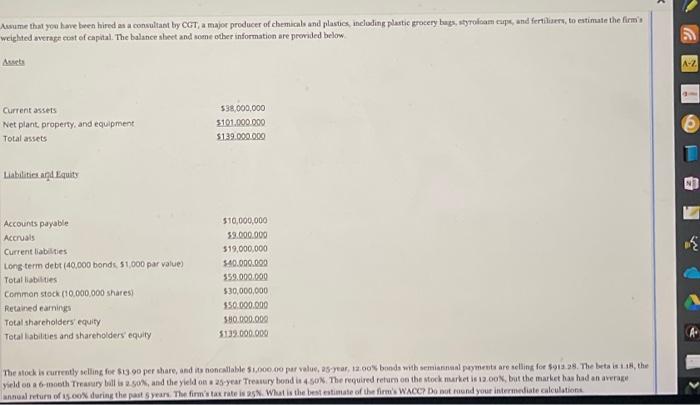

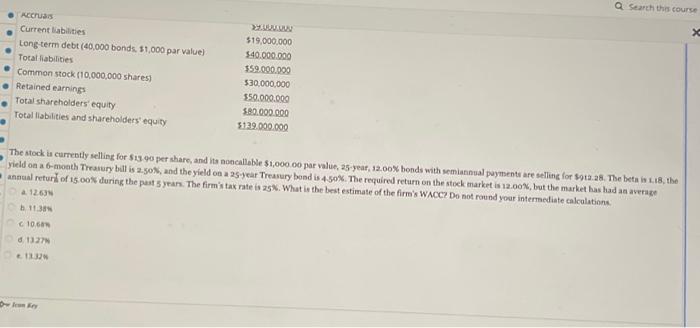

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plasties including plastic procery bugs, styrofoam eup, and fertilisers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below Areets A-Z Current assets Net plant property, and equipment Total assets 538,000,000 5101.000.000 5139.000.009 Liabilities and Equity Accounts payable Accruals Current liabilities Long term debt (40,000 bonds 51,000 par value) Total liabilities Common stock (10.000.000 shares Retained earnings Total shareholders equity Total abilities and shareholders equity $10,000,000 59.000.000 519,000,000 540.000.000 359.000.000 $30,000,000 550.000.000 580.000.000 5139.000.000 A The stock is currently selling for $300 per share, and it noncallable 51.000,00 urval year, 12.00bonds with semanal payments are selling for $91325. The best the yield on 6 mooth Treasury bill is 2.0' and the yield on 25-year Troury bond in 4 50% The required return on the stock market is 12.00, but the market has had an average annual return of is o% during the past year. The firm's tax rates. What is the best estimate of the firm. WACC? Do not and your intermediate calculation Search this course Accuas Current abilities Long-term debt (40,000 bonds. 51.000 par value) Total liabilities Common stock (10,000,000 shares) Retained earning Total shareholders' equity Total liabilities and shareholders' equity > $19,000,000 340.000.000 359.000.000 530,000,000 350.000.000 $80.000.000 $129.000.000 The stock is currently selling for $is 90 per share, and ita noncallable $1,000.00 par valur, as year, 12.00% bonds with semutmal payments are selling for Sa. 28. The beta in 1.18, the yield on a 6-month Treasury bull is 2.50%, and the yield on a 25-year Treasury bend is 4.50%. The required return on the stock market is 12.00%, but the market has had an average annual retur) of 15.00% during the past 5 years. The firm's tax rate is 25. What is the best estimate of the firm's WACC? Do not round your intermediate calculation 2126 11:38 C106 132 Delen