Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you have just turned 21, graduated from college, and got a great job. Because of a finance class that you took as

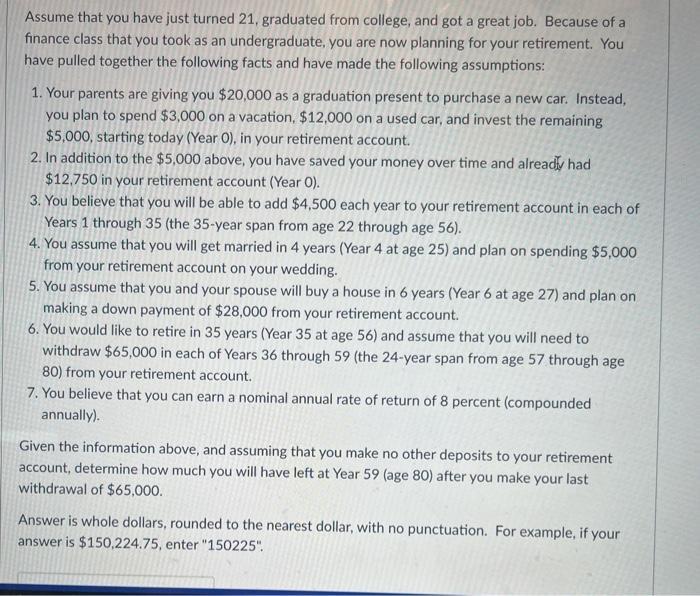

Assume that you have just turned 21, graduated from college, and got a great job. Because of a finance class that you took as an undergraduate, you are now planning for your retirement. You have pulled together the following facts and have made the following assumptions: 1. Your parents are giving you $20,000 as a graduation present to purchase a new car. Instead, you plan to spend $3,000 on a vacation, $12,000 on a used car, and invest the remaining $5,000, starting today (Year O), in your retirement account. 2. In addition to the $5,000 above, you have saved your money over time and already had $12,750 in your retirement account (Year O). 3. You believe that you will be able to add $4,500 each year to your retirement account in each of Years 1 through 35 (the 35-year span from age 22 through age 56). 4. You assume that you will get married in 4 years (Year 4 at age 25) and plan on spending $5,000 from your retirement account on your wedding. 5. You assume that you and your spouse will buy a house in 6 years (Year 6 at age 27) and plan on making a down payment of $28,000 from your retirement account. 6. You would like to retire in 35 years (Year 35 at age 56) and assume that you will need to withdraw $65,000 in each of Years 36 through 59 (the 24-year span from age 57 through age 80) from your retirement account. 7. You believe that you can earn a nominal annual rate of return of 8 percent (compounded annually). Given the information above, and assuming that you make no other deposits to your retirement account, determine how much you will have left at Year 59 (age 80) after you make your last withdrawal of $65,000. Answer is whole dollars, rounded to the nearest dollar, with no punctuation. For example, if your answer is $150,224.75, enter "150225".

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 The total amount left in the retirement account at Year 59 age 80 is 1140811 To determine the total amount left in the retirement account at Year 59 age 80 we must first calculate the cumulative con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started