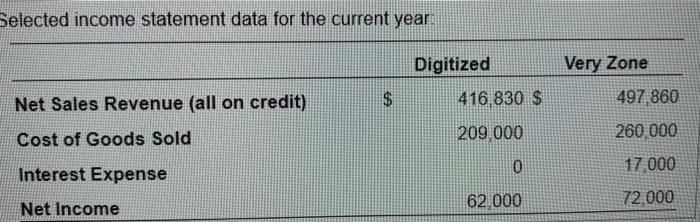

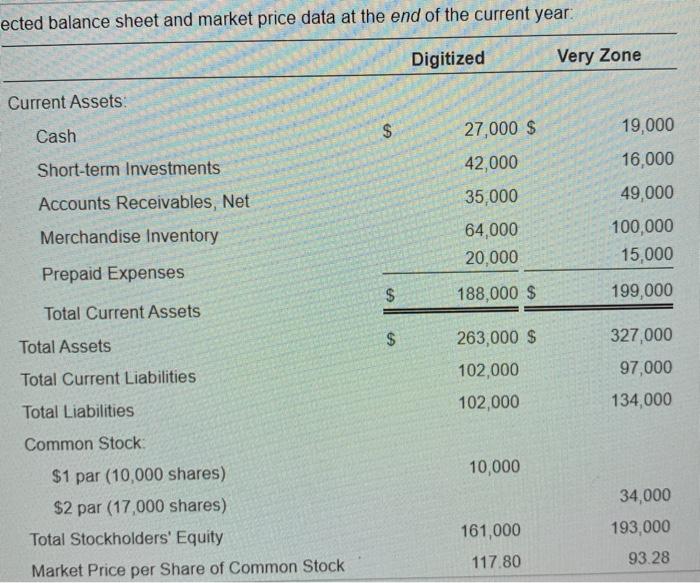

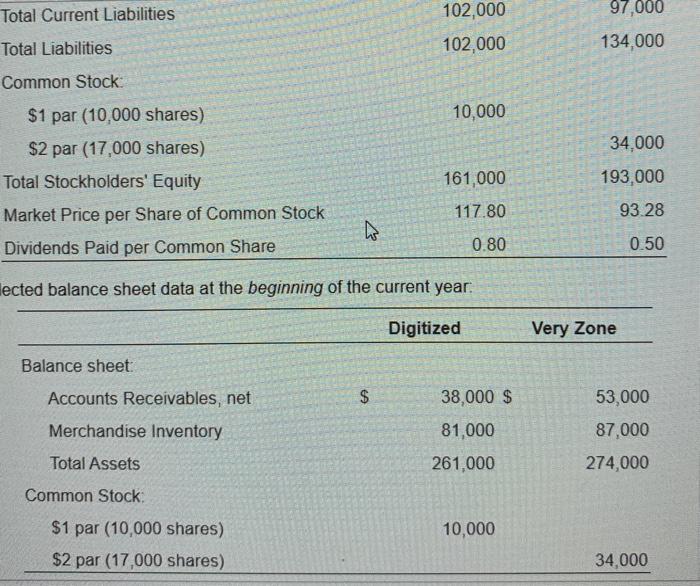

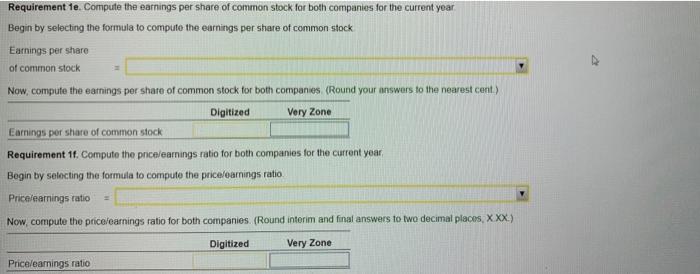

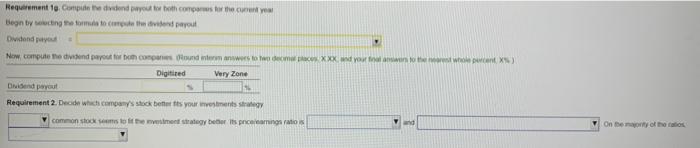

Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Digitized Corp. and Very Zone, Inc and have assembled the following data. Click to view the income statement data) (Click to view the balance sheet and market price data) Selected income statement data for the current year. Net Sales Revenue (all on credit) Very Zone 497 860 Digitized 416,830 $ 209,000 $ 260 000 Cost of Goods Sold 0 Interest Expense 17 000 62 000 72.000 Net Income ected balance sheet and market price data at the end of the current year. Digitized Very Zone Current Assets: Cash $ 27,000 $ 42,000 Short-term Investments Accounts Receivables, Net 35,000 19,000 16,000 49,000 100,000 15,000 Merchandise Inventory 64,000 20,000 Prepaid Expenses $ $ 188,000 $ 199,000 Total Current Assets $ Total Assets 263,000 $ 327,000 97,000 134,000 Total Current Liabilities 102,000 Total Liabilities 102,000 Common Stock 10,000 $1 par (10,000 shares) $2 par (17,000 shares) Total Stockholders' Equity Market Price per Share of Common Stock 34,000 193,000 161,000 117.80 93.28 Total Current Liabilities 102,000 102,000 97,000 134,000 Total Liabilities Common Stock: 10,000 $1 par (10,000 shares) $2 par (17,000 shares) Total Stockholders' Equity Market Price per Share of Common Stock Dividends Paid per Common Share 34.000 193,000 161,000 117.80 93.28 0.80 0.50 Hected balance sheet data at the beginning of the current year. Digitized Very Zone Balance sheet: $ 38,000 $ Accounts Receivables, net Merchandise Inventory 53,000 87,000 81,000 Total Assets 261,000 274,000 Common Stock 10,000 $1 par (10,000 shares) $2 par (17,000 shares) 34,000 Requirement te. Compute the earnings per share of common stock for both companies for the current year Begin by selecting the formula to compute the earnings per share of common stock Earnings per share of common stock Now.compute the earnings per share of common stock for both companies (Round your answers to the nearest cent) Digitized Very Zone Earnings per share of common stock Requirement 1. Compute the price/earnings ratio for both companies for the current year Begin by selecting the formula to compute the price/earnings ratio Pricelearnings ratio Now, compute the price earnings ratio for both companies. (Round interim and final answers to two decimal places, XXX) Digitized Very Zone Price/earings ratio Requirement i Compuedend you to both comes to the ceny Ben by acting a ford to compete Dividend pay Now computere did you to bom consondern wwers to come XXX and your own the whole went X) Digitized Very Zone Didend payout Requirement 2. Decide which company's stockbetts your money common stock to the strategy bor its coming nd On bety of the