Answered step by step

Verified Expert Solution

Question

1 Approved Answer

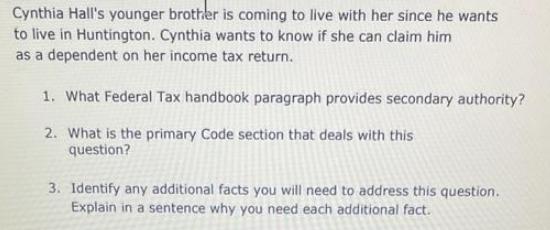

Cynthia Hall's younger brother is coming to live with her since he wants to live in Huntington. Cynthia wants to know if she can

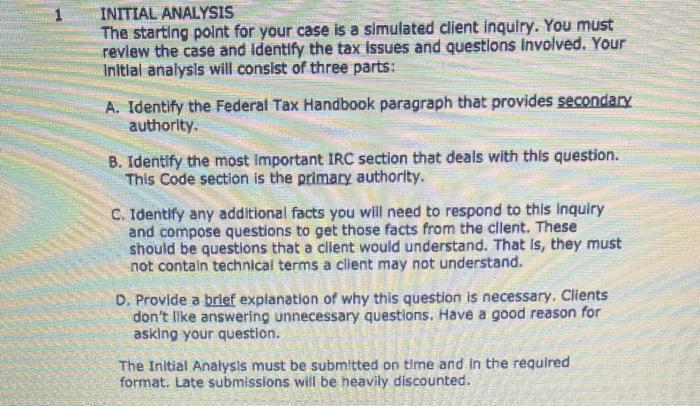

Cynthia Hall's younger brother is coming to live with her since he wants to live in Huntington. Cynthia wants to know if she can claim him as a dependent on her income tax return. 1. What Federal Tax handbook paragraph provides secondary authority? 2. What is the primary Code section that deals with this question? 3. Identify any additional facts you will need to address this question. Explain in a sentence why you need each additional fact. INITIAL ANALYSIS The starting point for your case is a simulated client inquiry. You must review the case and Identify the tax issues and questions involved. Your Initial analysis will consist of three parts: A. Identify the Federal Tax Handbook paragraph that provides secondary authority. B. Identify the most important IRC section that deals with this question. This Code section is the primary authority. C. Identify any additional facts you will need to respond to this Inquiry and compose questions to get those facts from the cllent. These should be questions that a client would understand. That is, they must not contain technical terms a client may not understand. D. Provide a brief explanation of why this question is necessary. Clients don't like answering unnecessary questions. Have a good reason for asking your question. The Initial Analysis must be submitted on time and in the required format. Late submissions will be heavily discounted.

Step by Step Solution

★★★★★

3.49 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

A The Federal Tax Handbook paragraph that provides secondary authority would depend on the specific rules and regulations regarding claiming dependents on income tax returns As an AI language model I ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started