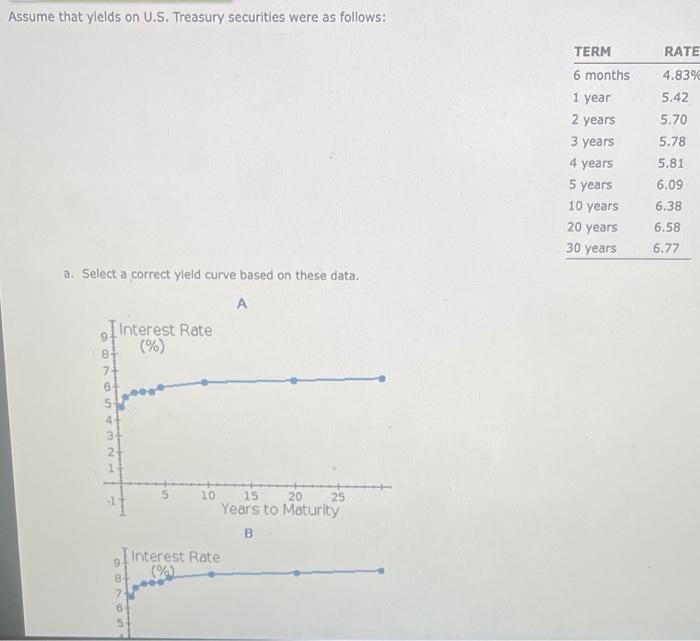

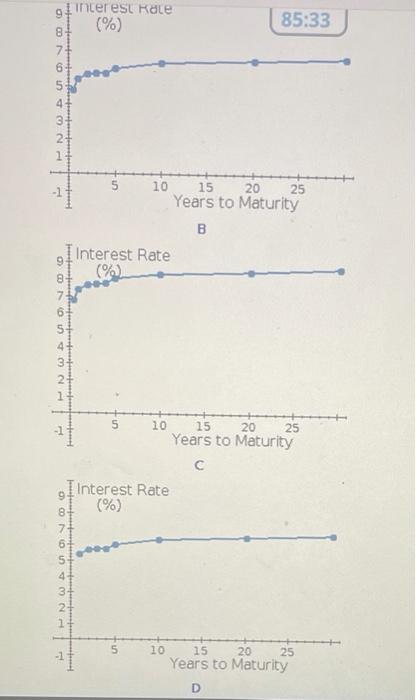

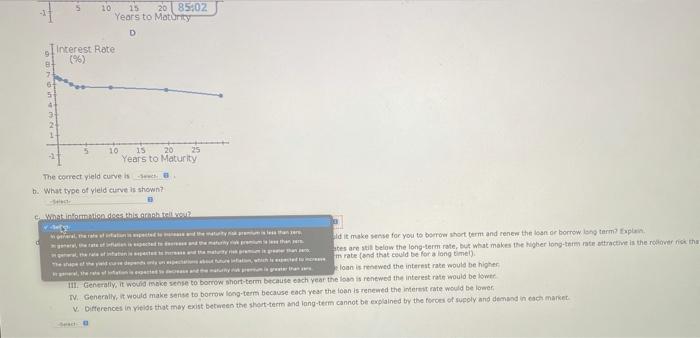

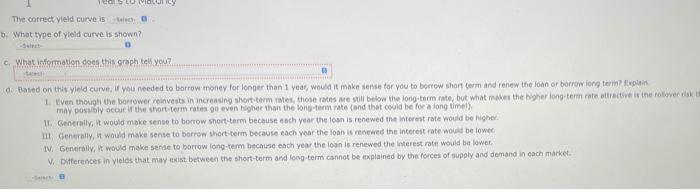

Assume that ylelds on U.S. Treasury securities were as follows: RATE TERM 6 months 1 year 2 years 3 years 4 years 5 years 10 years 20 years 30 years 4.839 5.42 5.70 5.78 5.81 6.09 6.38 6.58 6.77 a: Select a correct yleld curve based on these data. A I Interest Rate B+ (%) GONDON 7 6+ 5 3 2 10 15 20 Years to Maturity B Interest Rate 9 (%) 8 ON 85:33 of interest Kale (%) 8 71 6 000 NON +9 4 3 2 11 10 1 20 15 25 Years to Maturity B Interest Rate 7 NO 2 1 S Fun 1 10 15 20 25 Years to Maturity Interest Rate (%) +8 77 6 s7 19 NWA000 3+ 21 1 5 10 15 20 25 Years to Maturity D 5 10 15 20 85:02 Years to Matury Interest Rate 9 (9) 1 10 15 20 25 Years to Maturity The correct ylel curveis . What type of yleld curve shown? Cation des this article dit make sense for you to borrow short term and renew the land borrow long term plan ates are still below the long-term rate, but what makes the Nigher long-term at attractive is the roovitr nok the redere de un petit rate and that could be for a long time) loan is rented the interest rate would be higher Il Generally, it would make sense to borrow short-term because each year the loan is renewed the interest rate would be lower TV. Generally, it would make sense to borrow long-term because each year the loan is renewed the interest rate would be lower V. Differences in yields that may exist between the short-term and long-term cannot be explained by the forces of supply and demand in each market Teos The correct yield curve is 1. What type of yield curve is shown? c. What information does this graph tell you? Based on this yield curve, you needed to borrow money for longer than 1 year, would it make sense for you to borrow short term and renew the loan or borrow long term? Explain Even though the borrower reinvest in increasing short term rates, those rates me still below the long-term rate, but what makes the higher long-term rate attractive is the followers may possibly occur if the short-term rates go even higher than the long-term rate and that could be for a long time) 11. Generally, it would make sense to borrow short-term because each year the loan is renewed the interest rate would be higher Generally, it would make sense to borrow short-term because each year the loan is newed the interest rate would be lower IV. Generally, it would make sense to borrow long-term because each year the loan is renewed the interest rate would be lower V. Differences in yields that may exist between the short-term and long-term cannot be explained by the forces of supply and demand in each market