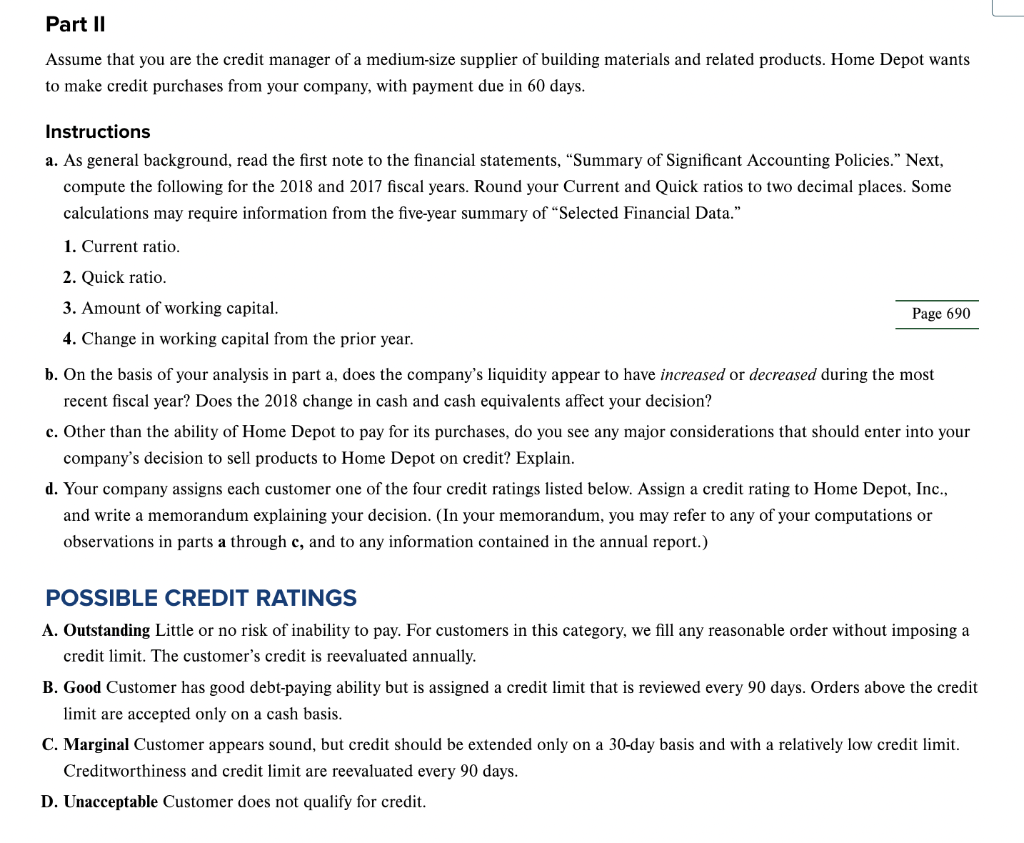

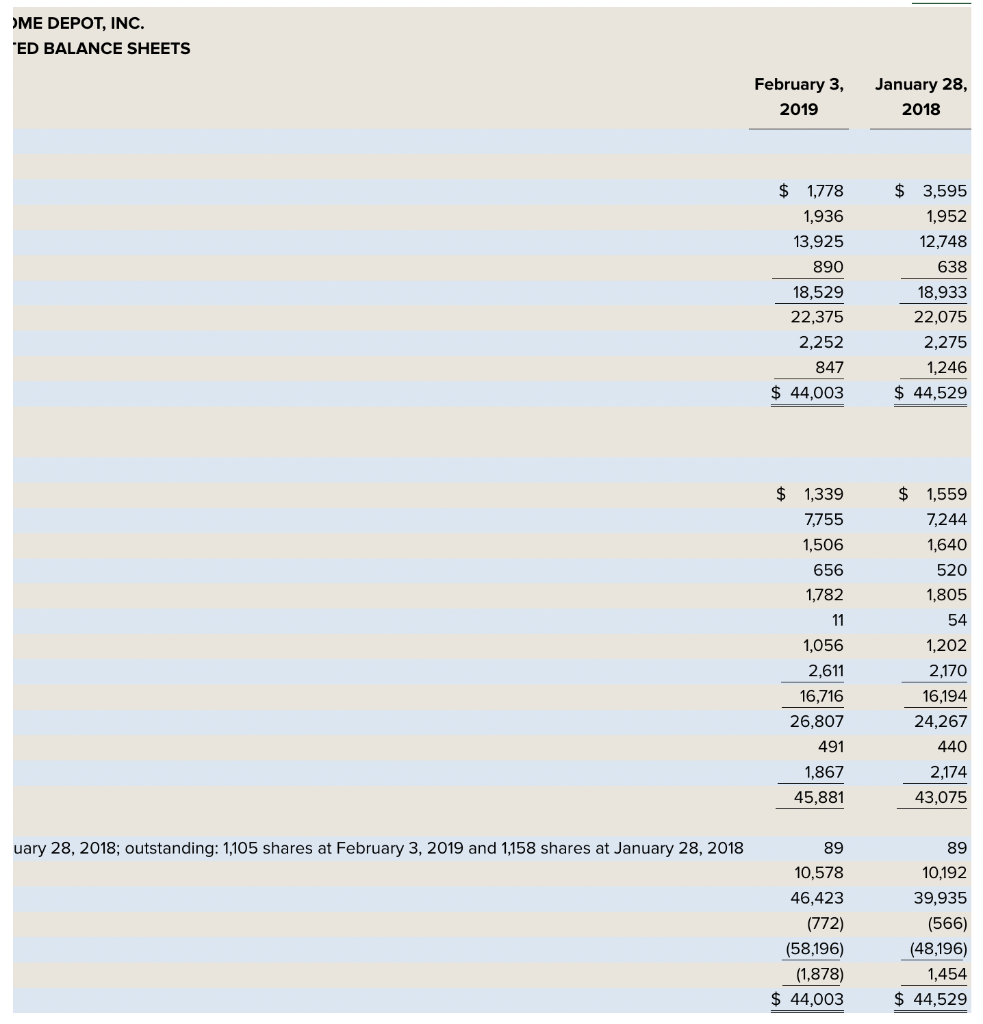

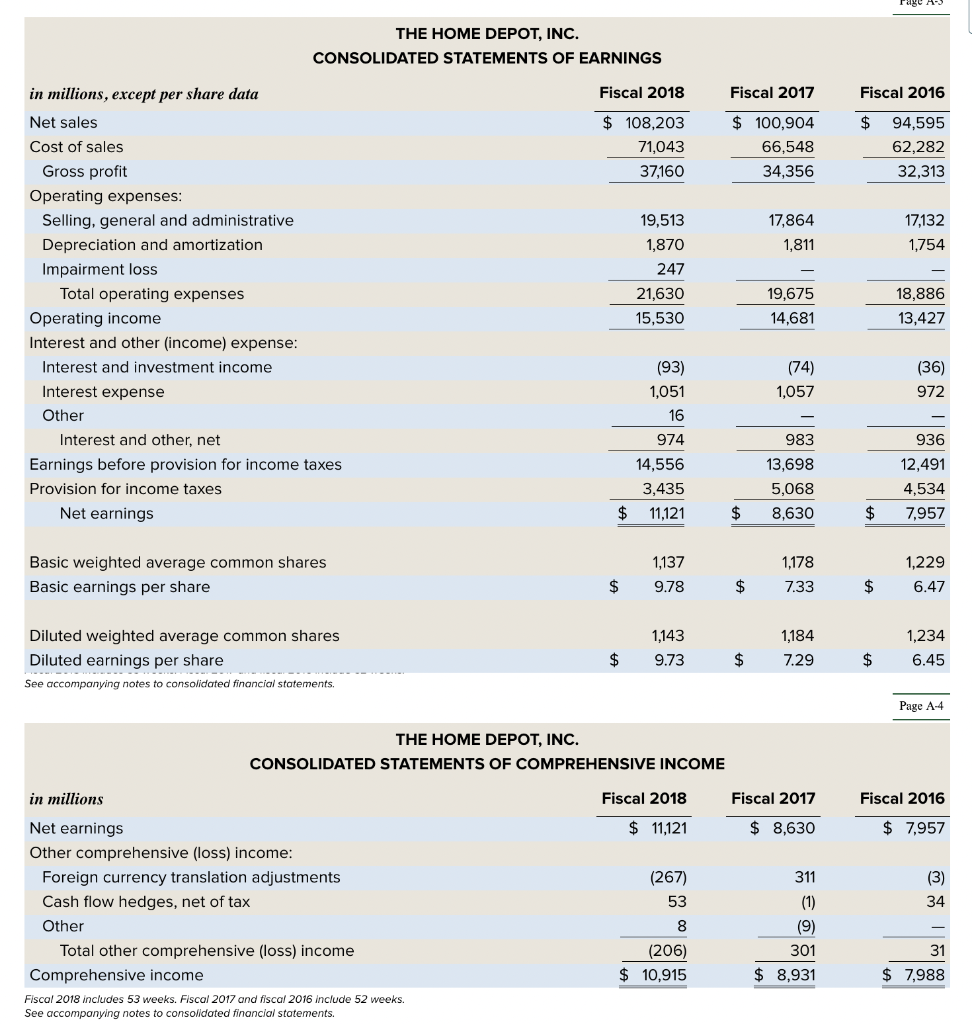

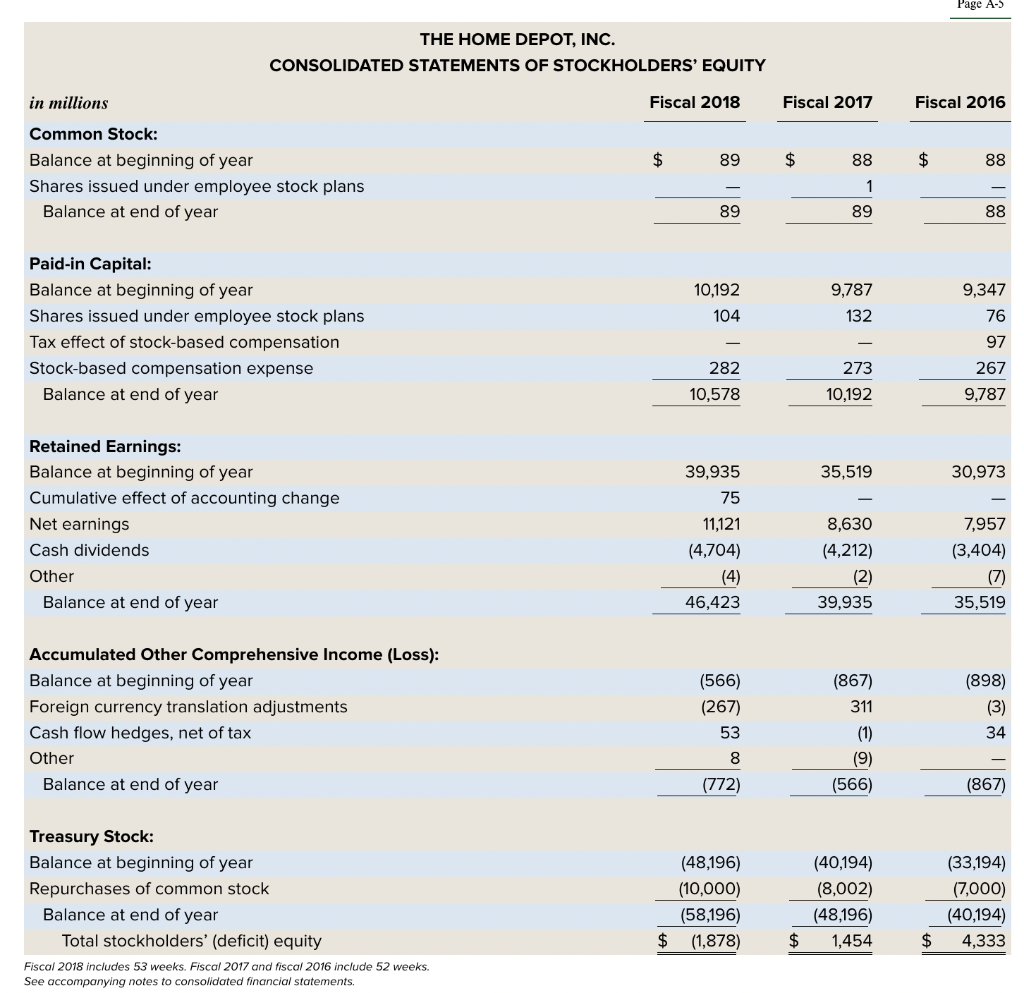

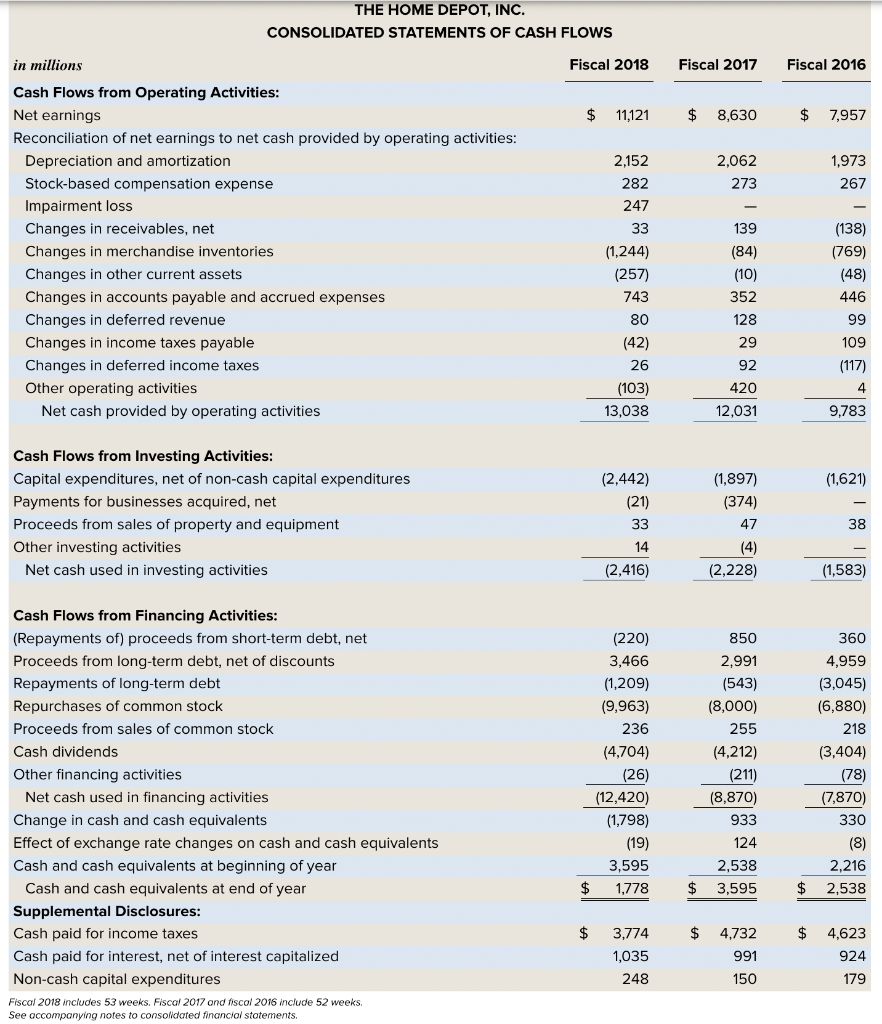

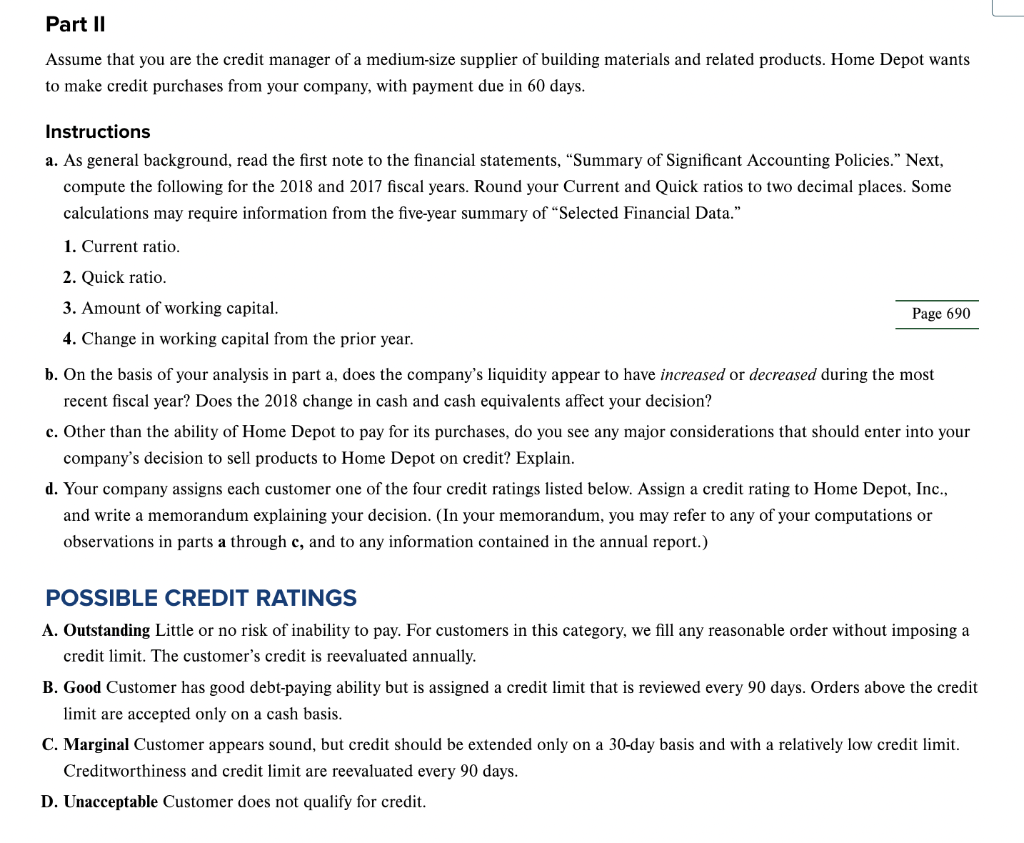

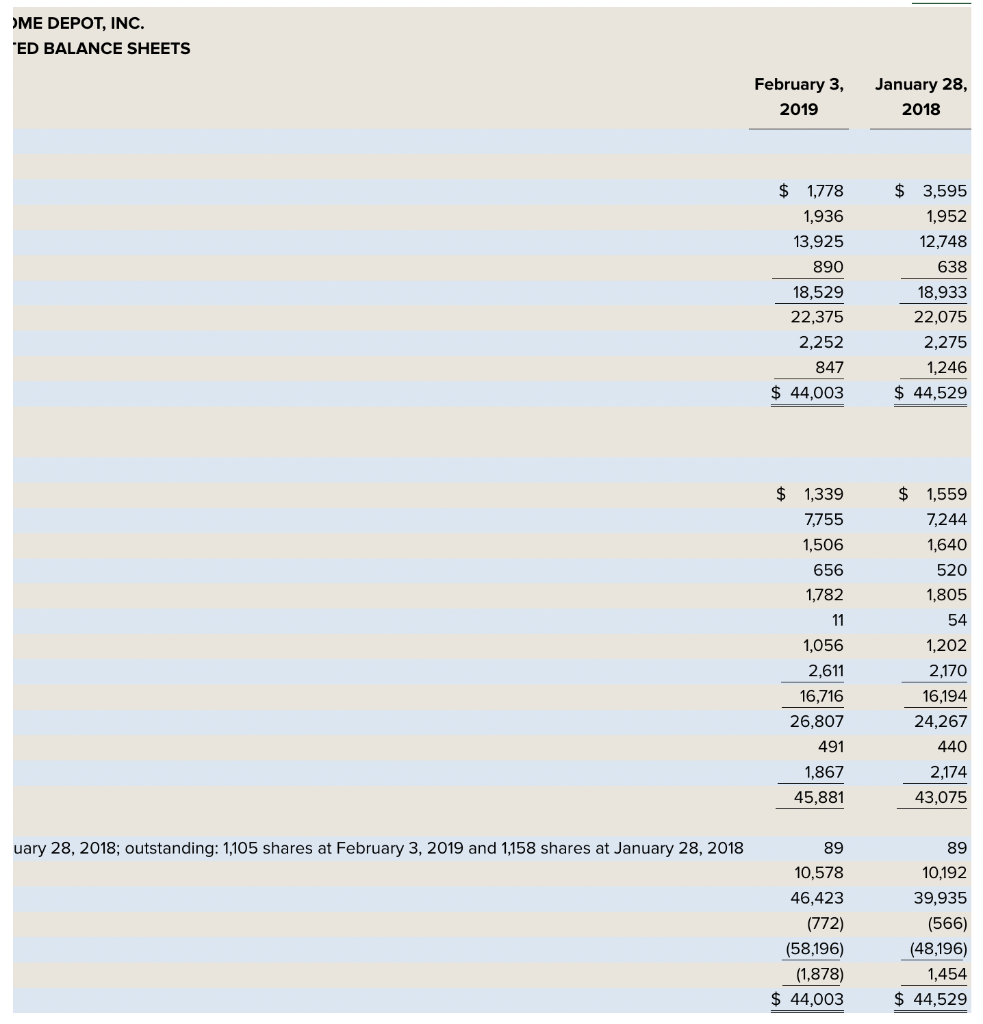

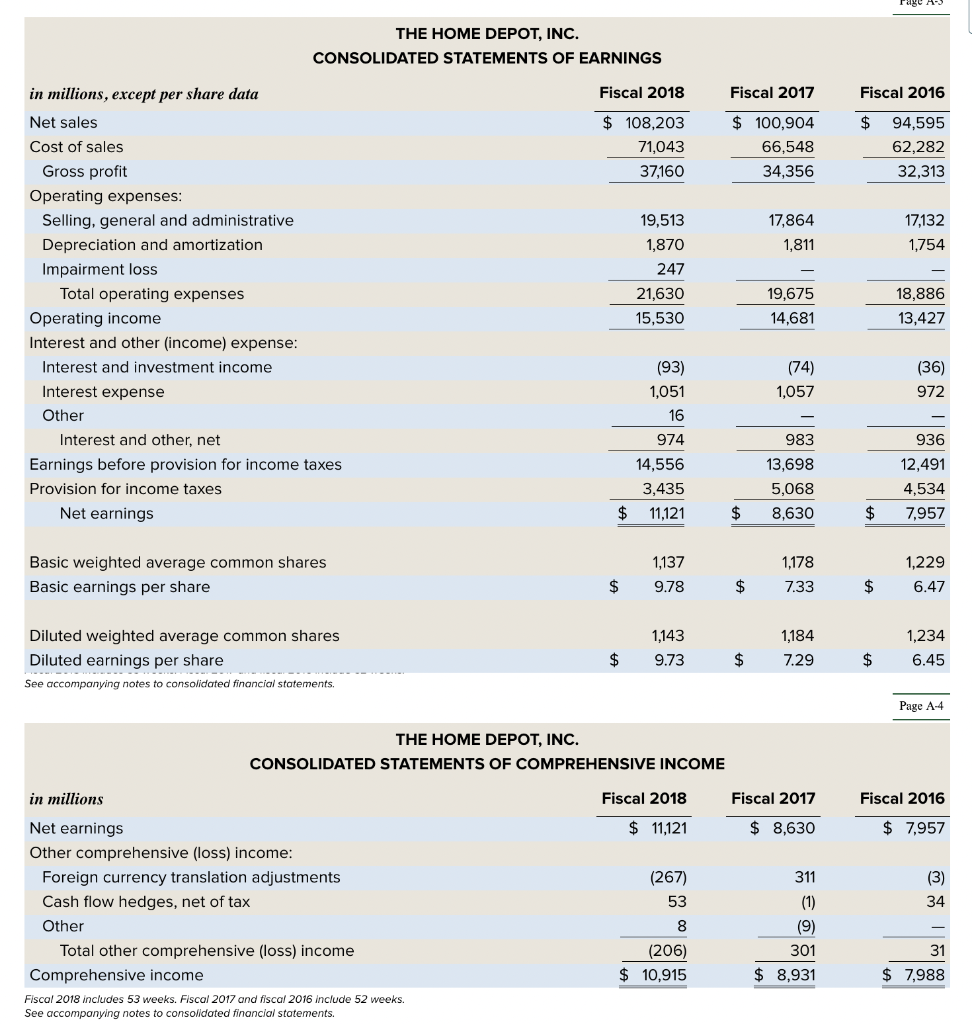

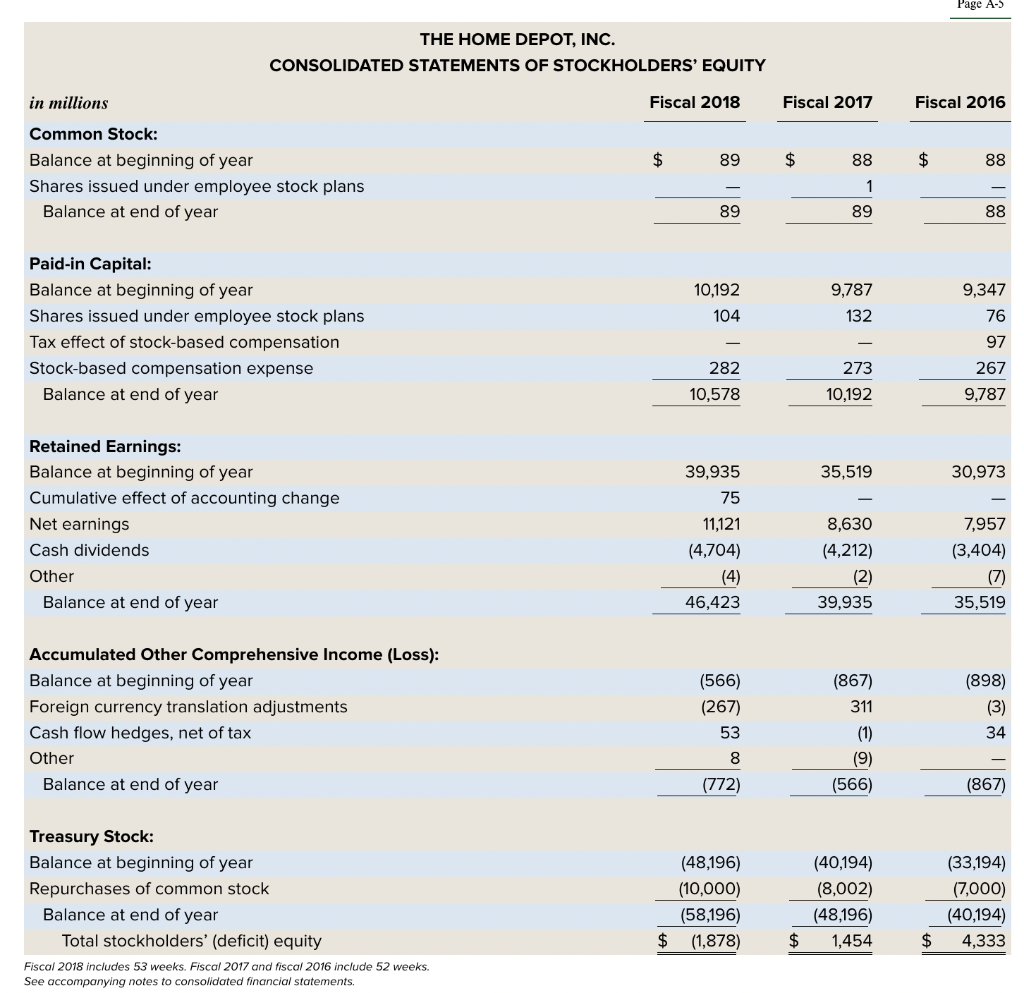

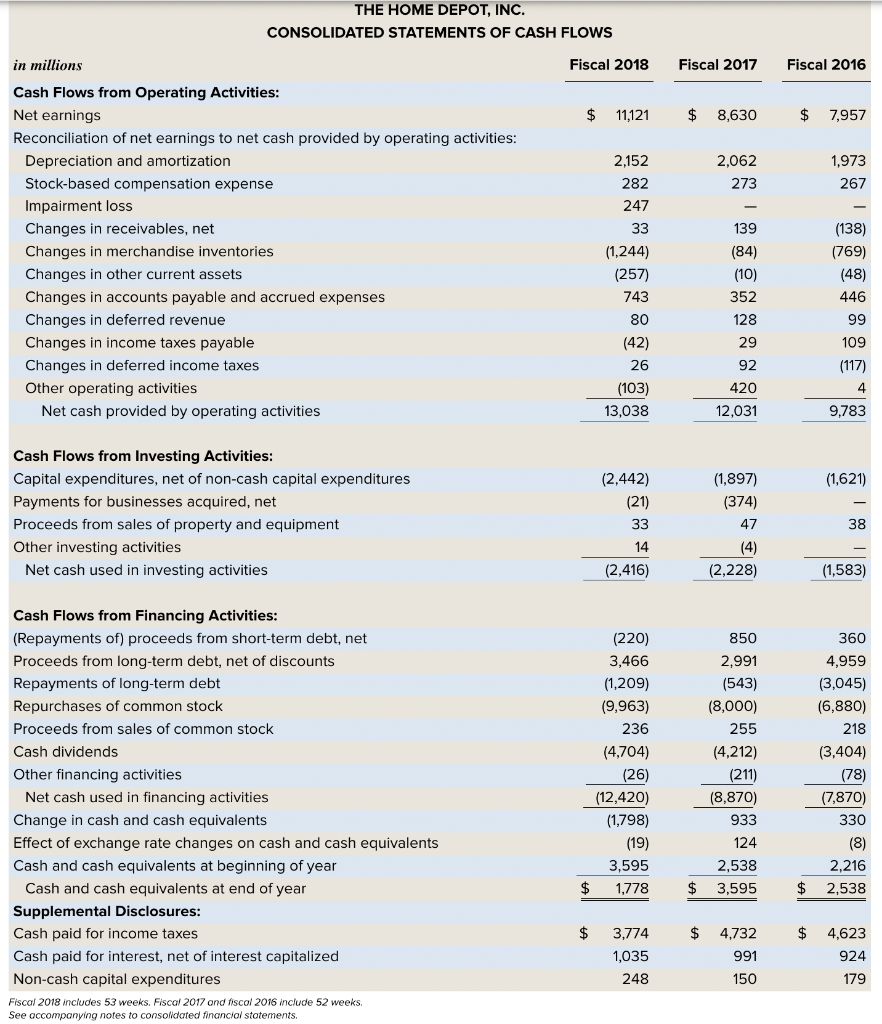

Assume that you are the credit manager of a medium-size supplier of building materials and related products. Home Depot wants to make credit purchases from your company, with payment due in 60 days. Instructions a. As general background, read the first note to the financial statements, "Summary of Significant Accounting Policies." Next, compute the following for the 2018 and 2017 fiscal years. Round your Current and Quick ratios to two decimal places. Some calculations may require information from the five-year summary of "Selected Financial Data." 1. Current ratio. 2. Quick ratio. 3. Amount of working capital. 4. Change in working capital from the prior year. Page 690 b. On the basis of your analysis in part a, does the company's liquidity appear to have increased or decreased during the most recent fiscal year? Does the 2018 change in cash and cash equivalents affect your decision? c. Other than the ability of Home Depot to pay for its purchases, do you see any major considerations that should enter into your company's decision to sell products to Home Depot on credit? Explain. d. Your company assigns each customer one of the four credit ratings listed below. Assign a credit rating to Home Depot, Inc., and write a memorandum explaining your decision. (In your memorandum, you may refer to any of your computations or observations in parts a through c, and to any information contained in the annual report.) POSSIBLE CREDIT RATINGS A. Outstanding Little or no risk of inability to pay. For customers in this category, we fill any reasonable order without imposing a credit limit. The customer's credit is reevaluated annually. B. Good Customer has good debt-paying ability but is assigned a credit limit that is reviewed every 90 days. Orders above the credit limit are accepted only on a cash basis. C. Marginal Customer appears sound, but credit should be extended only on a 30-day basis and with a relatively low credit limit. Creditworthiness and credit limit are reevaluated every 90 days. D. Unacceptable Customer does not qualify for credit. JME DEPOT, INC. 'ED BALANCE SHEETS THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF EARNINGS in millions, except per share data Net sales Cost of sales Gross profit Operating expenses: Selling, general and administrative Depreciation and amortization Impairment loss Total operating expenses Operating income Interest and other (income) expense: Interest and investment income Interest expense Other Interest and other, net Earnings before provision for income taxes Provision for income taxes Net earnings Basic weighted average common shares Basic earnings per share \begin{tabular}{rrr} 19,513 & 17,864 & 17,132 \\ 1,870 & 1,811 & 1,754 \\ 247 & & \\ \cline { 2 - 2 }r & 19,675 & 18,886 \\ \hline 15,530 & 14,681 & 13,427 \\ \hline \end{tabular} Diluted weighted average common shares Diluted earnings per share See accompanying notes to consolidated financial statements. Page A-4 THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME in millions Net earnings $11,121Fiscal2018$8,630Fiscal2017$7,957Fiscal2016 Other comprehensive (loss) income: Foreign currency translation adjustments Cash flow hedges, net of tax Other Total other comprehensive (loss) income Comprehensive income Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscal 2016 include 52 weeks. See accompanying notes to consolidated financial statements. THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY in millions Paid-in Capital: Balance at beginning of year Shares issued under employee stock plans Tax effect of stock-based compensation Stock-based compensation expense Balance at end of year Retained Earnings: Balance at beginning of year Cumulative effect of accounting change Net earnings Cash dividends \begin{tabular}{rrr} 10,192 & 9,787 & 9,347 \\ 104 & 132 & 76 \\ & & 97 \\ 282 & 273 & 267 \\ \hline 10,578 & 10,192 & 9,787 \\ \hline \end{tabular} Other Balance at end of year Accumulated Other Comprehensive Income (Loss): Balance at beginning of year Foreign currency translation adjustments Cash flow hedges, net of tax Other Balance at end of year Treasury Stock: Balance at beginning of year Repurchases of common stock Balance at end of year Total stockholders' (deficit) equity Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscal 2016 include 52 weeks. See accompanying notes to consolidated financial statements. THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS in millions Cash Flows from Operating Activities: Net earnings Reconciliation of net earnings to net cash provided by operating activities: Depreciation and amortization Stock-based compensation expense Impairment loss Changes in receivables, net Changes in merchandise inventories Changes in other current assets Changes in accounts payable and accrued expenses Changes in deferred revenue Changes in income taxes payable Changes in deferred income taxes Other operating activities Net cash provided by operating activities Cash Flows from Investing Activities: Capital expenditures, net of non-cash capital expenditures Payments for businesses acquired, net Proceeds from sales of property and equipment Other investing activities Net cash used in investing activities Cash Flows from Financing Activities: (Repayments of) proceeds from short-term debt, net Proceeds from long-term debt, net of discounts Repayments of long-term debt Repurchases of common stock Proceeds from sales of common stock Cash dividends Other financing activities Net cash used in financing activities Change in cash and cash equivalents Effect of exchange rate changes on cash and cash equivalents 2,1522822,0622731,973267 Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Supplemental Disclosures: Cash paid for income taxes Cash paid for interest, net of interest capitalized Non-cash capital expenditures Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscol 2016 include 52 weeks. See occompanying notes to consolidated financiol stotements. Assume that you are the credit manager of a medium-size supplier of building materials and related products. Home Depot wants to make credit purchases from your company, with payment due in 60 days. Instructions a. As general background, read the first note to the financial statements, "Summary of Significant Accounting Policies." Next, compute the following for the 2018 and 2017 fiscal years. Round your Current and Quick ratios to two decimal places. Some calculations may require information from the five-year summary of "Selected Financial Data." 1. Current ratio. 2. Quick ratio. 3. Amount of working capital. 4. Change in working capital from the prior year. Page 690 b. On the basis of your analysis in part a, does the company's liquidity appear to have increased or decreased during the most recent fiscal year? Does the 2018 change in cash and cash equivalents affect your decision? c. Other than the ability of Home Depot to pay for its purchases, do you see any major considerations that should enter into your company's decision to sell products to Home Depot on credit? Explain. d. Your company assigns each customer one of the four credit ratings listed below. Assign a credit rating to Home Depot, Inc., and write a memorandum explaining your decision. (In your memorandum, you may refer to any of your computations or observations in parts a through c, and to any information contained in the annual report.) POSSIBLE CREDIT RATINGS A. Outstanding Little or no risk of inability to pay. For customers in this category, we fill any reasonable order without imposing a credit limit. The customer's credit is reevaluated annually. B. Good Customer has good debt-paying ability but is assigned a credit limit that is reviewed every 90 days. Orders above the credit limit are accepted only on a cash basis. C. Marginal Customer appears sound, but credit should be extended only on a 30-day basis and with a relatively low credit limit. Creditworthiness and credit limit are reevaluated every 90 days. D. Unacceptable Customer does not qualify for credit. JME DEPOT, INC. 'ED BALANCE SHEETS THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF EARNINGS in millions, except per share data Net sales Cost of sales Gross profit Operating expenses: Selling, general and administrative Depreciation and amortization Impairment loss Total operating expenses Operating income Interest and other (income) expense: Interest and investment income Interest expense Other Interest and other, net Earnings before provision for income taxes Provision for income taxes Net earnings Basic weighted average common shares Basic earnings per share \begin{tabular}{rrr} 19,513 & 17,864 & 17,132 \\ 1,870 & 1,811 & 1,754 \\ 247 & & \\ \cline { 2 - 2 }r & 19,675 & 18,886 \\ \hline 15,530 & 14,681 & 13,427 \\ \hline \end{tabular} Diluted weighted average common shares Diluted earnings per share See accompanying notes to consolidated financial statements. Page A-4 THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME in millions Net earnings $11,121Fiscal2018$8,630Fiscal2017$7,957Fiscal2016 Other comprehensive (loss) income: Foreign currency translation adjustments Cash flow hedges, net of tax Other Total other comprehensive (loss) income Comprehensive income Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscal 2016 include 52 weeks. See accompanying notes to consolidated financial statements. THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY in millions Paid-in Capital: Balance at beginning of year Shares issued under employee stock plans Tax effect of stock-based compensation Stock-based compensation expense Balance at end of year Retained Earnings: Balance at beginning of year Cumulative effect of accounting change Net earnings Cash dividends \begin{tabular}{rrr} 10,192 & 9,787 & 9,347 \\ 104 & 132 & 76 \\ & & 97 \\ 282 & 273 & 267 \\ \hline 10,578 & 10,192 & 9,787 \\ \hline \end{tabular} Other Balance at end of year Accumulated Other Comprehensive Income (Loss): Balance at beginning of year Foreign currency translation adjustments Cash flow hedges, net of tax Other Balance at end of year Treasury Stock: Balance at beginning of year Repurchases of common stock Balance at end of year Total stockholders' (deficit) equity Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscal 2016 include 52 weeks. See accompanying notes to consolidated financial statements. THE HOME DEPOT, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS in millions Cash Flows from Operating Activities: Net earnings Reconciliation of net earnings to net cash provided by operating activities: Depreciation and amortization Stock-based compensation expense Impairment loss Changes in receivables, net Changes in merchandise inventories Changes in other current assets Changes in accounts payable and accrued expenses Changes in deferred revenue Changes in income taxes payable Changes in deferred income taxes Other operating activities Net cash provided by operating activities Cash Flows from Investing Activities: Capital expenditures, net of non-cash capital expenditures Payments for businesses acquired, net Proceeds from sales of property and equipment Other investing activities Net cash used in investing activities Cash Flows from Financing Activities: (Repayments of) proceeds from short-term debt, net Proceeds from long-term debt, net of discounts Repayments of long-term debt Repurchases of common stock Proceeds from sales of common stock Cash dividends Other financing activities Net cash used in financing activities Change in cash and cash equivalents Effect of exchange rate changes on cash and cash equivalents 2,1522822,0622731,973267 Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Supplemental Disclosures: Cash paid for income taxes Cash paid for interest, net of interest capitalized Non-cash capital expenditures Fiscal 2018 includes 53 weeks. Fiscal 2017 and fiscol 2016 include 52 weeks. See occompanying notes to consolidated financiol stotements