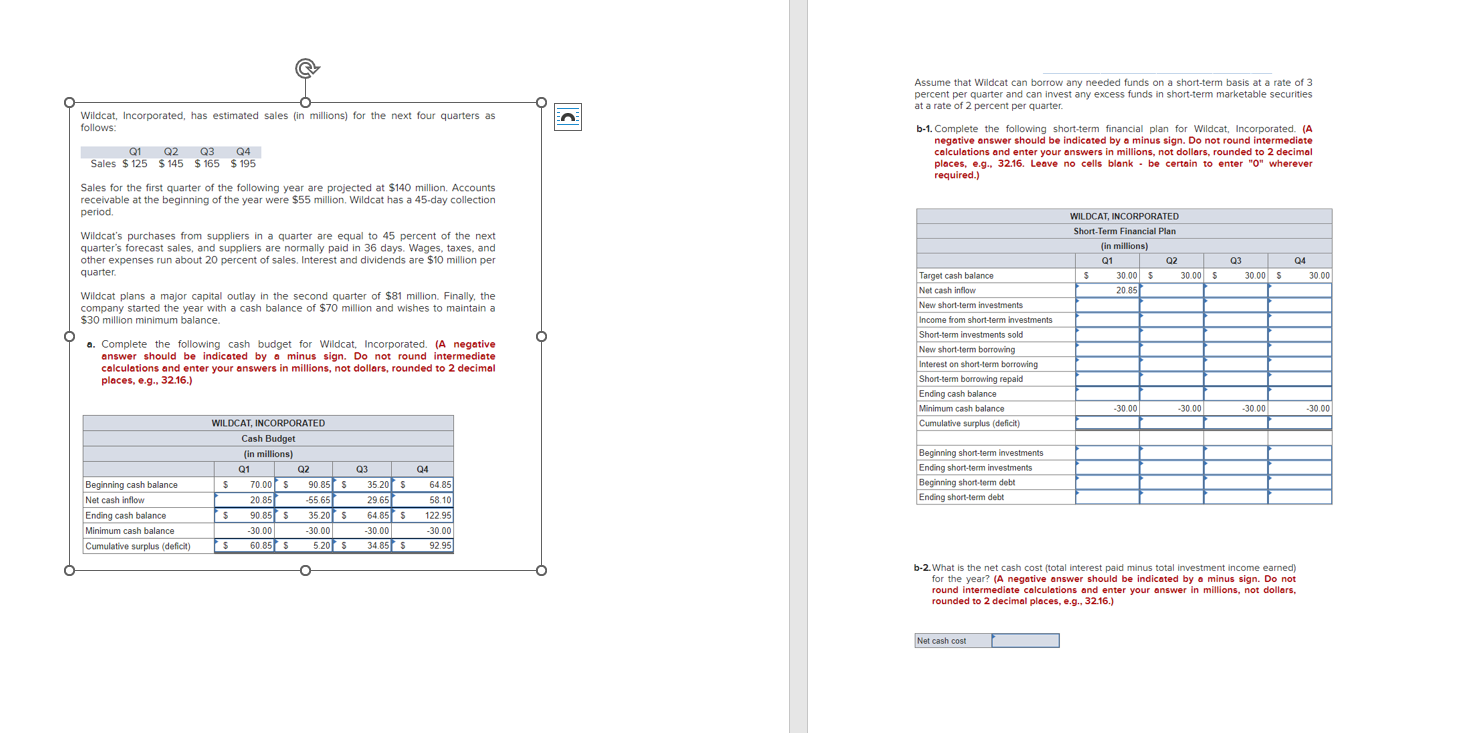

Assume that Wildcat can borrow any needed funds on a short - term basis at a rate of 3 percent per quarter and can invest

Assume that Wildcat can borrow any needed funds on a shortterm basis at a rate of

percent per quarter and can invest any excess funds in shortterm marketable securitie

at a rate of percent per quarter.

calculations and enter your answers in millions, not dollars, rounded to decimal places, eg Leave no cells blank be certain to enter wherever required.

required.

What is the net cash cost total interest paid minus total investment income earned

for the year? A negative onswer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in millions, not dollors.

rounded to decimal places, eg I need help filing this out per the book i have gotten the cash budget section correct but need help with the Short Term Financial plan and the net cas cost. I need help with filling out the short term financial plan some of it filled based on the book Part A is correct per the book I need help with B and B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started