Answered step by step

Verified Expert Solution

Question

1 Approved Answer

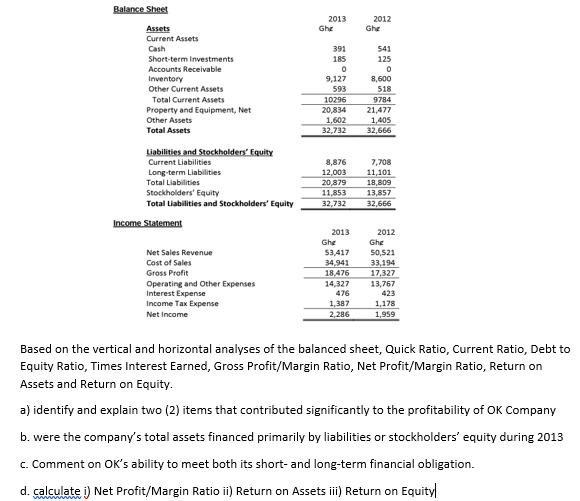

Balance Sheet Assets Current Assets Cash Short-term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Property and Equipment, Net Other Assets Total

Balance Sheet Assets Current Assets Cash Short-term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Property and Equipment, Net Other Assets Total Assets Liabilities and Stockholders' Equity Current Liabilities Long-term Liabilities Total Liabilities Stockholders' Equity Total Liabilities and Stockholders' Equity Income Statement Net Sales Revenue Cost of Sales Gross Profit Operating and Other Expenses Interest Expense Income Tax Expense Net Income 2013 Ghe 391 185 0 9,127 593 10296 20,834 1,602 32,732 8,876 12,003 20,879 11,853 32,732 2013 Ghe 53,417 34,941 18,476 14,327 476 1,387 2,286 2012 Ghe 541 125 0 8,600 518 9784 21,477 1,405 32,666 7,708 11,101 18,809 13,857 32,666 2012 Ghe 50,521 33,194 17,327 13,767 423 1,178 1,959 Based on the vertical and horizontal analyses of the balanced sheet, Quick Ratio, Current Ratio, Debt to Equity Ratio, Times Interest Earned, Gross Profit/Margin Ratio, Net Profit/Margin Ratio, Return on Assets and Return on Equity. a) identify and explain two (2) items that contributed significantly to the profitability of OK Company b. were the company's total assets financed primarily by liabilities or stockholders' equity during 201 c. Comment on OK's ability to meet both its short- and long-term financial obligation. d. calculate i) Net Profit/Margin Ratio ii) Return on Assets iii) Return on Equity

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Solution a See 12 xxx in the Lesson Plan b Let K 1nn EN The inversion map L R 0 R 0 x 12 is a hom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started