Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice

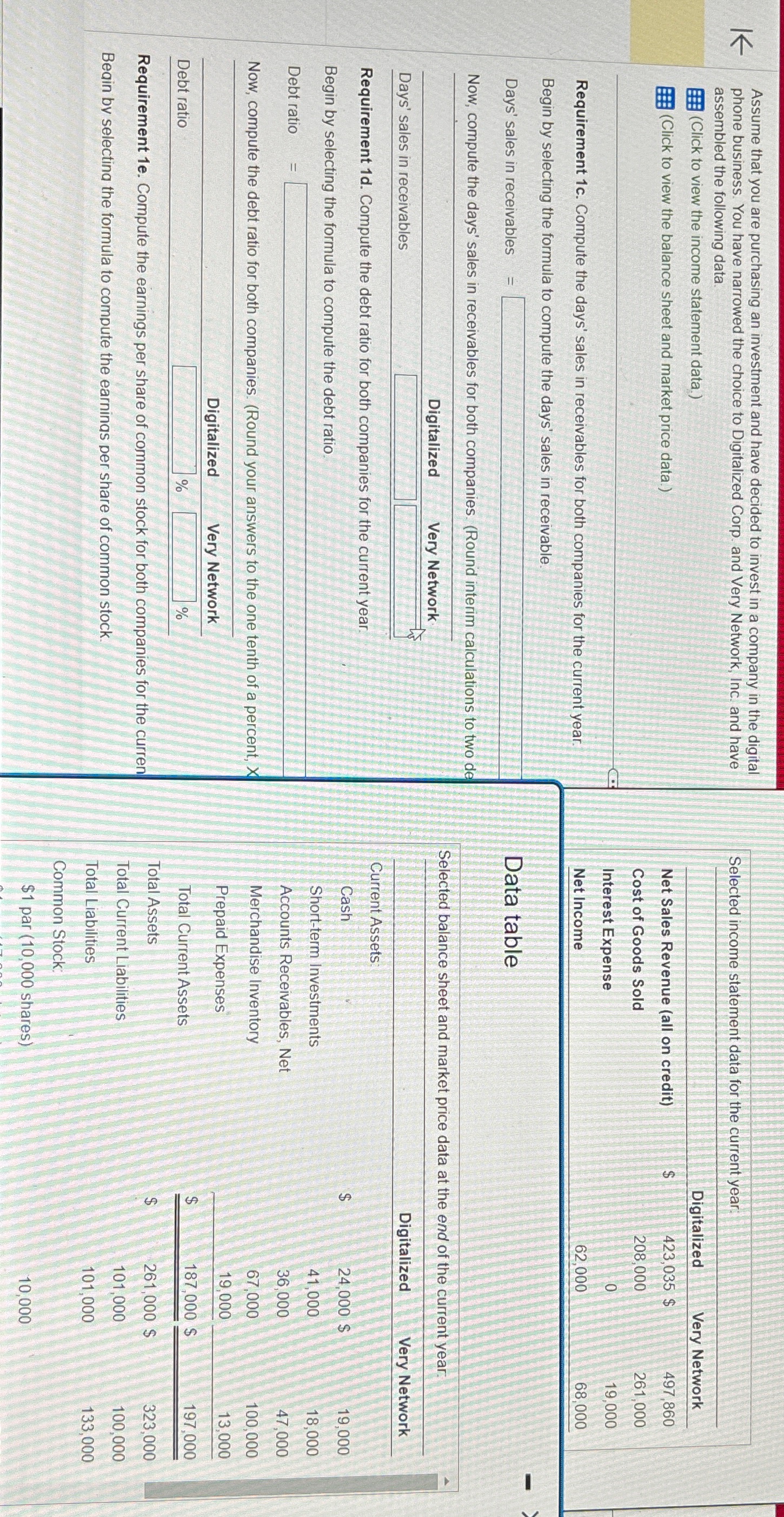

Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Digitalized Corp. and Very Network, Inc. and have assembled the following data.

Click to view the income statement data.

Click to view the balance sheet and market price data.

Requirement c Compute the days' sales in receivables for both companies for the current year.

Begin by selecting the formula to compute the days' sales in receivable.

Days' sales in receivables

Now, compute the days' sales in receivables for both companies. Round interim calculations to two de

tableDays sales in receivables Digitalized,

Requirement d Compute the debt ratio for both companies for the current year.

Begin by selecting the formula to compute the debt ratio

Debt ratio

Now, compute the debt ratio for both companies. Round your answers to the one tenth of a percent,

tableDigitalized,Very NetworkDebt ratio,,

Requirement e Compute the earnings per share of common stock for both companies for the curren

Beain by selectina the formula to compute the earninas per share of common stock.

Selected income statement data for the current year:

tableDigitalized,Very NetworkNet Sales Revenue all on credit$$Cost of Goods Sold,,Interest Expense,,Net Income,,

Data table

Selected balance sheet and market price data at the end of the current year:

tableDigitalized,Very Network,Current Assets:,$CashShortterm Investments,Accounts Receivables, Net,Merchandise Inventory,Prepaid Expenses,Total Current Assets,$Total Assets,Total Current Liabilities,Total Liabilities,,,Common Stock:,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started