Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you are a Loan Officer at Capital One Bank in New Orleans. Company ABC wants to get a ten - year ( long

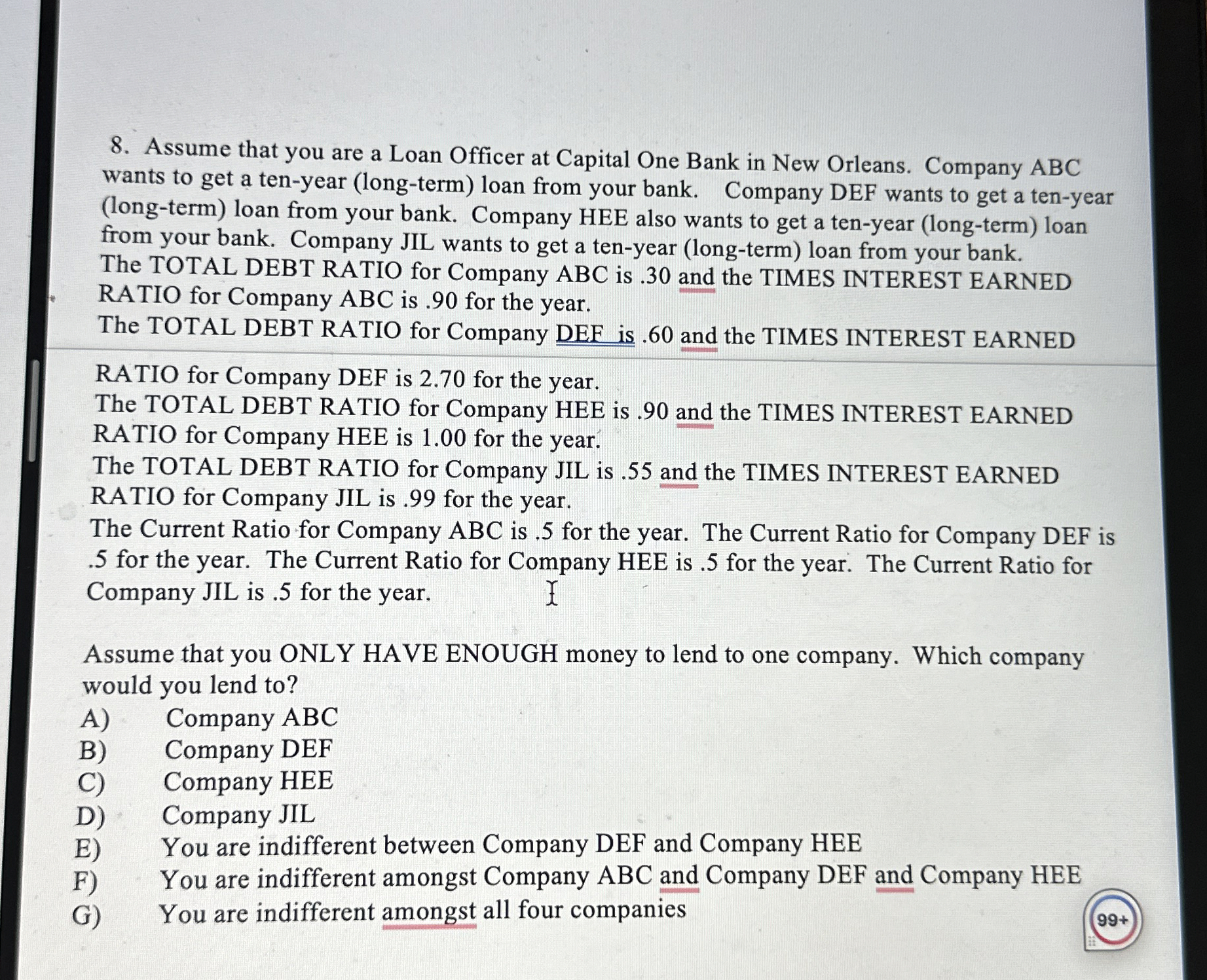

Assume that you are a Loan Officer at Capital One Bank in New Orleans. Company ABC wants to get a tenyear longterm loan from your bank. Company DEF wants to get a tenyear longterm loan from your bank. Company HEE also wants to get a tenyear longterm loan from your bank. Company JIL wants to get a tenyear longterm loan from your bank. The TOTAL DEBT RATIO for Company ABC is and the TIMES INTEREST EARNED RATIO for Company ABC is for the year.

The TOTAL DEBT RATIO for Company DEF is and the TIMES INTEREST EARNED

RATIO for Company DEF is for the year.

The TOTAL DEBT RATIO for Company HEE is and the TIMES INTEREST EARNED RATIO for Company HEE is for the year.

The TOTAL DEBT RATIO for Company JIL is and the TIMES INTEREST EARNED RATIO for Company JIL is for the year.

The Current Ratio for Company ABC is for the year. The Current Ratio for Company DEF is for the year. The Current Ratio for Company HEE is for the year. The Current Ratio for Company JIL is for the year.

Assume that you ONLY HAVE ENOUGH money to lend to one company. Which company would you lend to

A Company ABC

B Company DEF

C Company HEE

D Company JIL

E You are indifferent between Company DEF and Company HEE

F You are indifferent amongst Company ABC and Company DEF and Company HEE

G You are indifferent amongst all four companies

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started