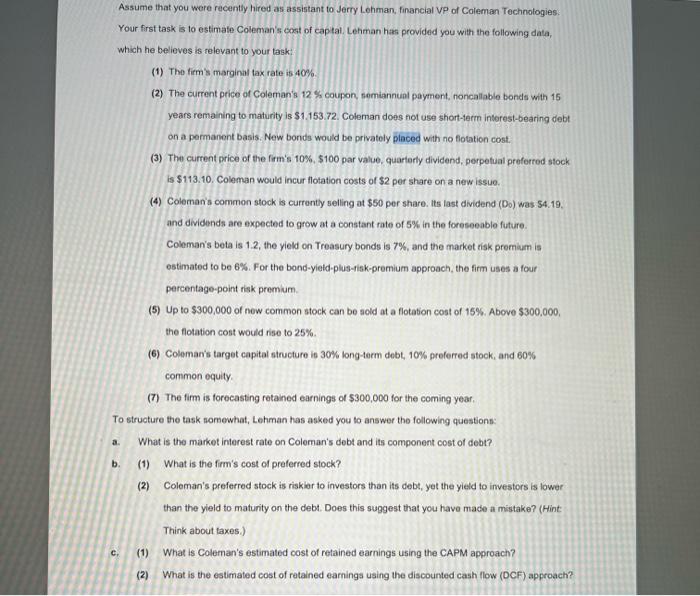

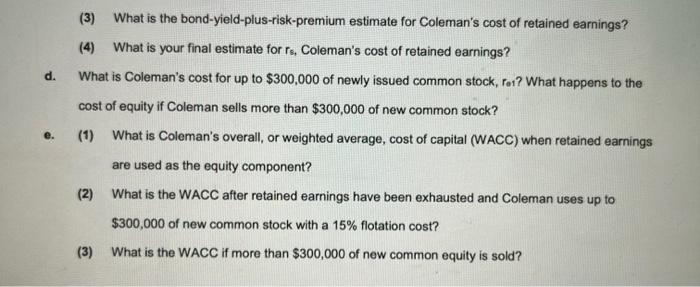

Assume that you were recently hired as assistant to Jerry Lehman, financial VP of Caleman Technotogies: Your first task is to estimafe Coleman's cost of captal. Lehman hast provided you with the following data, which he believes is relevant to your lask: (1) Tho firm's marginit tax rate is 40%. (2) The current price of Coleman's 12% coupon, temiannuil payment, noncallable bonds with 15 years remaining to maturity is 51.153.72. Coleman does not use short-term interest-bearing debt on a parmanent basis. New bonds would be privately placod with no fiotation cost. (3) The current price of the firm's 10%,$100 par value, quarterty dividend, perpetual preferred stock is $113.10. Coleman would incur flotation costs of $2 per share on a new issue. (4) Coleman's common stock is currantiy selling at 550 per share. lts last dividend (D0) was 54.19. and dividends are expected to grow at a constant rate of 5% in the foreseeable future. Coleman's beta is 1.2, the yield on Treasury bonds is 7%, and the market risk premium is ostimated to be 6\%h. For the bond-yied-plus-fisk-premium approach, the firm uses a four percentage-point risk premium. (5) Up to $300,000 of new common stock can be sold at a flotation cost of 15%. Above $300,000, the flotation cost would rise to 25%. (6) Coleman's target capital structure is 30% long-4erm debt, 10% preferred stock, and 60% cormmon oquity. (7) The firm is forecasting retained earnings of $300,000 for the coming year, To structure the task nomewhat, Lehman has asked you to answer the following questions: a. What is the market interest rate on Coleman's debt and its component cost of debt? b. (1) What is the fim's cost of preferred stock? (2) Coleman's preferred stock is riskior to investors than its debt, yet the yield to investors is lower than the yield to maturity on the debt. Does this suggest that you have mace a mistake? (Hint: Think about laxes.) c. (1) What is Coleman's estimated cost of retained earnings using the CAPM approach? (2) What is the estimated cost of retained earnings using the discounted cash flow (DCF) approach? (3) What is the bond-yield-plus-risk-premium estimate for Coleman's cost of retained earnings? (4) What is your final estimate for rs, Coleman's cost of retained earnings? d. What is Coleman's cost for up to $300,000 of newly issued common stock, for? What happens to the cost of equity if Coleman sells more than $300,000 of new common stock? e. (1) What is Coleman's overall, or weighted average, cost of capital (WACC) when retained earnings are used as the equity component? (2) What is the WACC after retained earnings have been exhausted and Coleman uses up to $300,000 of new common stock with a 15% flotation cost? (3) What is the WACC if more than $300,000 of new common equity is sold