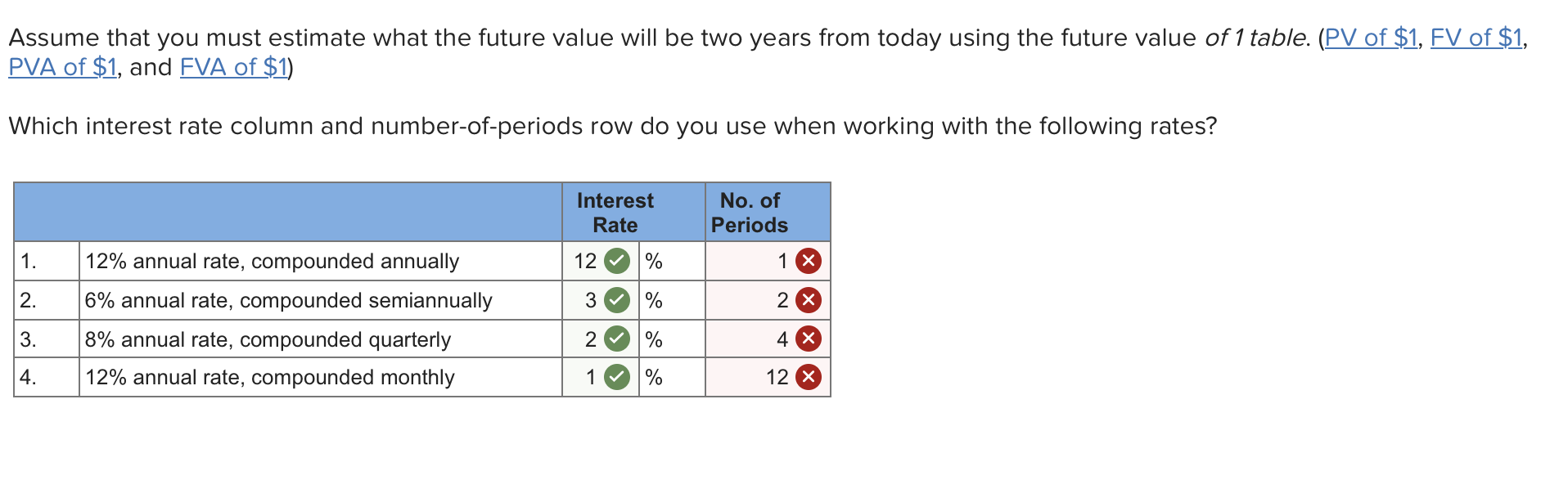

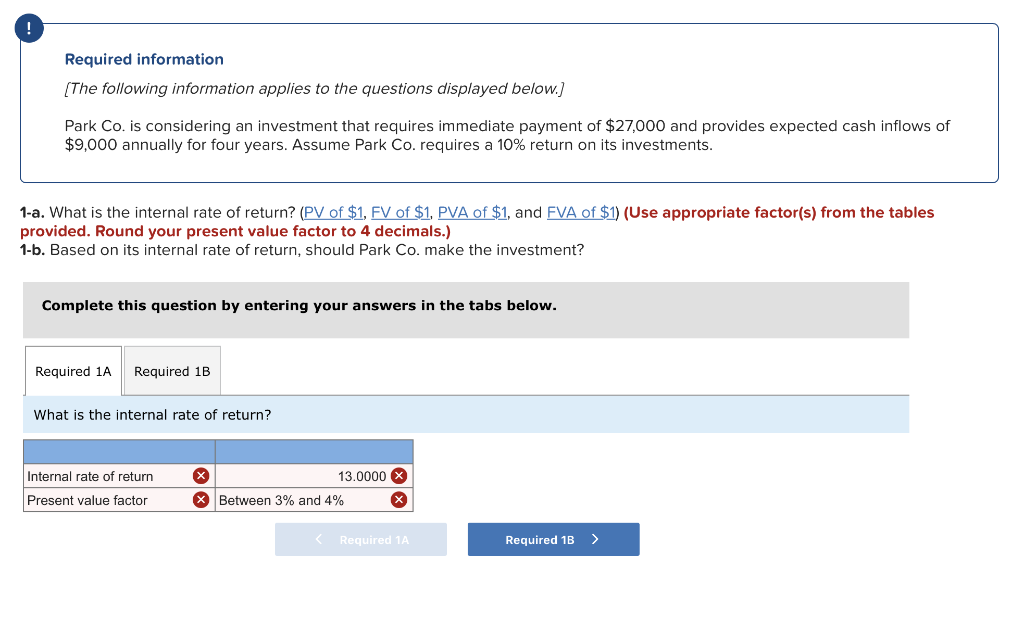

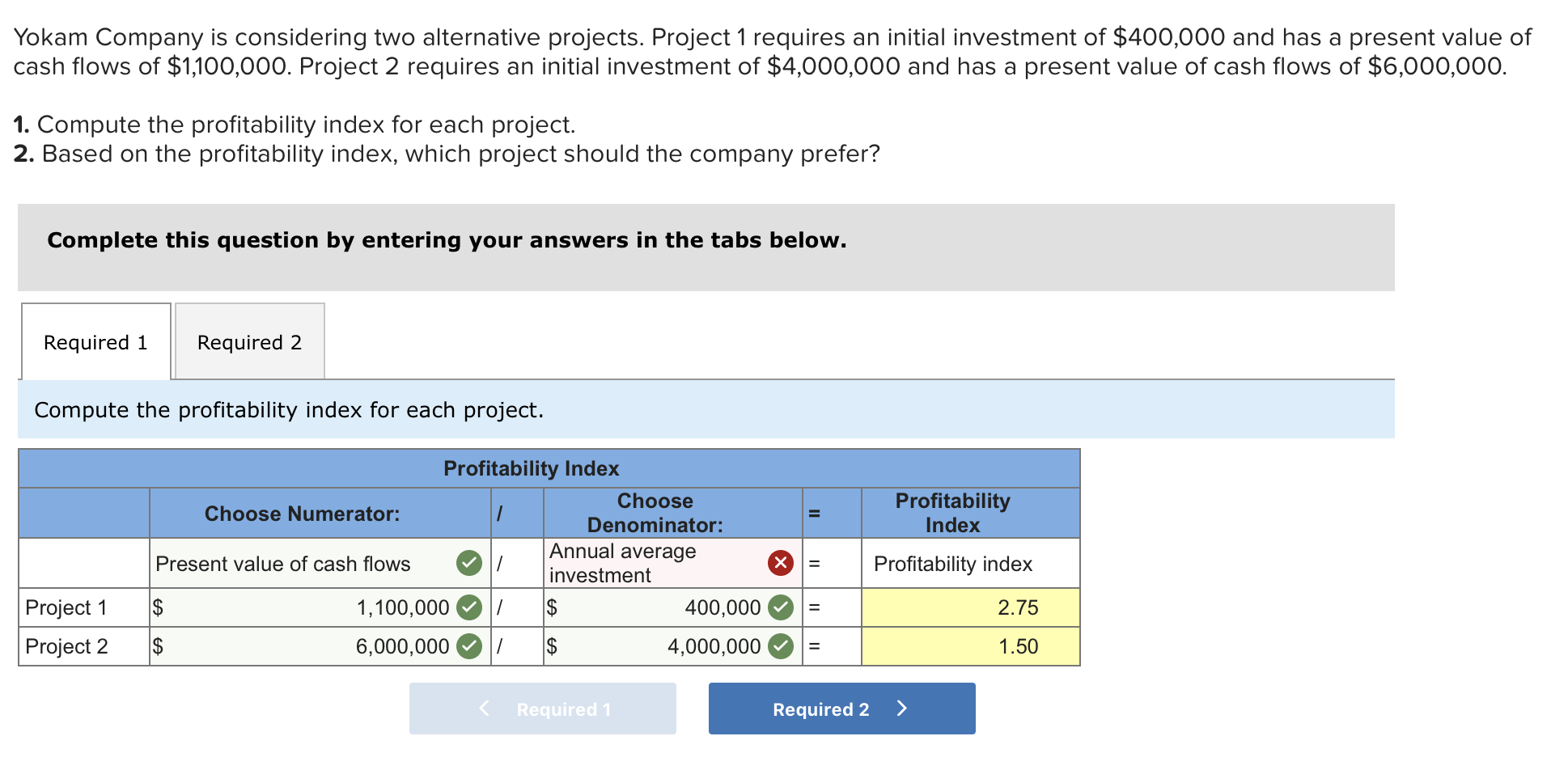

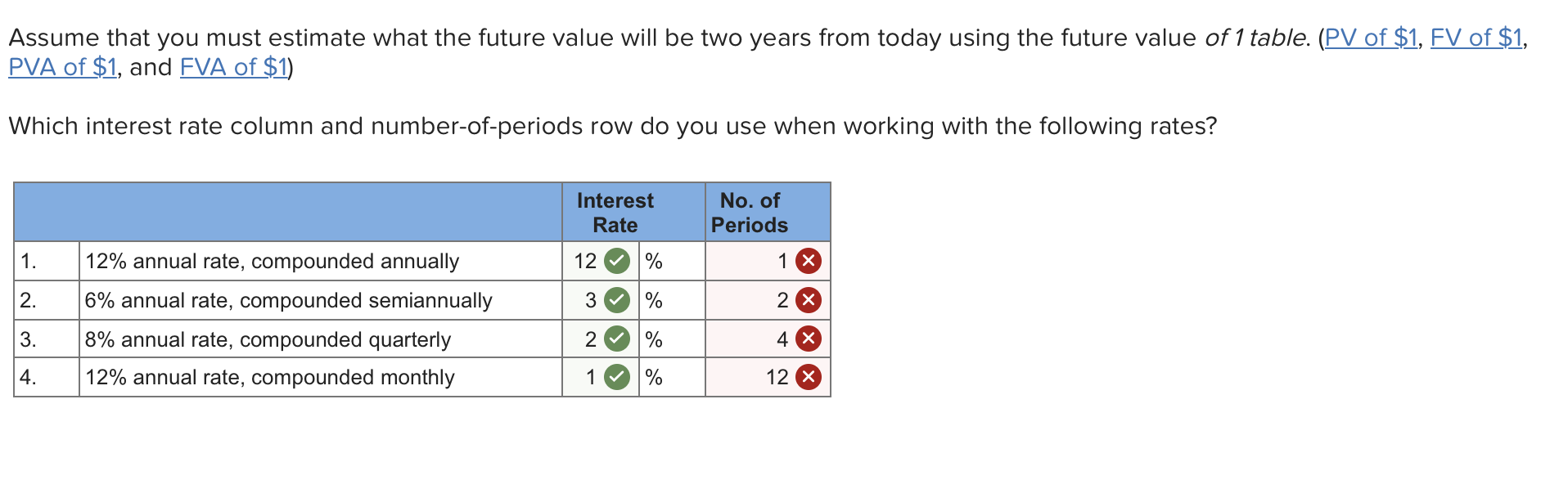

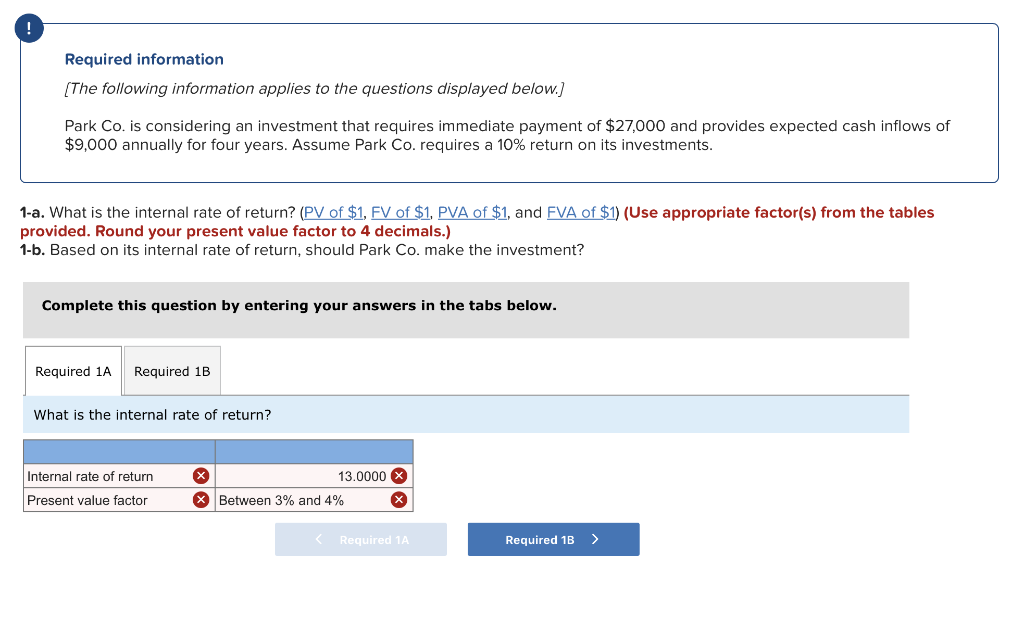

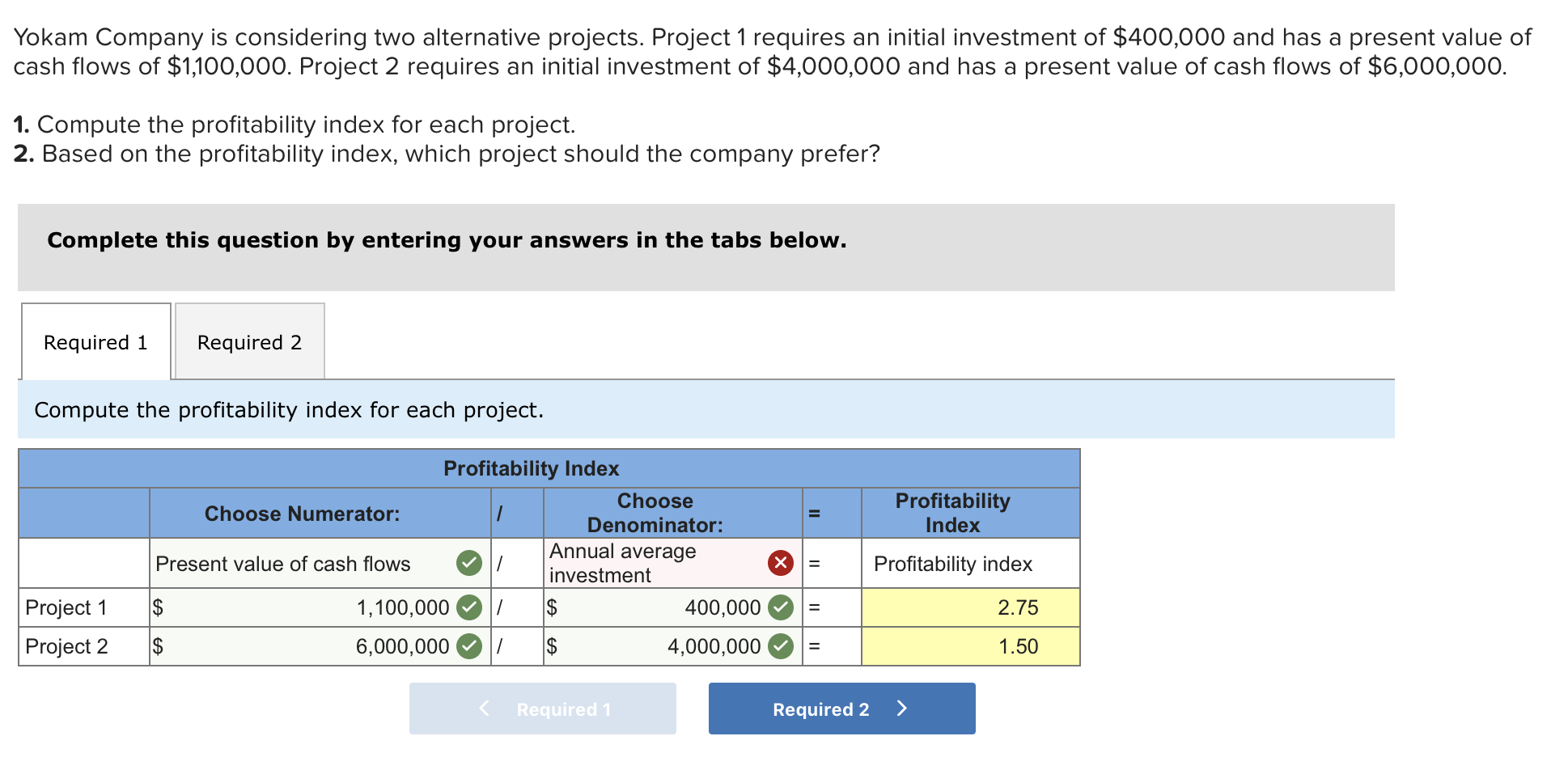

Assume that you must estimate what the future value will be two years from today using the future value of 1 table. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Which interest rate column and number-of-periods row do you use when working with the following rates? No. of Periods 1. 2. Interest Rate 12 % 3 % | 20% 1 % 2 12% annual rate, compounded annually 6% annual rate, compounded semiannually 8% annual rate, compounded quarterly 12% annual rate, compounded monthly x 3. 4 X 4. 12X Required information (The following information applies to the questions displayed below.) Park Co. is considering an investment that requires immediate payment of $27,000 and provides expected cash inflows of $9,000 annually for four years. Assume Park Co. requires a 10% return on its investments. 1-a. What is the internal rate of return? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) 1-b. Based on its internal rate of return, should Park Co. make the investment? Complete this question by entering your answers in the tabs below. Required 1A Required 1B What is the internal rate of return? Internal rate of return X 13.0000 Between 3% and 4% Present value factor % ( Required 1A Required 1B > Yokam Company is considering two alternative projects. Project 1 requires an initial investment of $400,000 and has a present value of cash flows of $1,100,000. Project 2 requires an initial investment of $4,000,000 and has a present value of cash flows of $6,000,000. 1. Compute the profitability index for each project. 2. Based on the profitability index, which project should the company prefer? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the profitability index for each project. Profitability Index Profitability Index Choose Choose Numerator: Denominator: Annual average Present value of cash flows investment 1,100,000 400,000 $ 6,000,000 $ 4,000,000 Profitability index 2.75 Project 1 Project 2 = = 1.50 Required 1 Required 2 >