Question

Penn Central Company, a wholesaler, purcashed 80% of the issued and outstanding stock of Sante Fe Inc., a retailer, on December 31, 2013, for $300,000.

Penn Central Company, a wholesaler, purcashed 80% of the issued and outstanding stock of Sante Fe Inc., a retailer, on December 31, 2013, for $300,000. At that date, Sante Fe Inc. had one class of common stock outstanding at a stated value of $150,000 and retained earnings of $37,500. The leases will expire on December 30, 2023,and Penn Central Company executives estimated the market value of Sante Fe Inc.'s assets and liabilities compared to their book value on December 31, 2013, as follows: Penn Central Company purchased Sante Fe Inc.'s stock from Sante Fe Inc.'s major stockholder, primarily to acquire control of signboard leases owned by Sante Fe Inc..

FMV BV

Current assets 41,250 $ 41,250 $

Inventories 123,750 $ 123,750

$ Land 30,000 $ 30,000 $

Buildings and equipment (net) 60,000 $ 60,000 $

Signboard leases 150,000 $ 60,000 $

Current liabilities (127,500) $ (127,500) $

Penn Central Company accounts for this investment using the equity method. Sante Fe Inc. declared a $37,500 cash dividend on December 20, 2017, payable on January 20, 2018, to stockholders of record on January 2, 2018. The financial statements for both companies for the year ended December 31, 2017, are shown below:

Penn Central Company Sante Fe Inc.

Current Assets 28,000 $ 168,000 $

Divdends Receivable 30,000

Inventories 22,000 117,000

Land 10,000 22,500

Building & Equip. 58,000 63,000

Accum. Deprec. (31,900) (22,050)

Signboard Leases 36,000

Investment in Sub. 320,760

Total Assets 436,860 $ 384,450 $

Current Liabilities 22,000 $ 97,500 $

Dividends Payable 37,500

Capital Stock 100,000 150,000

Retained Earnings 314,860 99,450

Total Liabilities and Equities $ 436,860 $ 384,450

INCOME STATEMENT

Penn Central Company Sante Fe Inc.

Revenue 225,000 $ 367,500 $

Income from sub 52,800

Total Rev 277,800 $ $ 367,500

Cost Of Sales 145,000 $ 255,000 $

Other Expenses 36,000 37,500

Total Expenses 181,000 $ 292,500 $

Net Income 96,800 $ 75,000

STATEMENT OF RETAINED EARNINGS

Penn Central Company Sante Fe Inc.

Begining Balance 218,060 $ 61,950 $

Add: Net Income 96,800 75,000

Deduct: Dividends 37,500

Ending Balance 314,860 $ 99,450 $

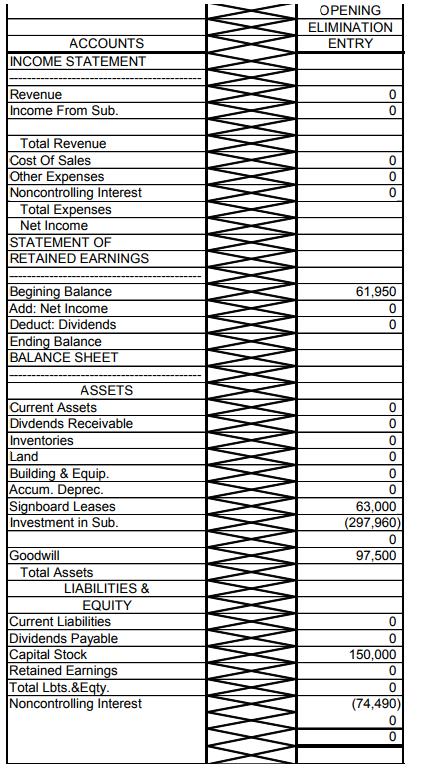

1 2 (AICPA adapted) Required: Assume that you did not have the last column from the phantom books with which to prepare eliminating entry (a) on the spreadsheet. Set up schedules to demonstrate that all letter (a) entry amounts could be derived from other numbers already in the problem. In other words, set up schedules to support all debits and credits for the letter (a) eliminating entry.

ACCOUNTS INCOME STATEMENT Revenue Income From Sub. Total Revenue Cost Of Sales Other Expenses Noncontrolling Interest Total Expenses Net Income STATEMENT OF RETAINED EARNINGS Begining Balance Add: Net Income Deduct: Dividends Ending Balance BALANCE SHEET ASSETS Current Assets Divdends Receivable Inventories Land Building & Equip. Accum. Deprec. Signboard Leases Investment in Sub. Goodwill Total Assets Current Liabilities Dividends Payable Capital Stock Retained Earnings Total Lbts.&Eqty. Noncontrolling Interest LIABILITIES & EQUITY OPENING ELIMINATION ENTRY 0 0 0 0 0 61,950 0 0 0 0 0 0 0 0 63,000 (297,960) 0 97,500 0 0 150,000 0 0 (74,490) 0 0

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

In fact there is surprisingly little consistency across Wall Street around the structure of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635df19f95621_180180.pdf

180 KBs PDF File

635df19f95621_180180.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started