Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you have just graduated ( Year 2 2 ) and that you are planning for your retirement. Because of Bright Futures and prepaid

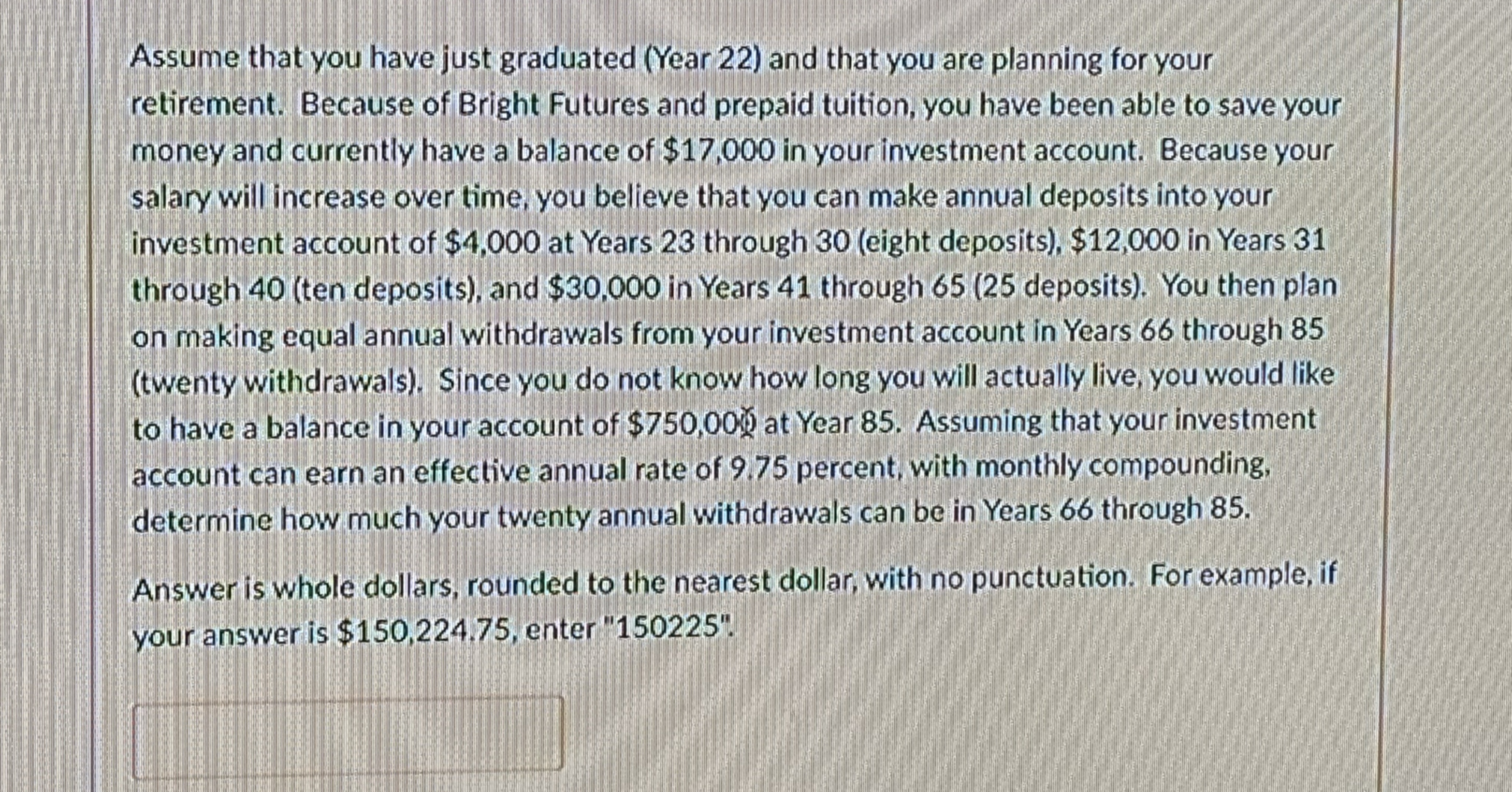

Assume that you have just graduated Year and that you are planning for your

retirement. Because of Bright Futures and prepaid tuition, you have been able to save your

money and currently have a balance of $ in your investment account. Because your

salary will increase over time, you believe that you can make annual deposits into your

investment account of $ at Years through eight deposits $ in Years

through ten deposits and $ in Years through deposits You then plan

on making equal annual withdrawals from your investment account in Years through

twenty withdrawals Since you do not know how long you will actually live, you would like

to have a balance in your account of $ at Year Assuming that your investment

account can earn an effective annual rate of percent, with monthly compounding,

determine how much your twenty annual withdrawals can be in Years through

Answer is whole dollars, rounded to the nearest dollar, with no punctuation. For example, if

your answer is $ enter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started