Answered step by step

Verified Expert Solution

Question

1 Approved Answer

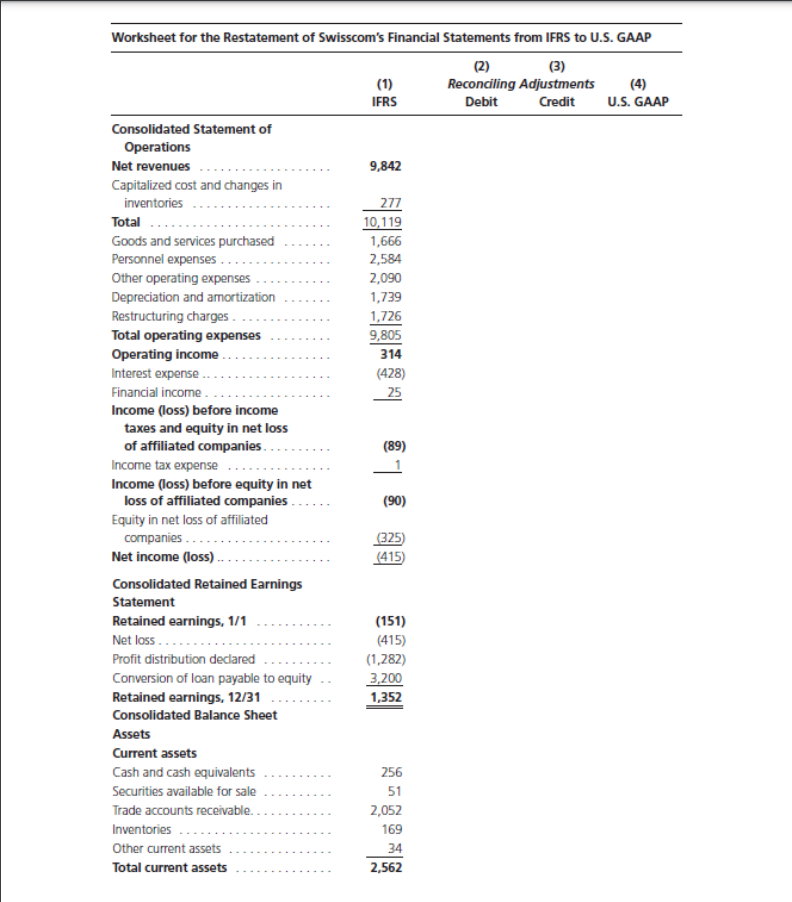

Worksheet for the Restatement of Swisscom's Financial Statements from IFRS to U.S. GAAP (2) (3) Reconciling Adjustments Debit Credit Consolidated Statement of Operations Net

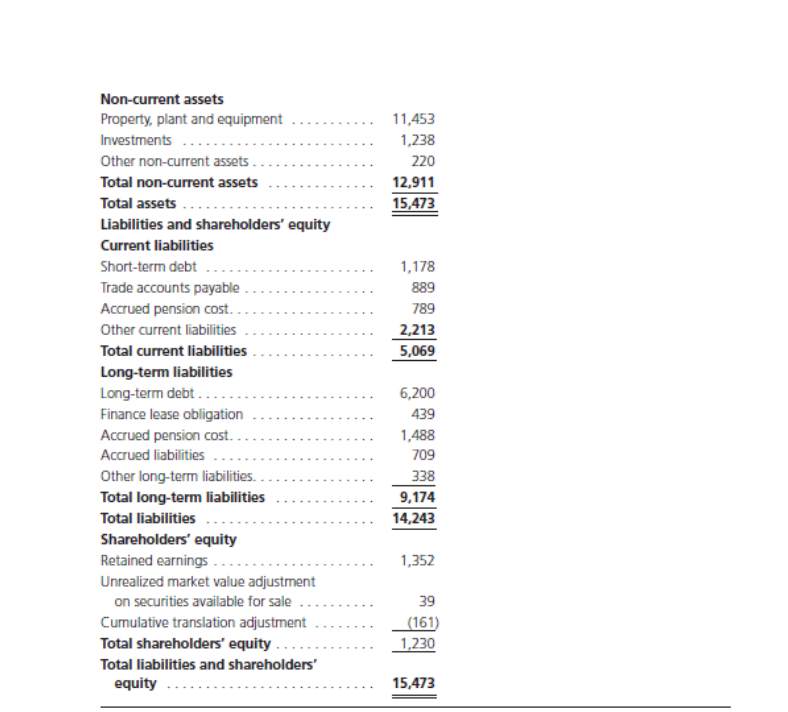

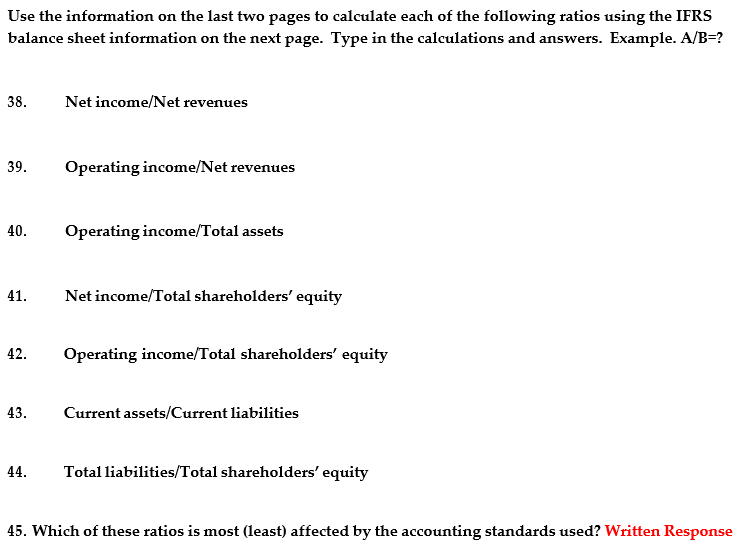

Worksheet for the Restatement of Swisscom's Financial Statements from IFRS to U.S. GAAP (2) (3) Reconciling Adjustments Debit Credit Consolidated Statement of Operations Net revenues Capitalized cost and changes in inventories Total.... Goods and services purchased Personnel expenses.... Other operating expenses Depreciation and amortization Restructuring charges. Total operating expenses Operating income.. Interest expense Financial income. Income (loss) before income taxes and equity in net loss of affiliated companies.. Income tax expense ... Income (loss) before equity in net loss of affiliated companies. Equity in net loss of affiliated companies..... Net income (loss)... Consolidated Retained Earnings Statement Retained earnings, 1/1 Net loss..... Profit distribution declared Conversion of loan payable to equity Retained earnings, 12/31 Consolidated Balance Sheet Assets Current assets Cash and cash equivalents Securities available for sale Trade accounts receivable.. Inventories Other current assets Total current assets (1) IFRS 9,842 277 10,119 1,666 2,584 2,090 1,739 1,726 9,805 314 (428) 25 (89) (90) (325) (415) (151) (415) (1,282) 3,200 1,352 256 51 2,052 169 34 2,562 U.S. GAAP Non-current assets Property, plant and equipment Investments .... Other non-current assets. Total non-current assets Total assets Liabilities and shareholders' equity Current liabilities Short-term debt..... Trade accounts payable Accrued pension cost.. Other current liabilities Total current liabilities Long-term liabilities Long-term debt...... Finance lease obligation Accrued pension cost.. Accrued liabilities Other long-term liabilities.. Total long-term liabilities Total liabilities Shareholders' equity Retained earnings .... Unrealized market value adjustment on securities available for sale Cumulative translation adjustment Total shareholders' equity.... Total liabilities and shareholders' equity 11,453 1,238 220 12,911 15,473 1,178 889 789 2,213 5,069 6,200 439 1,488 709 338 9,174 14,243 1,352 39 (161) 1,230 15,473 Use the information on the last two pages to calculate each of the following ratios using the IFRS balance sheet information on the next page. Type in the calculations and answers. Example. A/B=? 38. 39. Operating income/Net revenues 40. Operating income/Total assets 41. Net income/Net revenues 42. 43. Net income/Total shareholders' equity Operating income/Total shareholders' equity Current assets/Current liabilities 44. Total liabilities/Total shareholders' equity 45. Which of these ratios is most (least) affected by the accounting standards used? Written Response

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Date Name of account Debit Credit a Property plant and equipment 54 Depreciation and amortization 5 Interest expense 13 Retained earnings 46 b Property plant and equipment 107 Other longterm li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started