Assume that you purchased a corporate bond with a face value of $5,000. The interest rate is 4.50 percent. What is the dollar amount of annual interest you will receive each year?

Assume that you purchased a corporate bond with a face value of $5,000. The interest rate is 4.50 percent. What is the dollar amount of annual interest you will receive each year?

a $29,000

b $27,985

c $1,015

d $30,015

e $10.15

The New American Enterprise Mutual Fund's portfolio is valued at $160,000,000. The fund has liabilities of $5,900,000, and the investment company sponsoring the fund has issued 6,700,000 shares. What is the fund's net asset value?

Multiple Choice

- $23.00

- $46.00

- $27.12

- $67.00

- $160.00

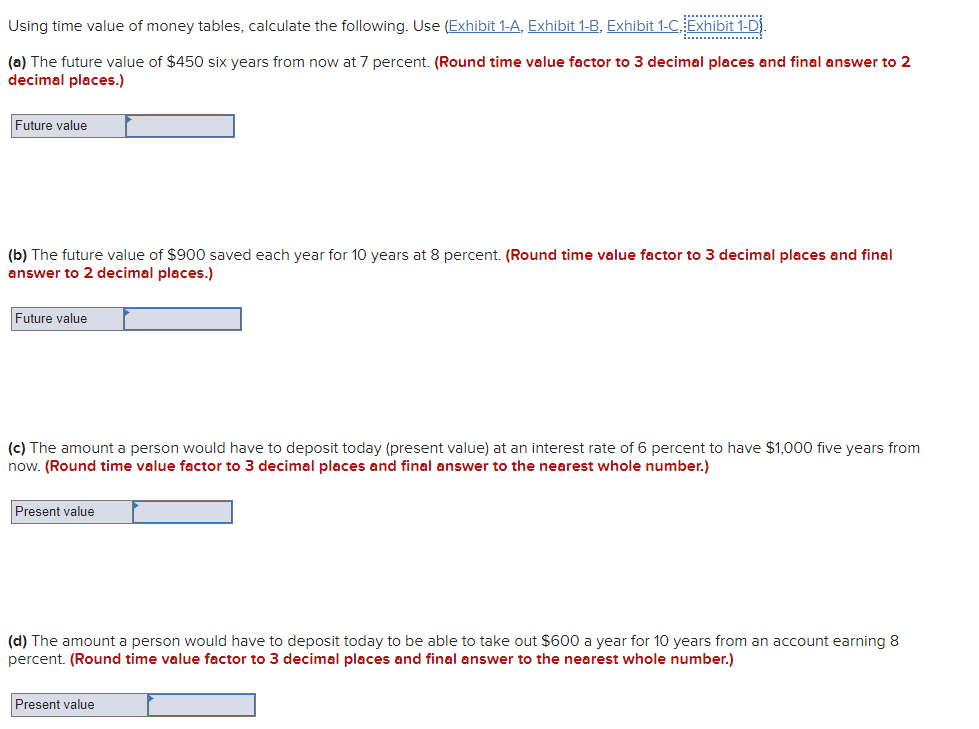

use exhibit a to d to answer time value questions

Exhibit 1-A Future value (compounded sum) of $1 after a given number of time periods W m m Exhibit 1-3 Future value (compounded sum) of $1 paid in at the end of each period for a given number of time periods (an annuity) 114-413 mm 561-626 mm 167-266 285-614 6663-676 2646-666 \" 126392-683 Exhibit 1-1: Present value of $1 to be received at the end of a given number of time periods 0-000 0-071 0-002 0071 0-042 0-010 0-000 0001 0-000 0-003 0-022 0033 0-071 0-013 0-700 0014 0-037 0-700 0-703 0000 0-004 0-722 0-000 0044 0-714 0-000 0-510 0820 0-080 0-570 0-470 0700 0-010 0-470 0-370 0072 0-400 0-307 0-20_ n.m m M-ml _-: .m1-1-1 \"9-1-1-1-1 Exhibit 1-D Present value of $1 received at the end of each period for a given number of time periods (an annuity) 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 0.990 0.980 0.943 0.935 0.926 0.917 0.909 3 2.941 2.884 2.829 2.775 2.673 2.624 2.487 2.444 2.402 5 4.580 4.452 4.212 4.100 3.791 3.605 5.076 4.111 5.728 6.472 6.230 6.002 5.786 .389 5.033 4.868 4.712 8 .652 7.020 5.733 5.463 6.210 5.971 5.747 5.335 5.146 3.566 10 3.530 .650 11 10.368 8.760 7.887 7.139 6.207 11.255 1.943 13 12.134 11.348 10.635 9.986 3.853 8.358 7.103 6.750 6.424 14 13.004 .367 15 13.865 1.938 11.118 0.380 .108 7.606 . 191 16 14.718 13.578 1.652 10.838 10.106 9.447 5.974 17 15.562 14.292 13.166 12.166 1.274 9.763 9.122 8.022 7.549 18 6.398 14.992 13.754 12.659 11.690 10.82 10.059 9.372 8.756 7.250 19 17.226 15.678 14.324 13.134 12.085 10.336 9.604 7.366 8.046 25 22.023 19.523 17.413 15.622 14.094 12.783 1.654 8.422 40 27.355 23.115 17.159 15.046 13.332 9.779 8.244 50 39.196 31.424 25.730 21.482 18.256 15.762 12.233 10.962 9.915 9.042 8.304 13% 14% 15% 16% 17% 35% 40% 50% 0.885 0.877 0.870 0.862 0.840 0.833 0.800 0.769 0.741 0.714 0.667 .585 .566 2.361 2.322 2.283 2.246 2.210 2.140 1.816 4 2.974 2.914 2.798 1.605 5 3.352 3.274 3.199 3.058 2.991 2.436 2.035 6 3.498 3.410 3.32 2.64 2.168 3.812 9 5.132 4.77 4.607 4.451 4.303 4.031 5.426 5.019 11 5.029 4.83 4.656 4.486 3.656 3.147 2.752 2.438 1.977 12 4.439 3.725 3.190 2.779 2.45 13 5.122 5.842 5.583 5.342 5.118 4.910 4.715 14 5.468 5.229 5.008 1.802 3.824 5.092 16 3.887 1.997 17 6.72 6.047 5.749 5.475 5.222 1.990 4.775 3.910 3.295 2.840 2.492 1.998 18 3.928 2.844 19 6.938 5.877 5.584 5.316 4.843 20 25 6.873 6.097 5.766 5.467 5.19 4.948 3.985 30 6.566 6.177 5.829 5.235 4.979 3.99 3.332 2.857 2.500 2.000 40 5.233 5.258 50 7.675 6.246 5.880 4.000 2.857\f