Answered step by step

Verified Expert Solution

Question

1 Approved Answer

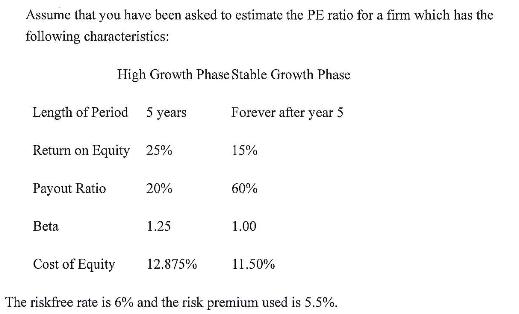

Assume that you have been asked to estimate the PE ratio for a firm which has the following characteristics: High Growth Phase Stable Growth

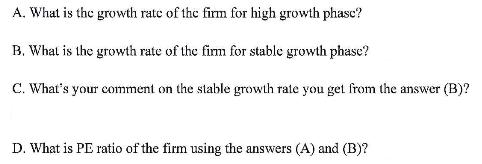

Assume that you have been asked to estimate the PE ratio for a firm which has the following characteristics: High Growth Phase Stable Growth Phase Length of Period 5 years Forever after year 5 Return on Equity 25% 15% Payout Ratio 20% 60% Beta 1.25 1.00 Cost of Equity 12.875% 11.50% The riskfree rate is 6% and the risk premium used is 5.5%. A. What is the growth rate of the firm for high growth phase? B. What is the growth rate of the firm for stable growth phase? C. What's your comment on the stable growth rate you get from the answer (B)? D. What is PE ratio of the firm using the answers (A) and (B)?

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate the growth rate for the high growth phase we use the formula Growth Rate ROE 1 Payout ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started