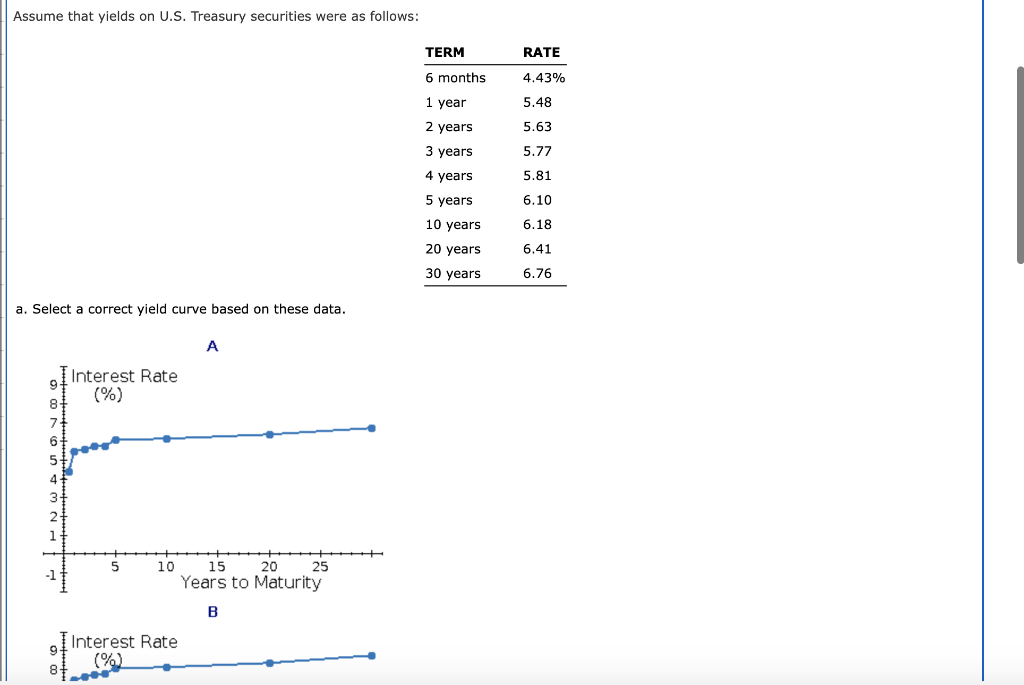

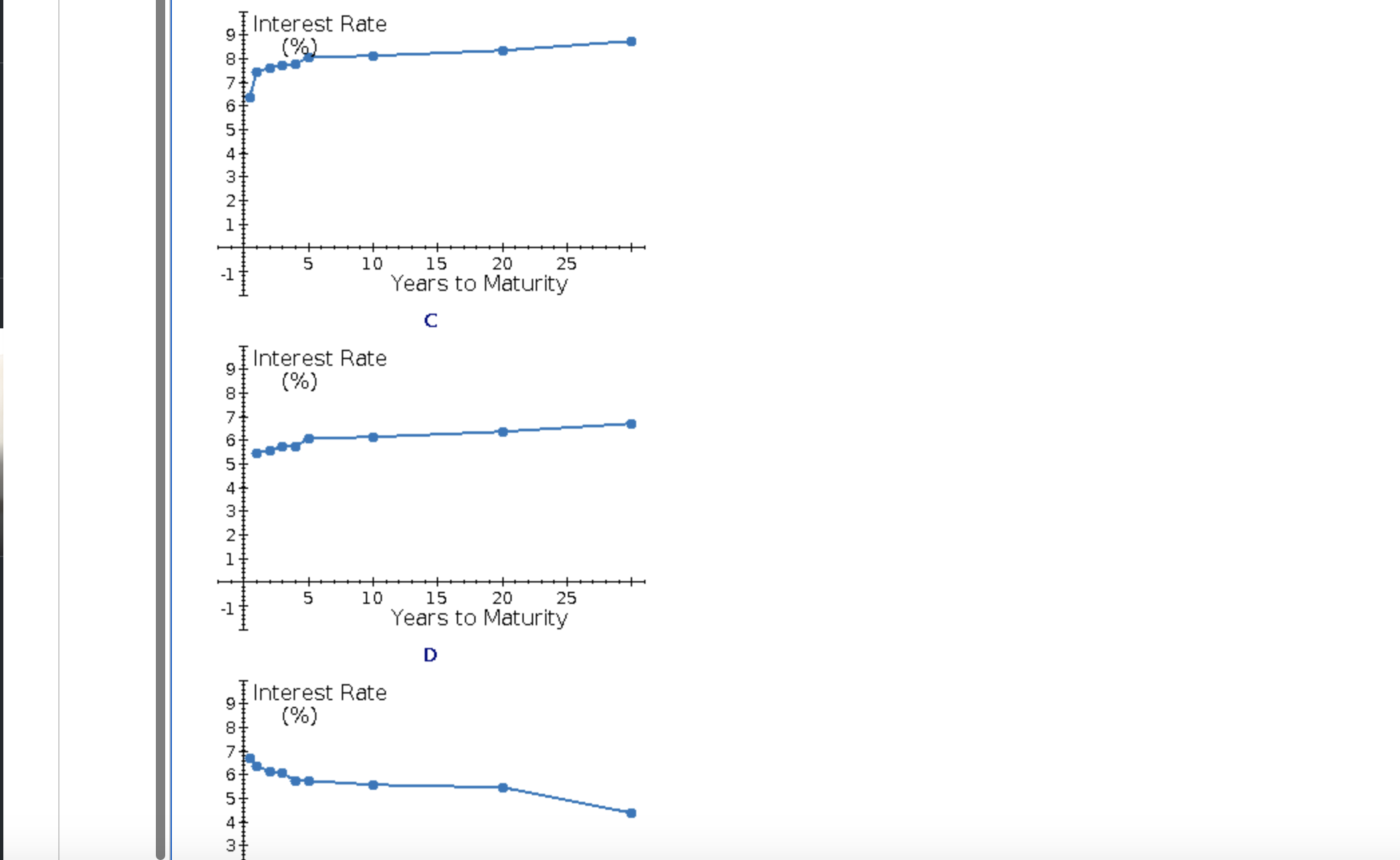

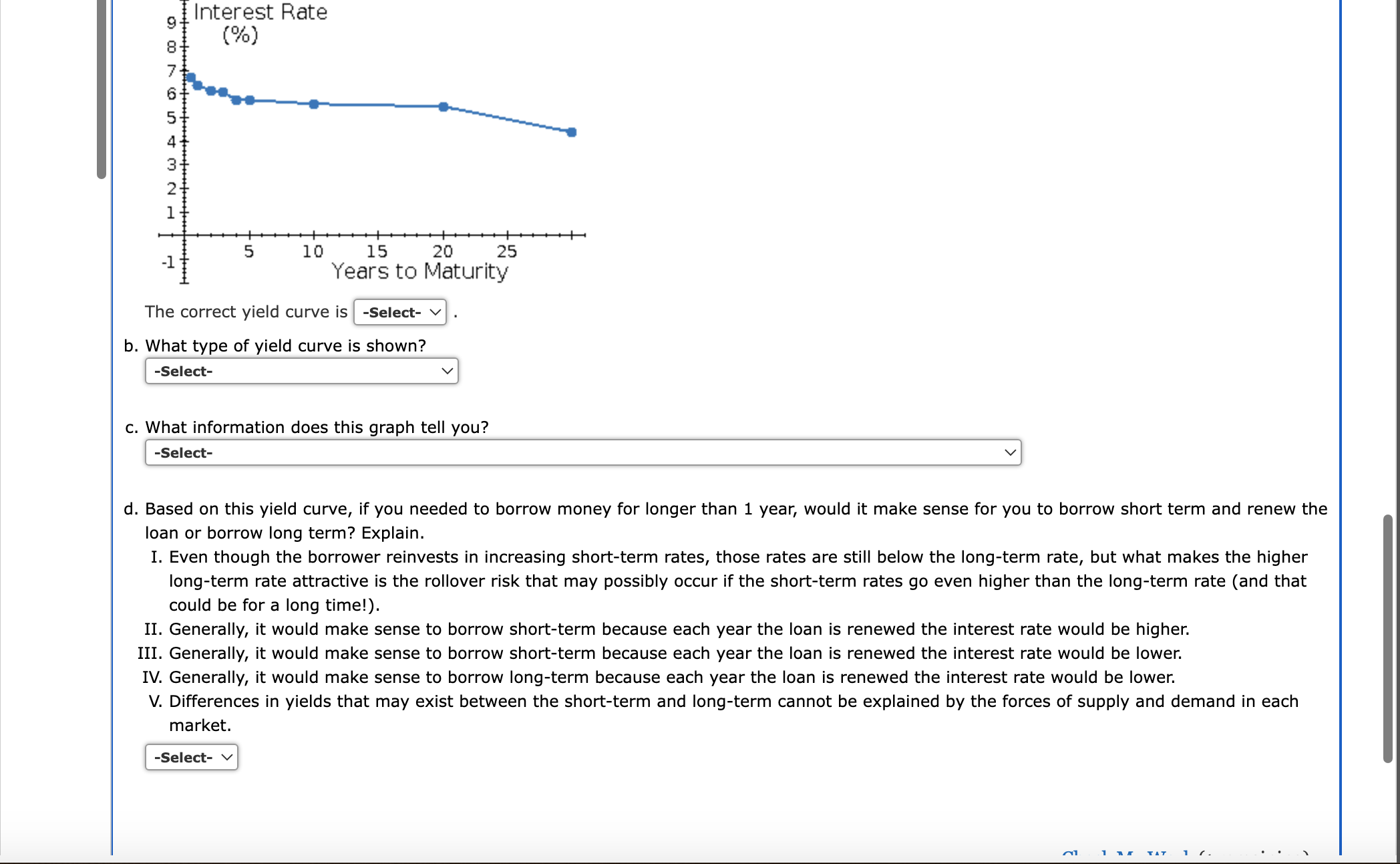

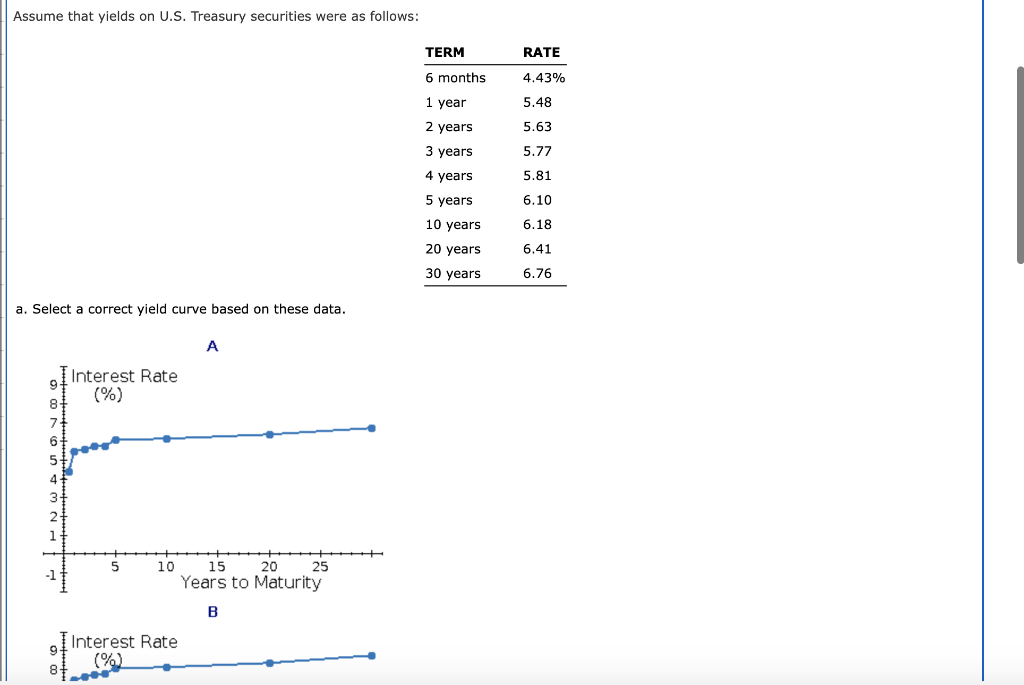

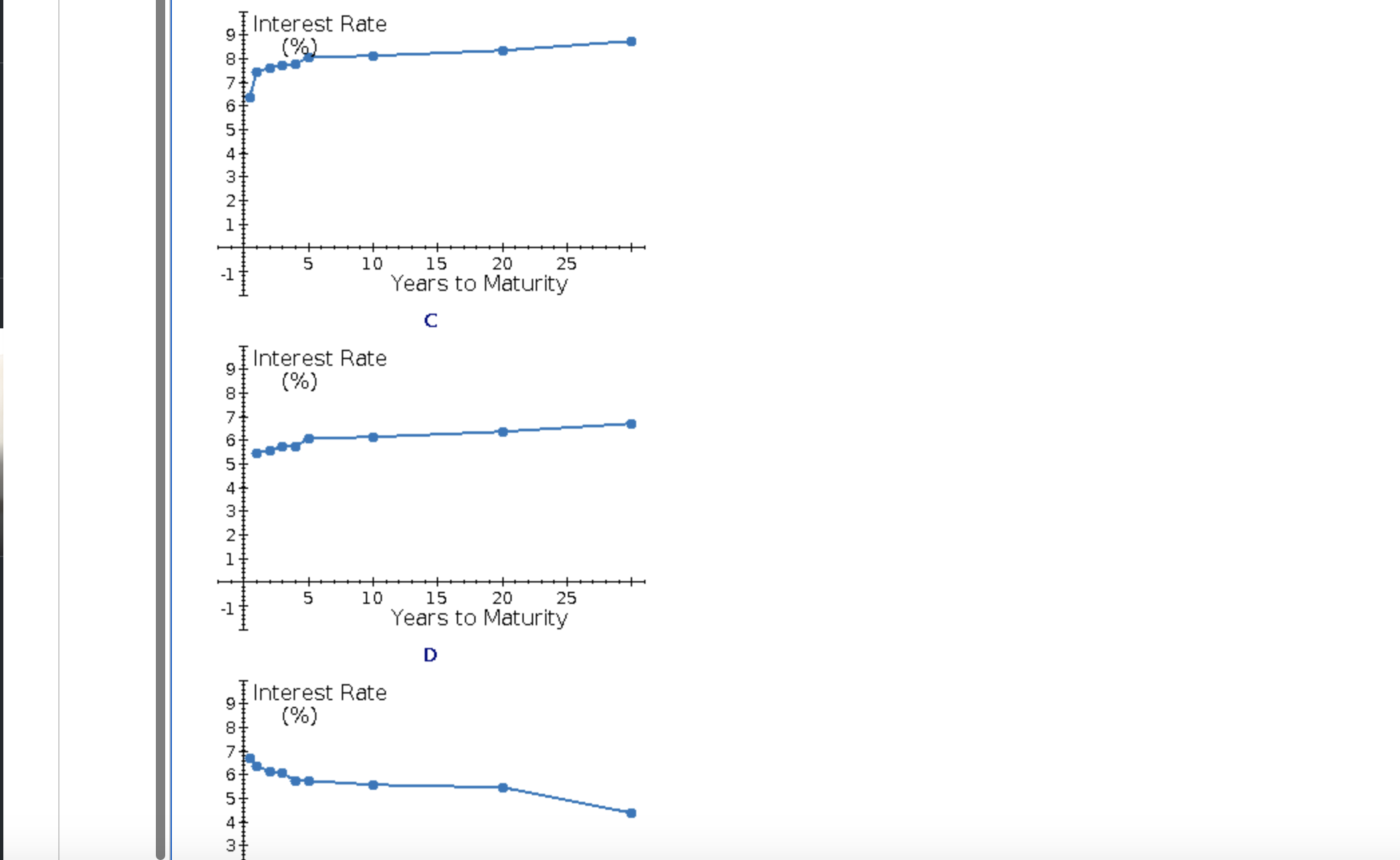

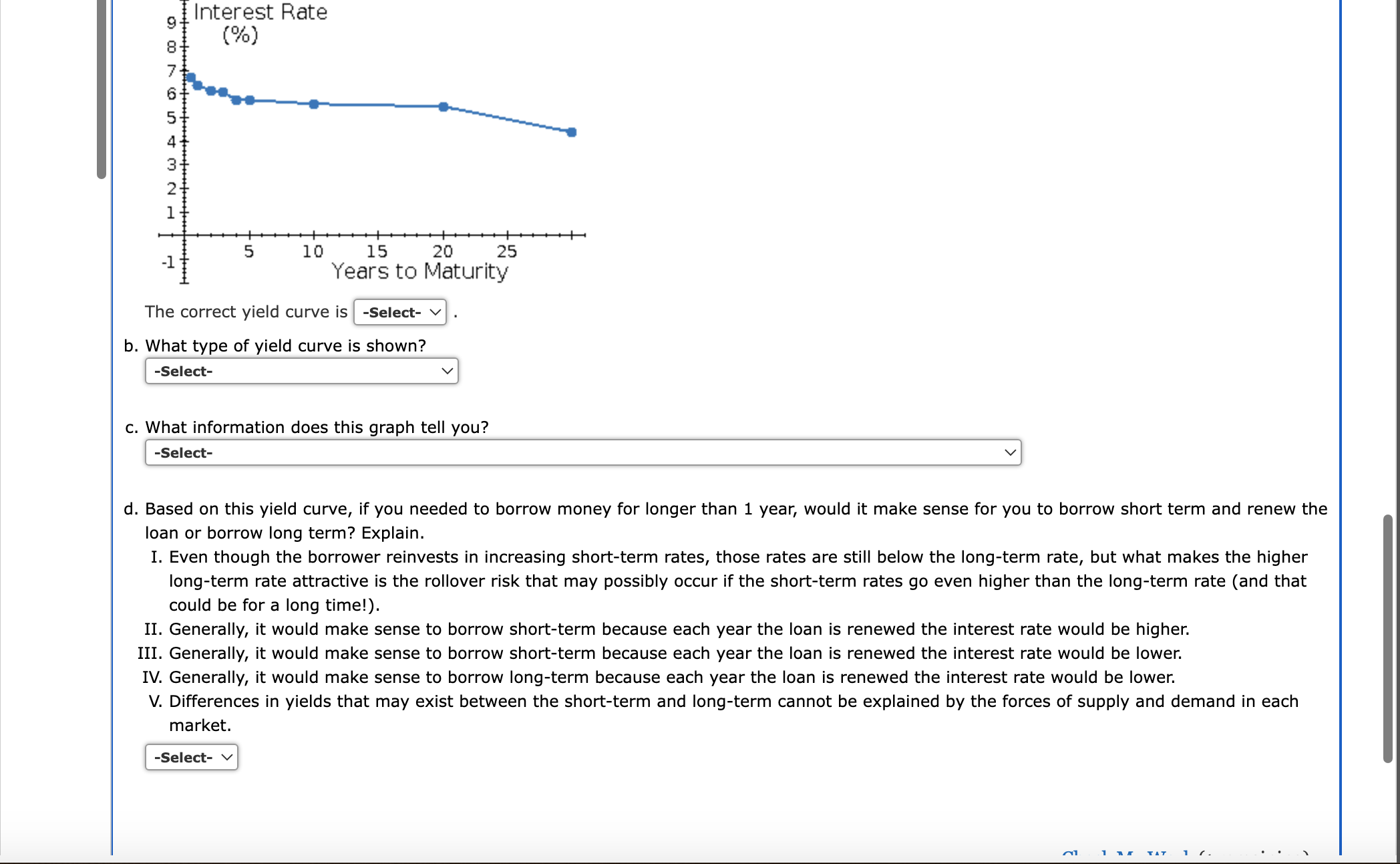

Assume that yields on U.S. Treasury securities were as follows: a. Select a correct yield curve based on these data. d. Based on this yield curve, if you needed to borrow money for longer than 1 year, would it make sense for you to borrow short term and renew the loan or borrow long term? Explain. I. Even though the borrower reinvests in increasing short-term rates, those rates are still below the long-term rate, but what makes the higher long-term rate attractive is the rollover risk that may possibly occur if the short-term rates go even higher than the long rate (and that could be for a long time!). II. Generally, it would make sense to borrow short-term because each year the loan is renewed the interest rate would be higher. III. Generally, it would make sense to borrow short-term because each year the loan is renewed the interest rate would be lower IV. Generally, it would make sense to borrow long-term because each year the loan is renewed the interest rate would be lower. V. Differences in yields that may exist between the short-term and long-term cannot be explained by the forces of supply and demand in each market. Assume that yields on U.S. Treasury securities were as follows: a. Select a correct yield curve based on these data. d. Based on this yield curve, if you needed to borrow money for longer than 1 year, would it make sense for you to borrow short term and renew the loan or borrow long term? Explain. I. Even though the borrower reinvests in increasing short-term rates, those rates are still below the long-term rate, but what makes the higher long-term rate attractive is the rollover risk that may possibly occur if the short-term rates go even higher than the long rate (and that could be for a long time!). II. Generally, it would make sense to borrow short-term because each year the loan is renewed the interest rate would be higher. III. Generally, it would make sense to borrow short-term because each year the loan is renewed the interest rate would be lower IV. Generally, it would make sense to borrow long-term because each year the loan is renewed the interest rate would be lower. V. Differences in yields that may exist between the short-term and long-term cannot be explained by the forces of supply and demand in each market