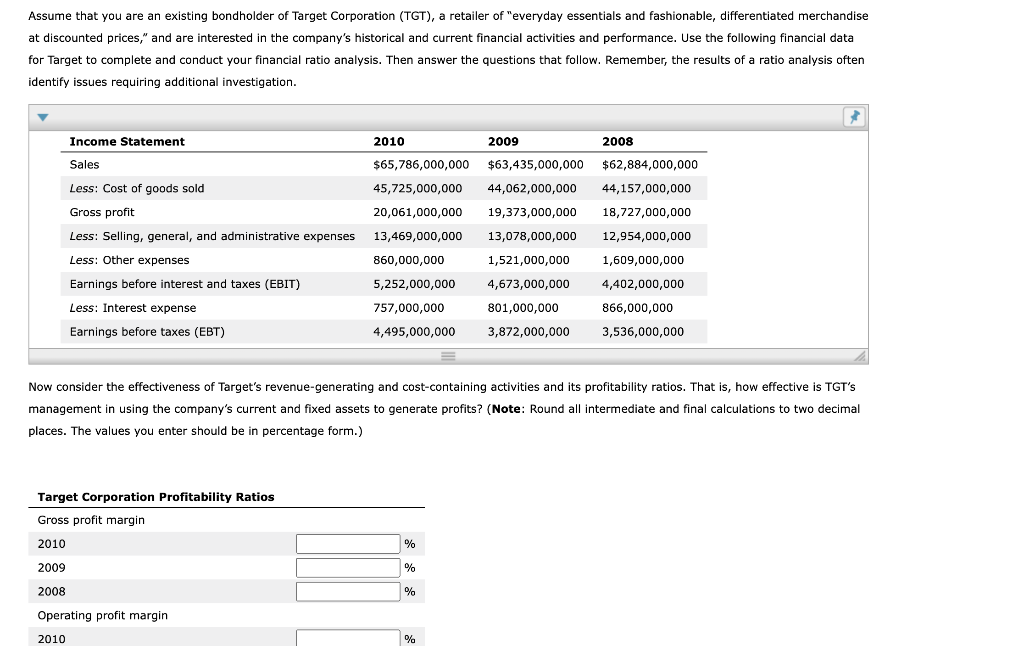

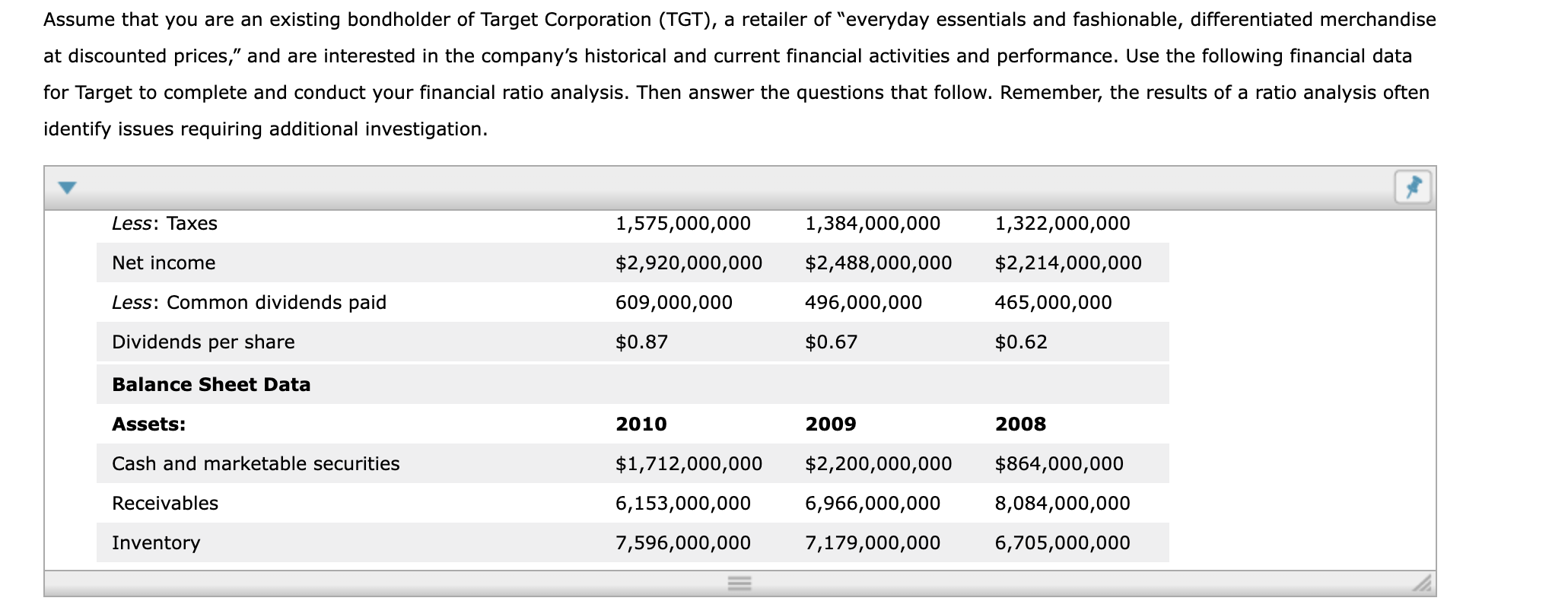

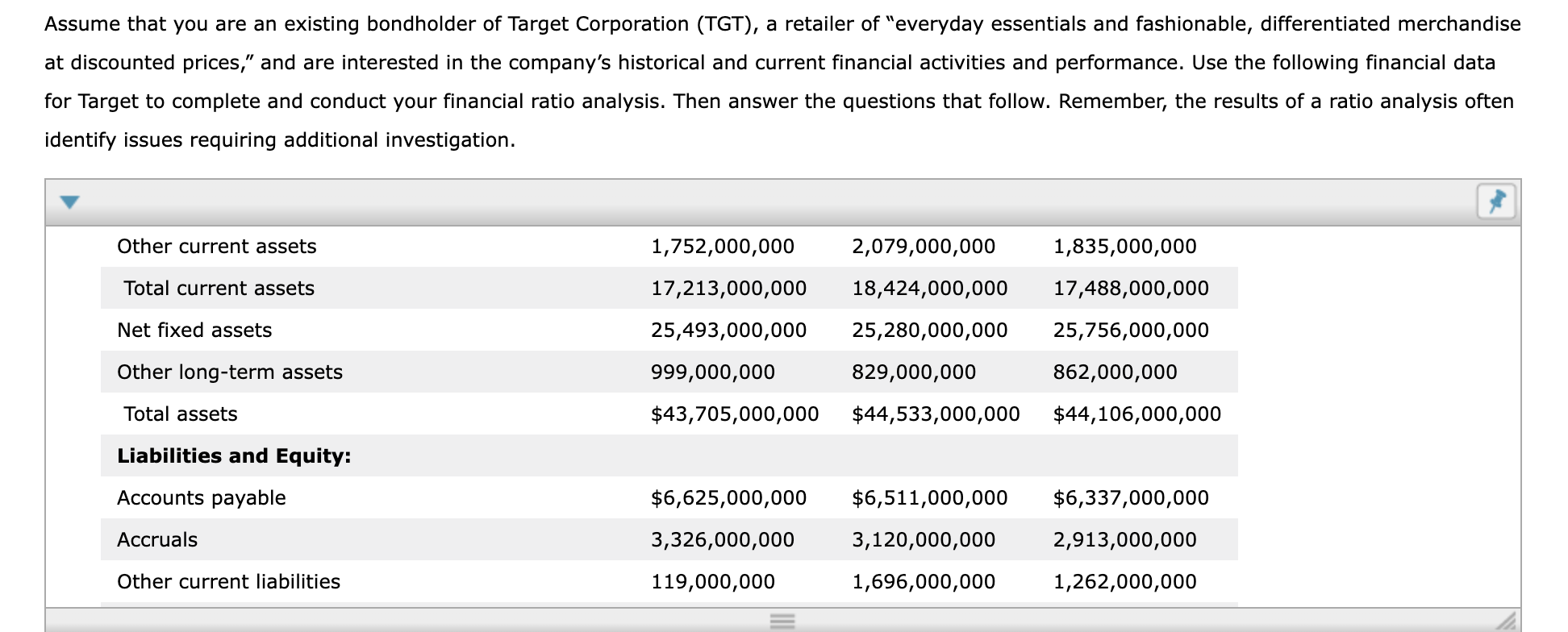

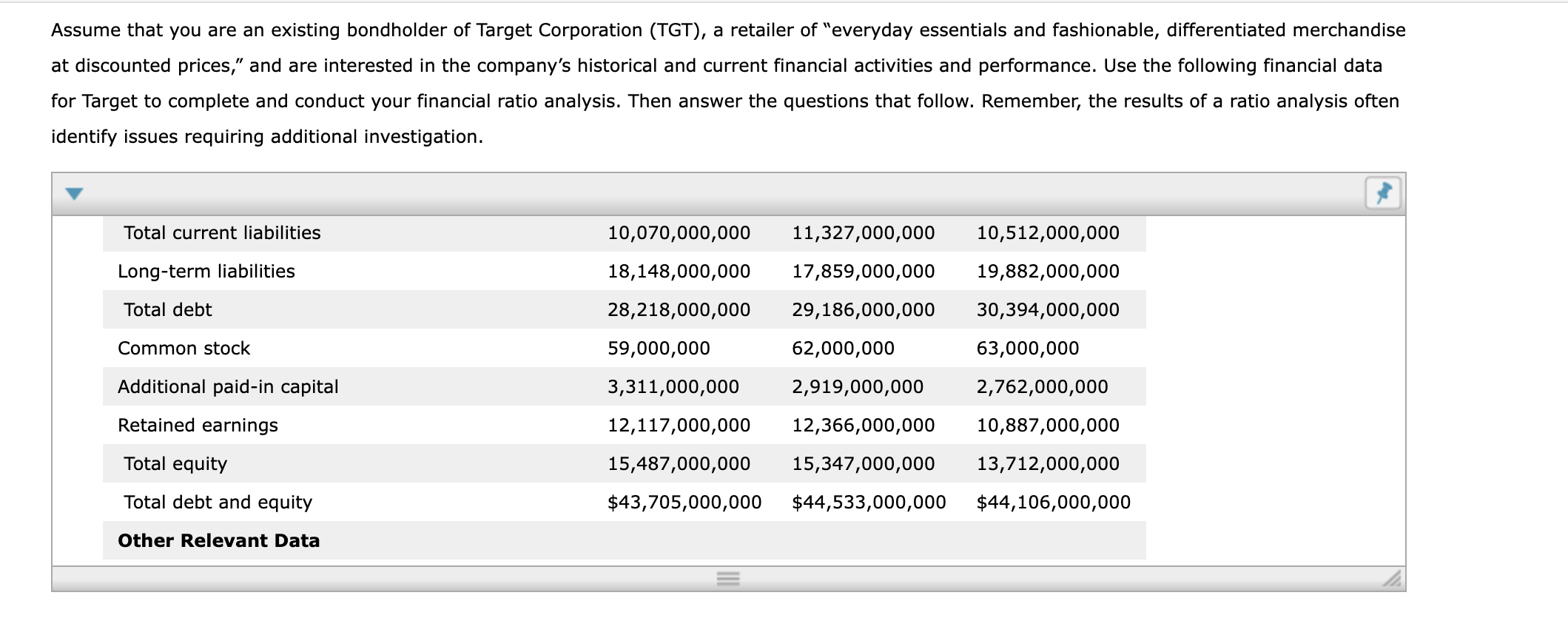

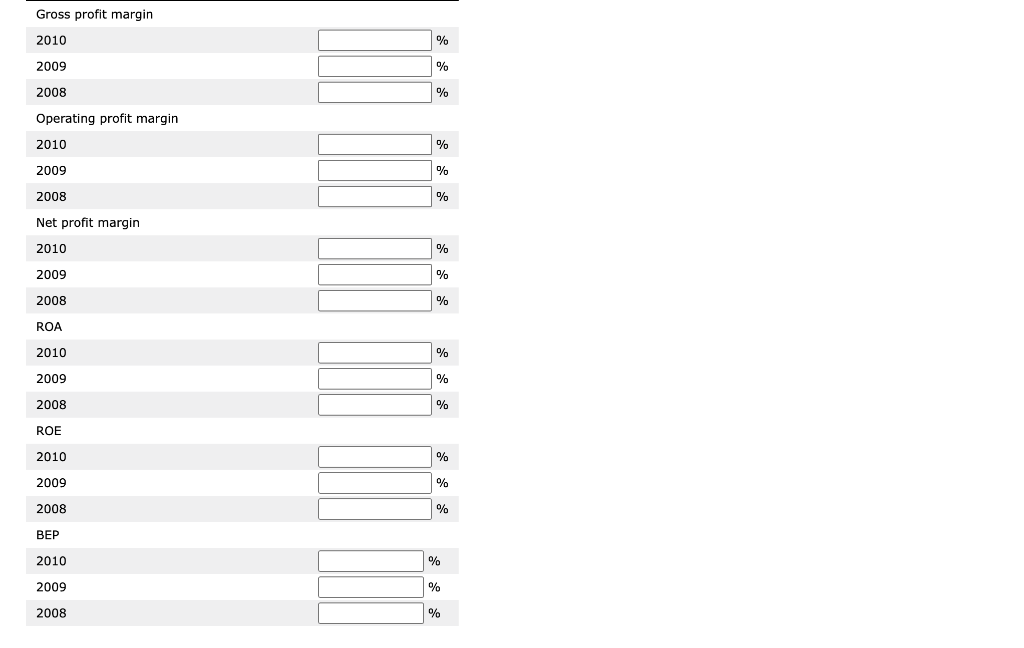

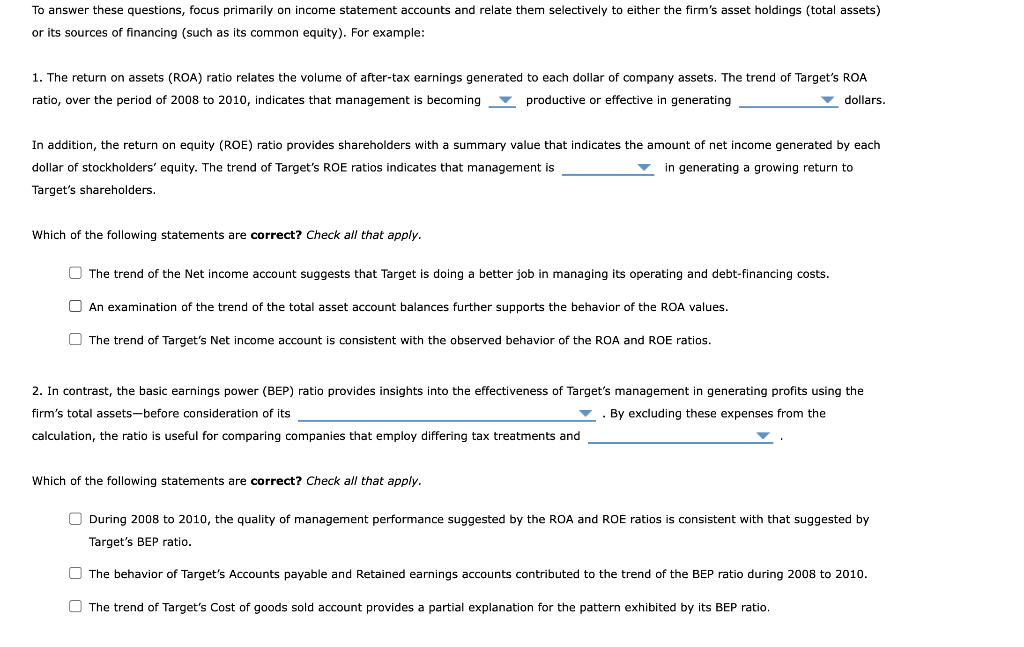

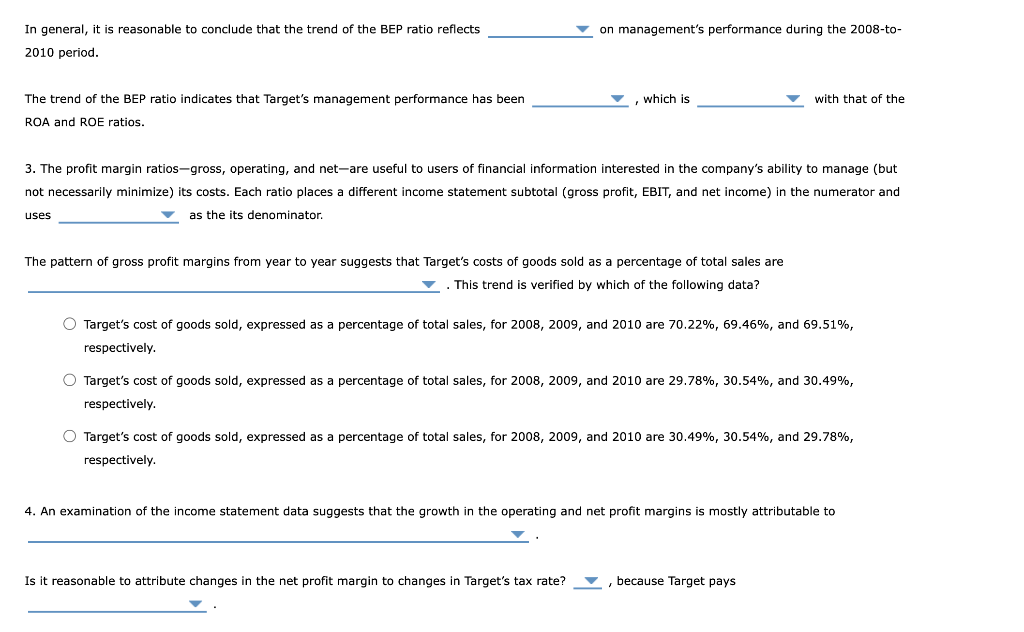

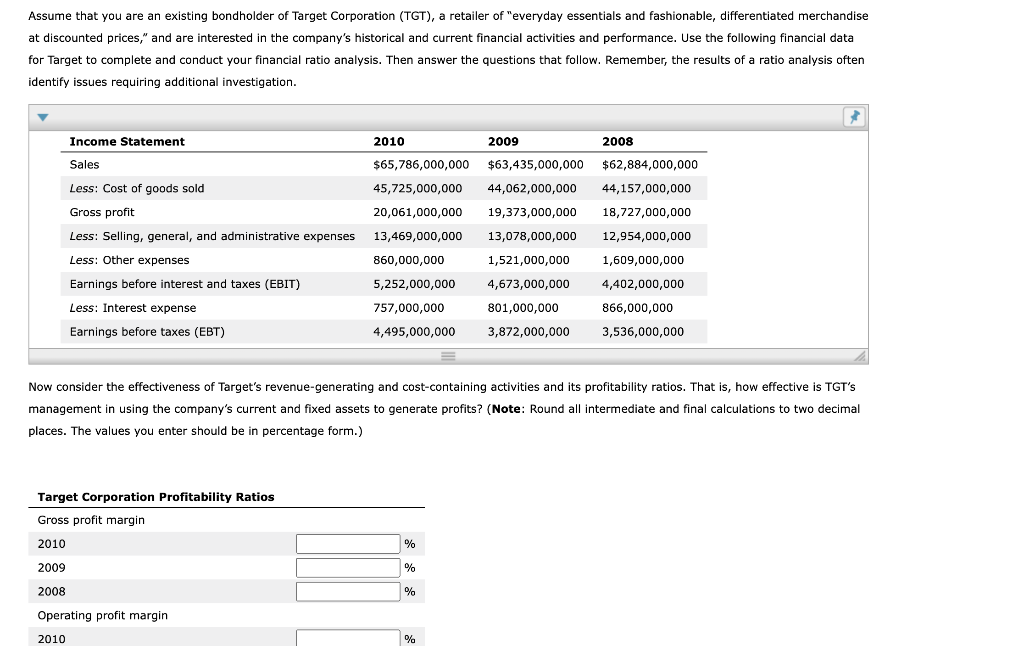

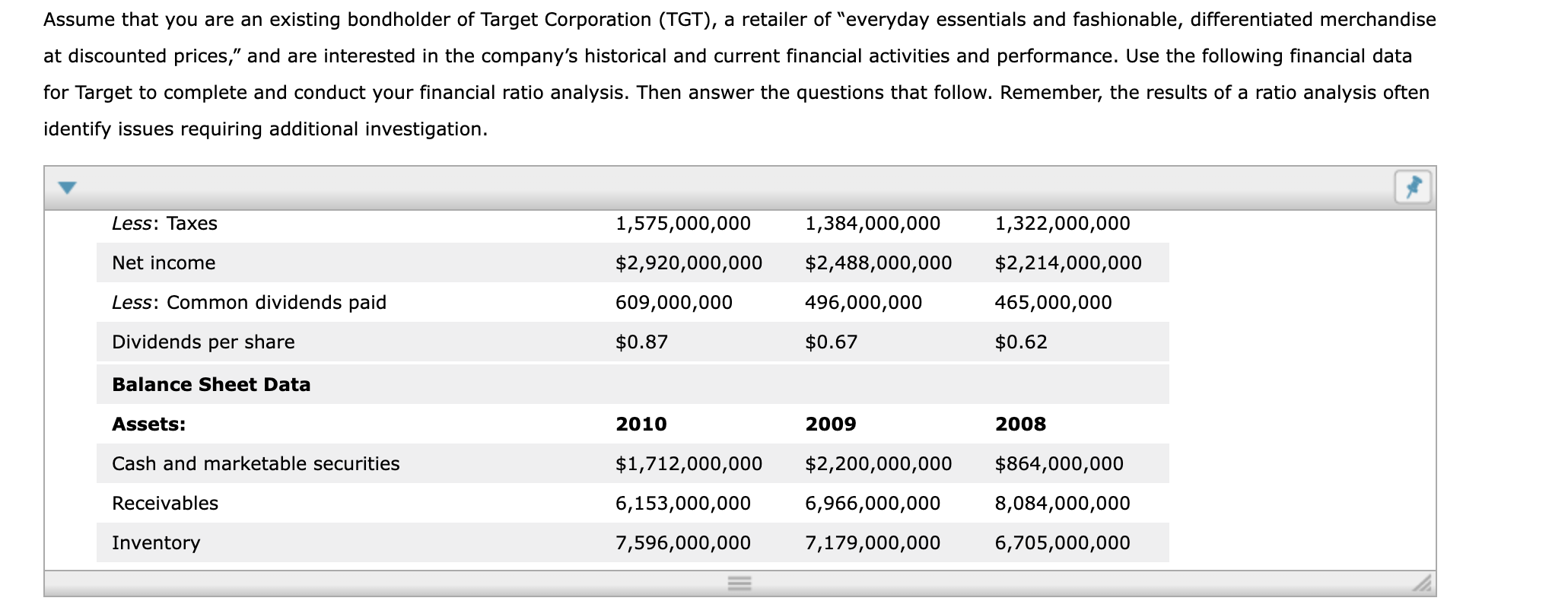

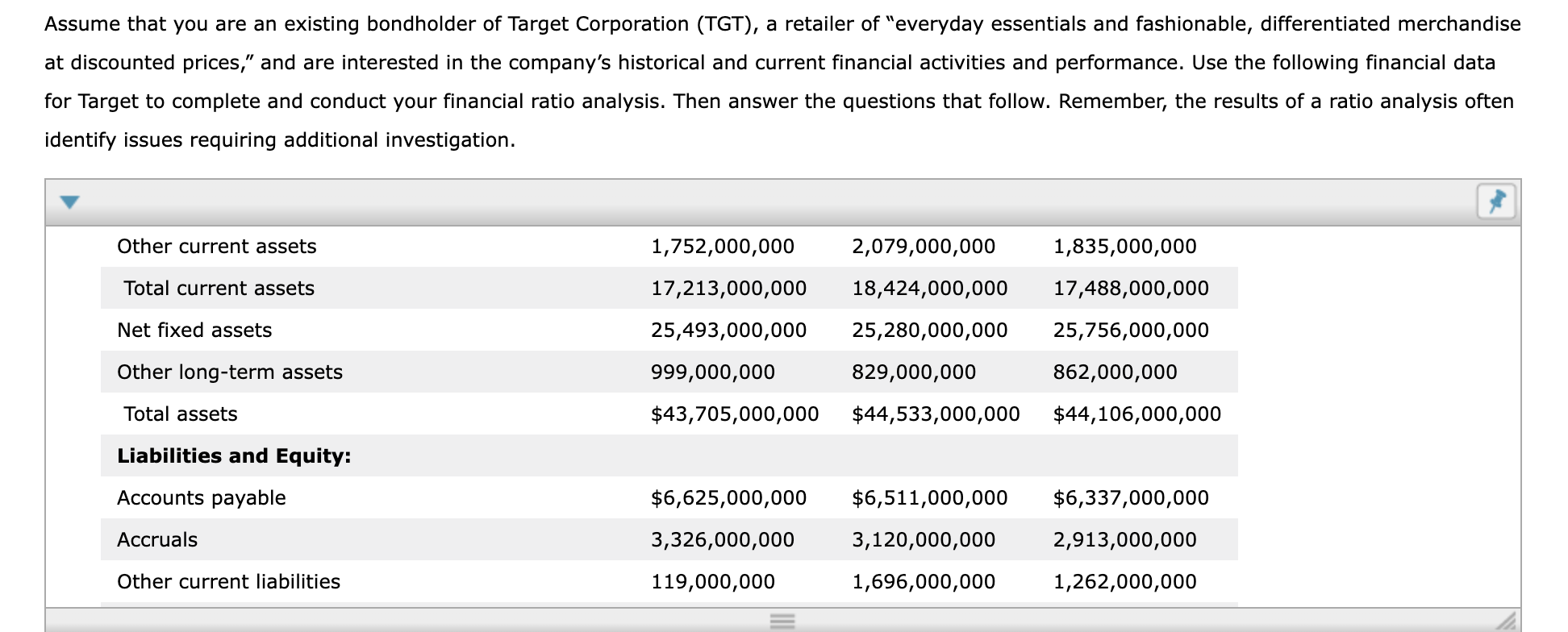

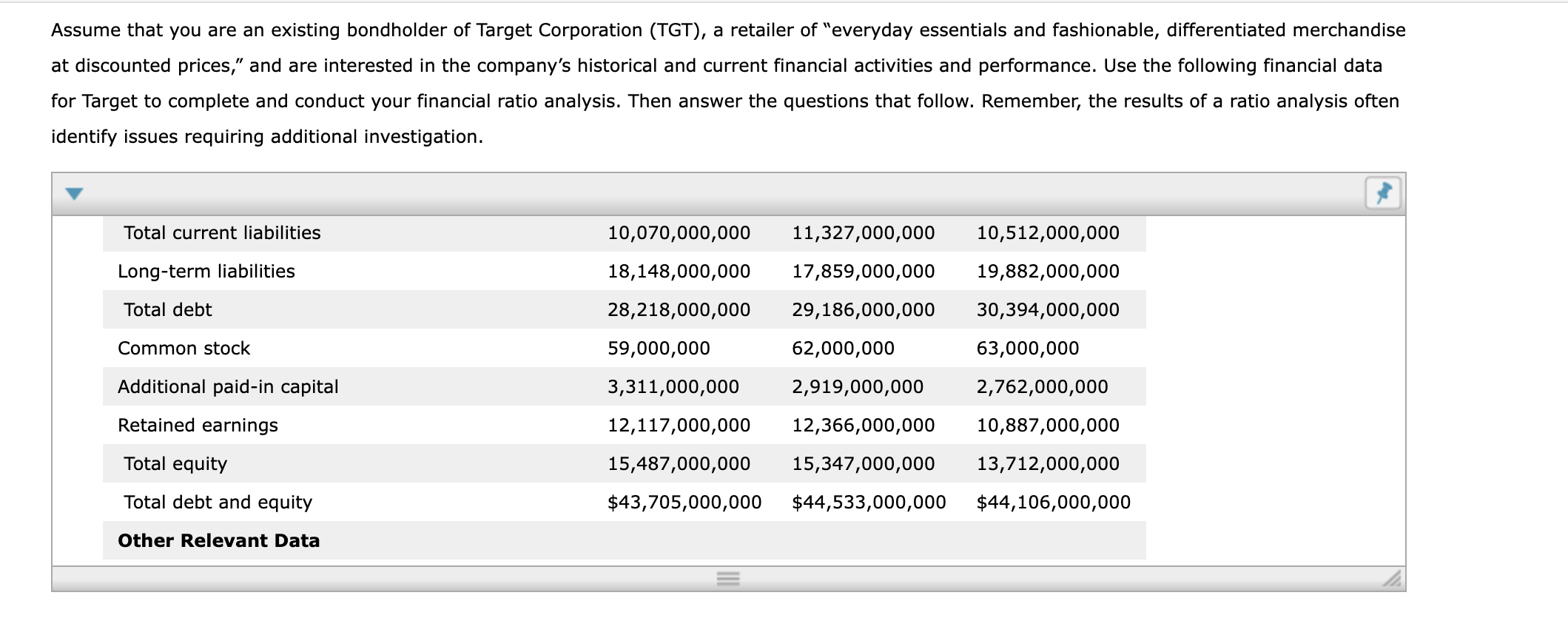

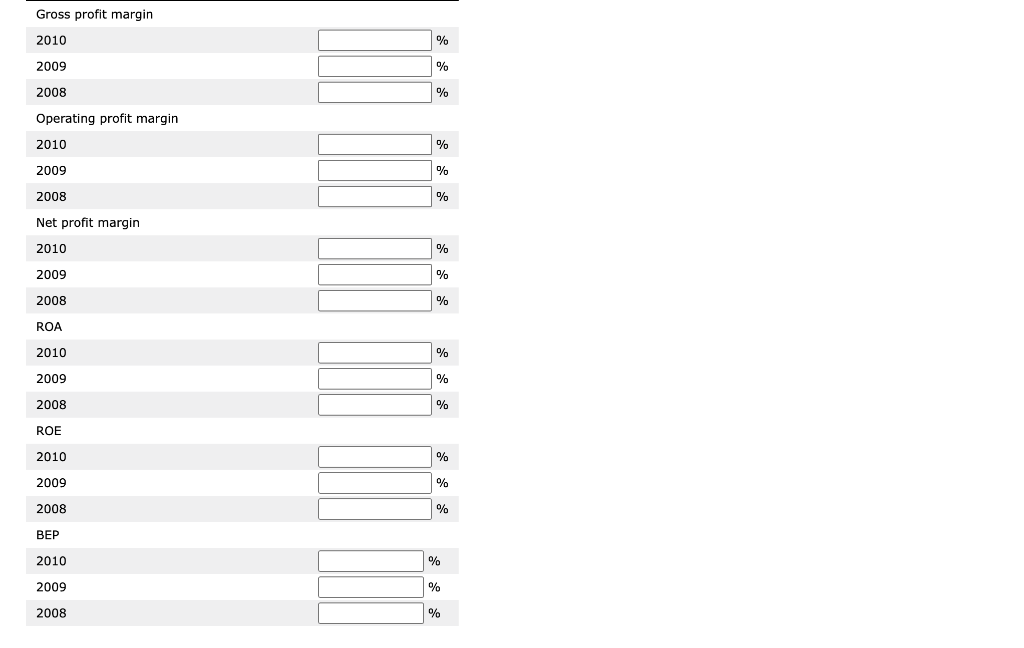

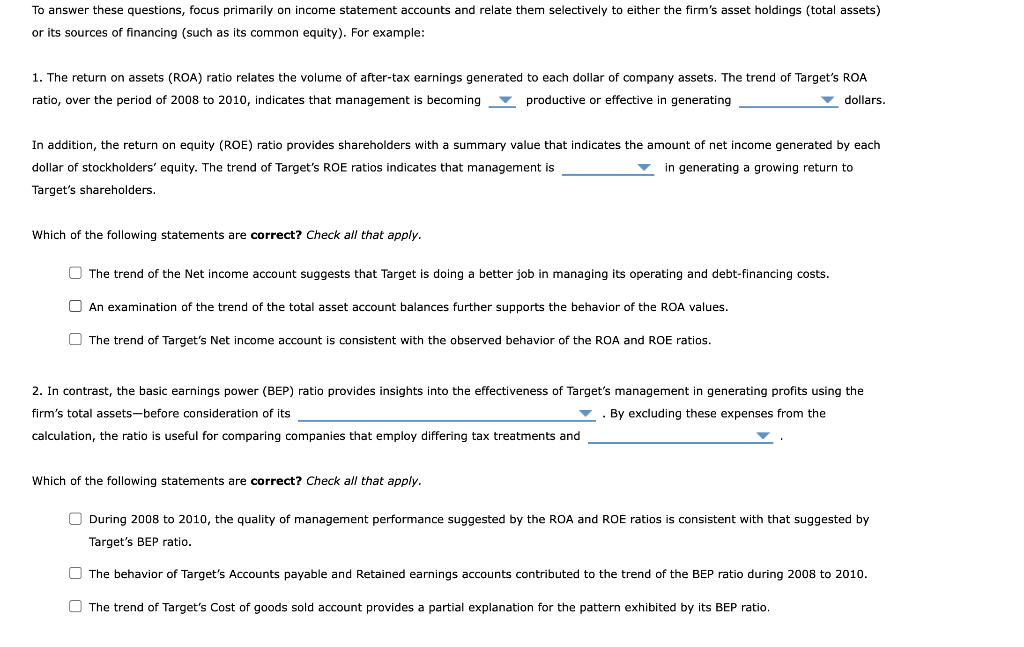

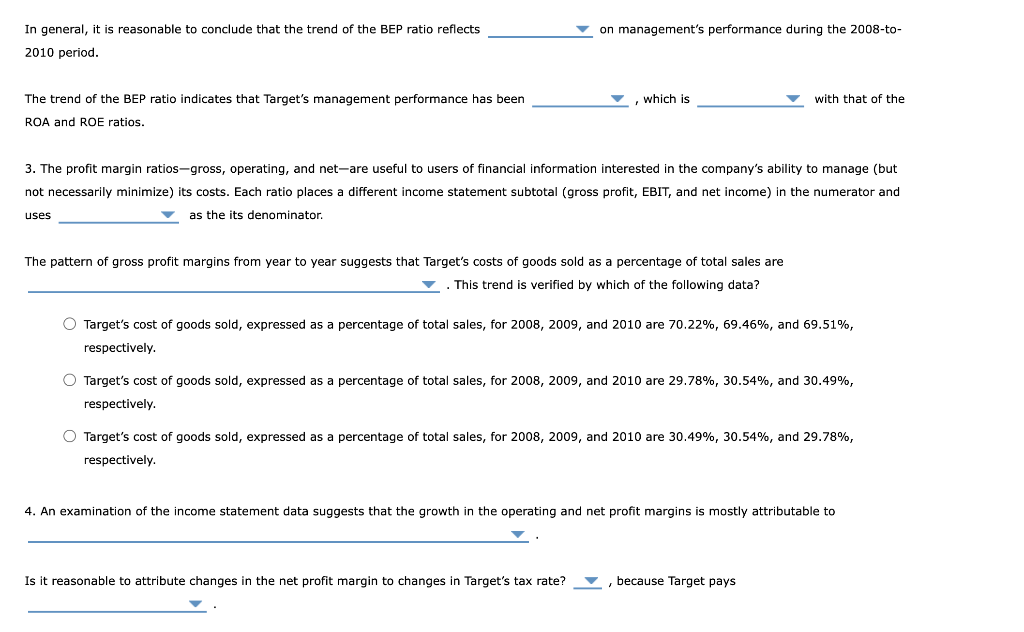

Assume that you are an existing bondholder of Target Corporation (TGT), a retailer of "everyday essentials and fashionable, differentiated merchandise at discounted prices," and are interested in the company's historical and current financial activities and performance. Use the following financial data for Target to complete and conduct your financial ratio analysis. Then answer the questions that follow. Remember, the results of a ratio analysis identify issues requiring additional investigation. Now consider the effectiveness of Target's revenue-generating and cost-containing activities and its profitability ratios. That is, how effective is TGT's management in using the company's current and fixed assets to generate profits? (Note: Round all intermediate and final calculations to two decimal places. The values you enter should be in percentage form.) Assume that you are an existing bondholder of Target Corporation (TGT), a retailer of "everyday essentials and fashionable, differentiated merchandise at discounted prices," and are interested in the company's historical and current financial activities and performance. Use the following financial data for Target to complete and conduct your financial ratio analysis. Then answer the questions that follow. Remember, the results of a ratio analysis often identify issues requiring additional investigation. Assume that you are an existing bondholder of Target Corporation (TGT), a retailer of "everyday essentials and fashionable, differentiated merchandise at discounted prices," and are interested in the company's historical and current financial activities and performance. Use the following financial data for Target to complete and conduct your financial ratio analysis. Then answer the questions that follow. Remember, the results of a ratio analysis identify issues requiring additional investigation. Assume that you are an existing bondholder of Target Corporation (TGT), a retailer of "everyday essentials and fashionable, differentiated merchandise at discounted prices," and are interested in the company's historical and current financial activities and performance. Use the following for Target to complete and conduct your financial ratio analysis. Then answer the questions that follow. Remember, the results a ris identify issues requiring additional investigation. Common stock 59,000,0003,311,000,00012,117,000,00015,487,000,000$43,705,000,00062,000,0002,919,000,00012,366,000,00015,347,000,000$44,533,000,00063,000,0002,762,000,00010,887,000,00013,712,000,000$44,106,000,000 Additional paid-in capital Retained earnings Total equity Total debt and equity Other Relevant Data Common shares outstan Total dividends paid Market price per share 704,038,218609,000,000$54.35744,644,454496,000,000$51.27752,712,464465,000,000$31.20 Gross profit margin ROA201020092008 ROE \begin{tabular}{ll} 2010 & \\ 2009 & \\ 2008 & \\ \hline \end{tabular} BEP201020092008%%% or its sources of financing (such as its common equity). For example: 1. The return on assets (ROA) ratio relates the volume of after-tax earnings generated to each dollar of company assets. The trend of Target's ratio, over the period of 2008 to 2010 , indicates that management is becoming productive or effective in generating In addition, the return on equity (ROE) ratio provides shareholders with a summary value that indicates the amount of net income generated dollar of stockholders' equity. The trend of Target's ROE ratios indicates that management is in a growing to Target's shareholders. Which of the following statements are correct? Check all that apply. The trend of the Net income account suggests that Target is doing a better job in managing its operating and debt-financing costs. An examination of the trend of the total asset account balances further supports the behavior of the ROA values. The trend of Target's Net income account is consistent with the observed behavior of the ROA and ROE ratios. 2. In contrast, the basic earnings power (BEP) ratio provides insights into the effectiveness of Target's management in generating profits using the firm's total assets-before consideration of its calculation, the ratio is useful for comparing companies that employ differing tax treatments and Which of the following statements are correct? Check all that apply. _. By excluding these expenses from the During 2008 to 2010 , the quality of management performance suggested by the ROA and ROE ratios is consistent with that suggested by Target's BEP ratio. The behavior of Target's Accounts payable and Retained earnings accounts contributed to the trend of the BEP ratio during 2008 to 2010 . The trend of Target's Cost of goods sold account provides a partial explanation for the pattern exhibited by its BEP ratio. In general, it is reasonable to conclude that the trend of the BEP ratio reflects on management's performance during the 2008-to- 2010 period. The trend of the BEP ratio indicates that Target's management performance has been , which is with that of the ROA and ROE ratios. 3. The profit margin ratios-gross, operating, and net-are useful to users of financial information interested in the company's ability to manage (but not necessarily minimize) its costs. Each ratio places a different income statement subtotal (gross profit, EBIT, and net income) in the numerator and uses as the its denominator. The pattern of gross profit margins from year to year suggests that Target's costs of goods sold as a percentage of total sales are . This trend is verified by which of the following data? Target's cost of goods sold, expressed as a percentage of total sales, for 2008,2009 , and 2010 are 70.22%,69.46%, and 69.51%, respectively. Target's cost of goods sold, expressed as a percentage of total sales, for 2008, 2009, and 2010 are 29.78%,30.54%, and 30.49%, respectively. Target's cost of goods sold, expressed as a percentage of total sales, for 2008,2009 , and 2010 are 30.49%,30.54%, and 29.78%, respectively. 4. An examination of the income statement data suggests that the growth in the operating and net profit margins is mostly attributable to Is it reasonable to attribute changes in the net profit margin to changes in Target's tax rate? , because Target pays