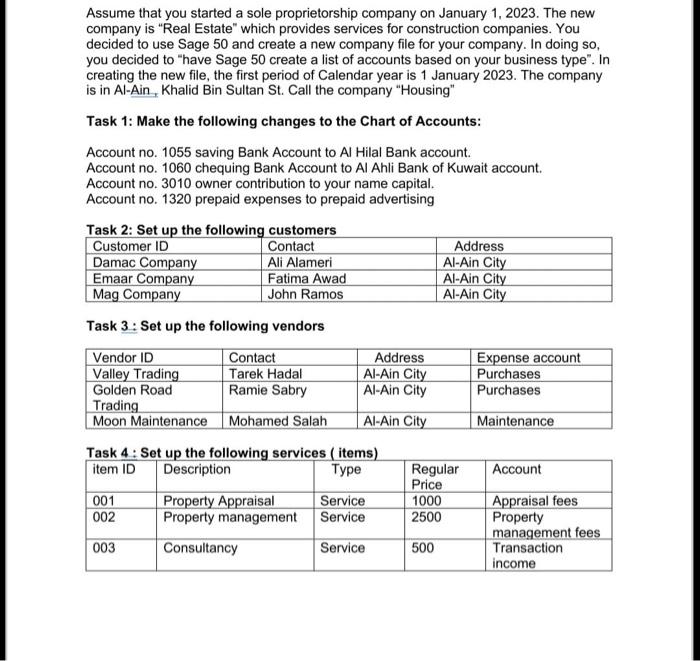

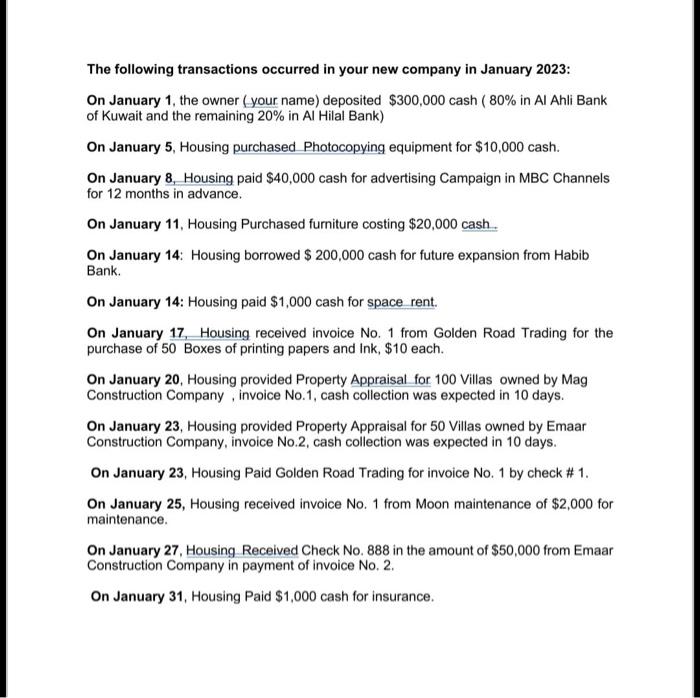

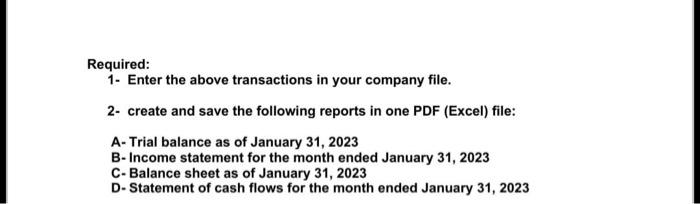

Assume that you started a sole proprietorship company on January 1,2023 . The new company is "Real Estate" which provides services for construction companies. You decided to use Sage 50 and create a new company file for your company. In doing so, you decided to "have Sage 50 create a list of accounts based on your business type". In creating the new file, the first period of Calendar year is 1 January 2023. The company is in Al-Ain. Khalid Bin Sultan St. Call the company "Housing" Task 1: Make the following changes to the Chart of Accounts: Account no. 1055 saving Bank Account to Al Hilal Bank account. Account no. 1060 chequing Bank Account to Al Ahli Bank of Kuwait account. Account no. 3010 owner contribution to your name capital. Account no. 1320 prepaid expenses to prepaid advertising Task 3: Set up the following vendors The following transactions occurred in your new company in January 2023: On January 1, the owner (your name) deposited $300,000 cash ( 80% in Al Ahli Bank of Kuwait and the remaining 20% in Al Hilal Bank) On January 5, Housing purchased Photocopying equipment for $10,000 cash. On January 8, Housing paid $40,000 cash for advertising Campaign in MBC Channels for 12 months in advance. On January 11, Housing Purchased furniture costing $20,000 cash On January 14: Housing borrowed $200,000 cash for future expansion from Habib Bank. On January 14: Housing paid $1,000 cash for space rent. On January 17. Housing received invoice No. 1 from Golden Road Trading for the purchase of 50 Boxes of printing papers and Ink, $10 each. On January 20, Housing provided Property Appraisal for 100 Villas owned by Mag Construction Company , invoice No.1, cash collection was expected in 10 days. On January 23, Housing provided Property Appraisal for 50 Villas owned by Emaar Construction Company, invoice No.2, cash collection was expected in 10 days. On January 23, Housing Paid Golden Road Trading for invoice No. 1 by check \# 1. On January 25, Housing received invoice No. 1 from Moon maintenance of $2,000 for maintenance. On January 27, Housing Received Check No. 888 in the amount of $50,000 from Emaar Construction Company in payment of invoice No. 2. On January 31, Housing Paid $1,000 cash for insurance. Required: 1- Enter the above transactions in your company file. 2- create and save the following reports in one PDF (Excel) file: A- Trial balance as of January 31, 2023 B- Income statement for the month ended January 31, 2023 C- Balance sheet as of January 31, 2023 D- Statement of cash flows for the month ended January 31, 2023