Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you want to borrow $800,000 in order to purchase a new car. As you are a fresh graduate, you can only find

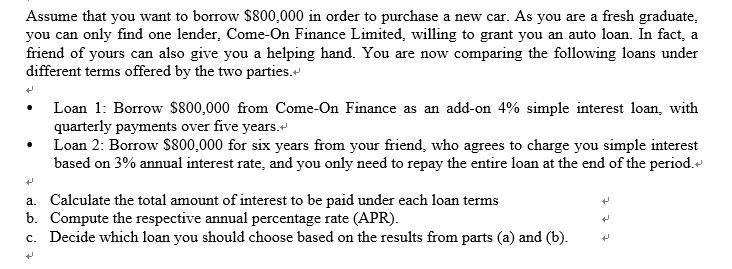

Assume that you want to borrow $800,000 in order to purchase a new car. As you are a fresh graduate, you can only find one lender, Come-On Finance Limited, willing to grant you an auto loan. In fact, a friend of yours can also give you a helping hand. You are now comparing the following loans under different terms offered by the two parties.+ Loan 1: Borrow $800,000 from Come-On Finance as an add-on 4% simple interest loan, with quarterly payments over five years.+ Loan 2: Borrow $800,000 for six years from your friend, who agrees to charge you simple interest N based on 3% annual interest rate, and you only need to repay the entire loan at the end of the period.+ a. Calculate the total amount of interest to be paid under each loan terms b. Compute the respective annual percentage rate (APR). c. Decide which loan you should choose based on the results from parts (a) and (b).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started