Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you are about to sell property (a vacant parcel of real estate) you own but otherwise have no use for. The net-of-sales- commission

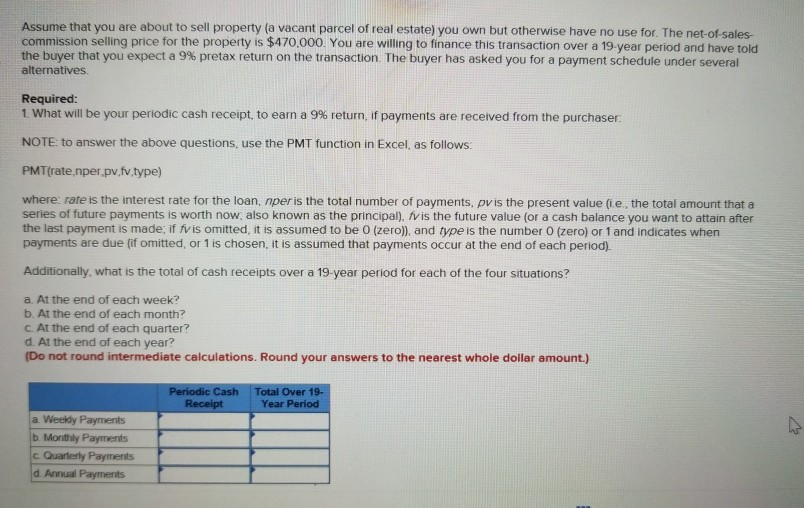

Assume that you are about to sell property (a vacant parcel of real estate) you own but otherwise have no use for. The net-of-sales- commission selling price for the property is $470.000. You are willing to finance this transaction over a 19-year period and have told the buyer that you expect a 9% pretax return on the transaction The buyer has asked you for a payment schedule under several alternatives. Required: 1. What will be our periodic cash receipt to earn a 9% return, if payments are received from the purchaser NOTE: to answer the above questions, use the PMT function in Excel, as follows: PMT(rate nper,pv.fv.type) where: rate is the interest rate for the loan, nper is the total number of payments, pvis the present value (ie, the total amount that a series of future payments is worth now, also known as the principal), fvis the future value (or a cash balance you want to attain after the last payment is made; if fvis omitted, it is assumed to be 0 (zero), and type is the number O (zero) or 1 and indicates when payments are due (if omitted, or 1 is chosen, it is assumed that payments occur at the end of each period). Additionally, what is the total of cash receipts over a 19-year period for each of the four situations? a. At the end of each week? b. At the end of each month? c. At the end of each quarter? d. At the end of each year? (Do not round intermediate calculations. Round your answers to the nearest whole doilar amount.) Periodic Cash Total Over 19- Year Period a Weekdy Payments b Monthly Payments c Quarterly Payments d. Annual Payments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started