Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you are considering purchasing a commercial property today (which is the beginning of Year 1) for $100,000. You as an investor have a

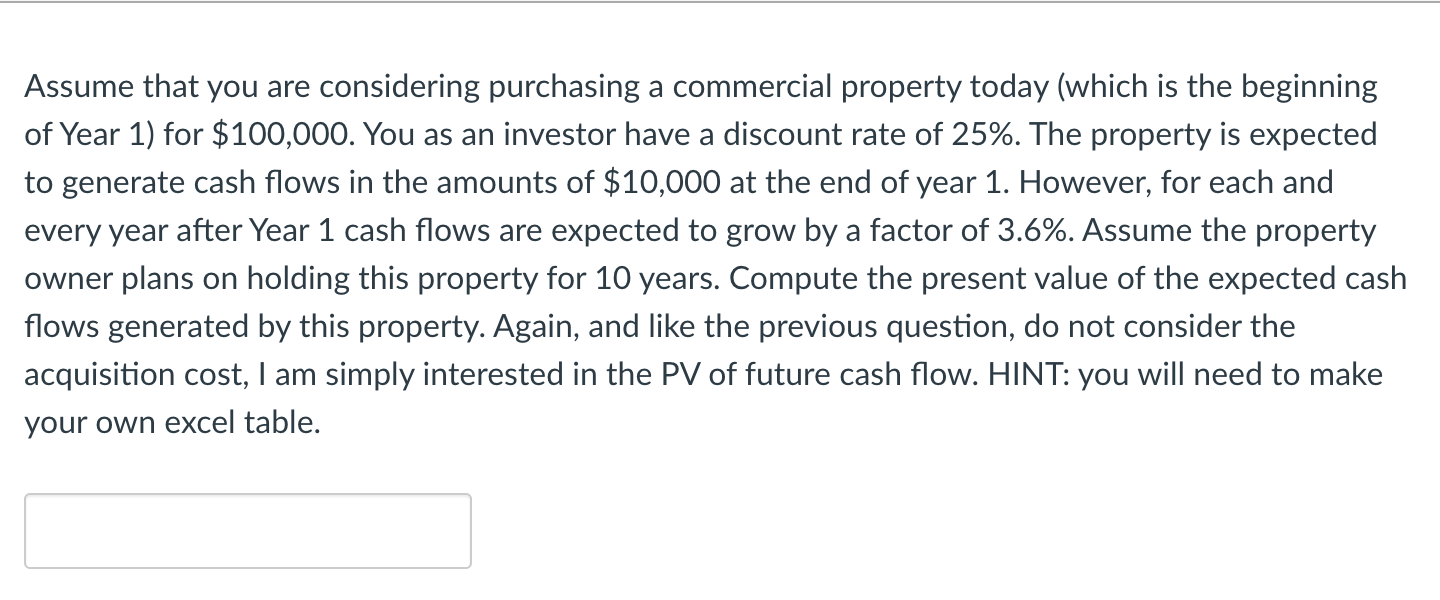

Assume that you are considering purchasing a commercial property today (which is the beginning of Year 1) for $100,000. You as an investor have a discount rate of 25%. The property is expected to generate cash flows in the amounts of $10,000 at the end of year 1 . However, for each and every year after Year 1 cash flows are expected to grow by a factor of 3.6%. Assume the property owner plans on holding this property for 10 years. Compute the present value of the expected cash flows generated by this property. Again, and like the previous question, do not consider the acquisition cost, I am simply interested in the PV of future cash flow. HINT: you will need to make your own excel table

Assume that you are considering purchasing a commercial property today (which is the beginning of Year 1) for $100,000. You as an investor have a discount rate of 25%. The property is expected to generate cash flows in the amounts of $10,000 at the end of year 1 . However, for each and every year after Year 1 cash flows are expected to grow by a factor of 3.6%. Assume the property owner plans on holding this property for 10 years. Compute the present value of the expected cash flows generated by this property. Again, and like the previous question, do not consider the acquisition cost, I am simply interested in the PV of future cash flow. HINT: you will need to make your own excel table Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started