Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you are given the true model of expected returns in a market. If that market is efficient, you would expect to observe: Select

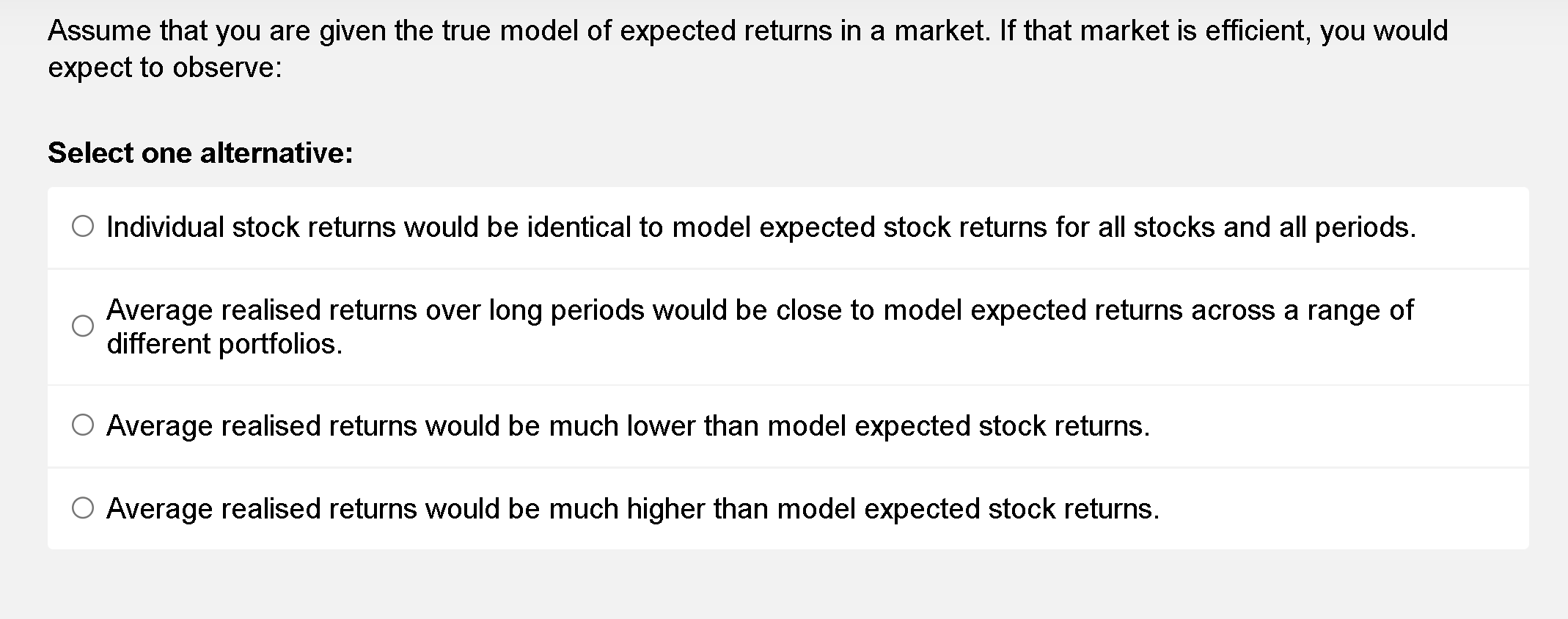

Assume that you are given the true model of expected returns in a market. If that market is efficient, you would expect to observe: Select one alternative: Individual stock returns would be identical to model expected stock returns for all stocks and all periods. Average realised returns over long periods would be close to model expected returns across a range of different portfolios. Average realised returns would be much lower than model expected stock returns. Average realised returns would be much higher than model expected stock returns

Assume that you are given the true model of expected returns in a market. If that market is efficient, you would expect to observe: Select one alternative: Individual stock returns would be identical to model expected stock returns for all stocks and all periods. Average realised returns over long periods would be close to model expected returns across a range of different portfolios. Average realised returns would be much lower than model expected stock returns. Average realised returns would be much higher than model expected stock returns Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started