Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you want to buy stock of this company. Use the most appropriate efficiency and profitability ratios for the last financial year from the

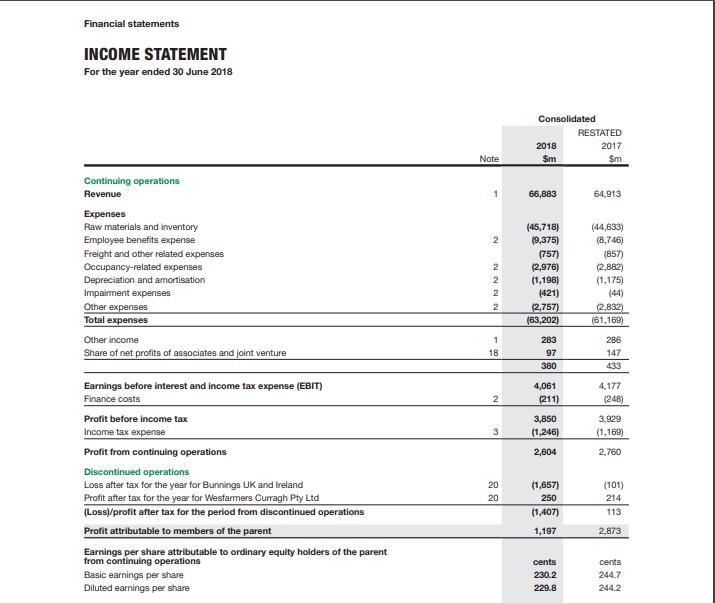

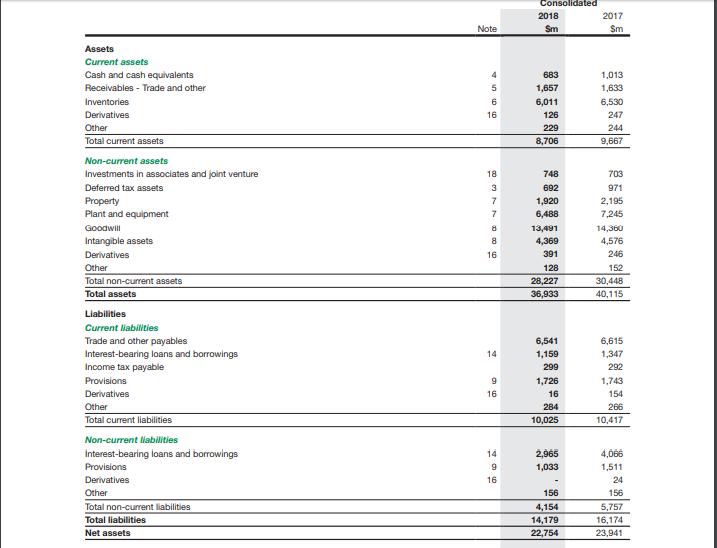

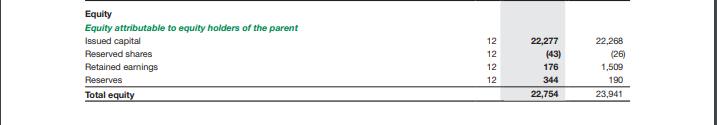

Assume that you want to buy stock of this company. Use the most appropriate efficiency and profitability ratios for the last financial year from the annual report and use these data to evaluate whether this company is a suitable candidate for investment purpose. [Use at least 3 ratios].

Balance Sheet

Financial statements INCOME STATEMENT For the year ended 30 June 2018 Consolidated RESTATED 2018 2017 Note Sm Sm Continuing operations Revenue 1. 66,883 64,913 Expenses Raw materials and inventory (45,718) (9,375) (44,63) (8,746) Employee benefits expense Freight and other related expenses Occupancy-related expenses Depreciation and amortisation Impairment expenses (757) (2,976) (1,198) (857) (2,882) (1,175) (44) 2. 2 (421) Other expenses Total expenses (2,757) (63,202) (2,832) (61,169) Other income 283 286 Share of net profits of associates and joint venture 18 97 147 380 433 Earnings before interest and income tax expense (EBIT) 4,061 4,177 Finance costs (211) (248) Profit before income tax 3,850 3,929 Income tax expense 3 (1,246) (1,169) Profit from continuing operations 2,604 2,760 Discontinued operations Loss after tax for the year for Bunnings UK and Ireland Profit after tax for the year for Westamers Curragh Pty Ltd (Loss)/profit after tax for the period from discontinued operations Profit attributable to members of the parent 20 (1,657) (101) 20 250 214 (1,407) 113 1,197 2,873 Earnings per share attributable to ordinary equity holders of the parent from continuing operations cents cents 244.7 Basic earnings per share Diluted earnings per share 230.2 229.8 244.2 2.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Efficiency ratios 1 Inventory turonover ratio Revenues Average inventory 66883 601165302 106...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started