Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you work for a travel agency. The owner of the store, David Beckham, has asked you to prepare a cash budget for

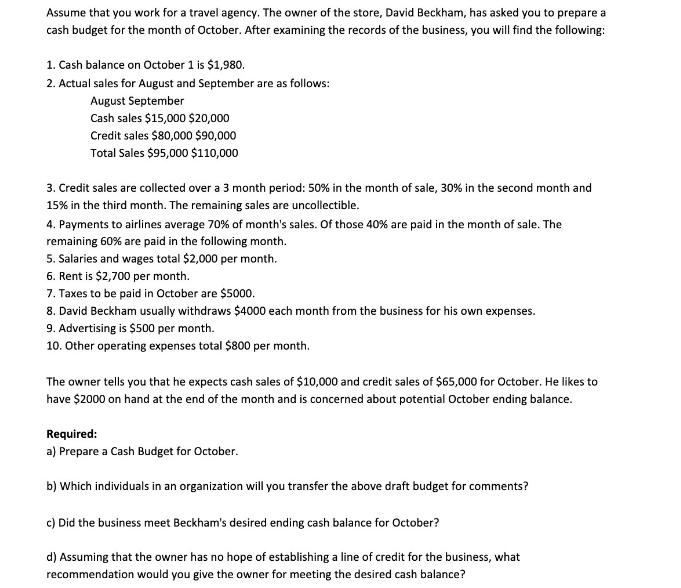

Assume that you work for a travel agency. The owner of the store, David Beckham, has asked you to prepare a cash budget for the month of October. After examining the records of the business, you will find the following: 1. Cash balance on October 1 is $1,980. 2. Actual sales for August and September are as follows: August September Cash sales $15,000 $20,000 Credit sales $80,000 $90,000 Total Sales $95,000 $110,000 3. Credit sales are collected over a 3 month period: 50% in the month of sale, 30% in the second month and 15% in the third month. The remaining sales are uncollectible. 4. Payments to airlines average 70% of month's sales. Of those 40% are paid in the month of sale. The remaining 60% are paid in the following month. 5. Salaries and wages total $2,000 per month. 6. Rent is $2,700 per month. 7. Taxes to be paid in October are $5000. 8. David Beckham usually withdraws $4000 each month from the business for his own expenses. 9. Advertising is $500 per month. 10. Other operating expenses total $800 per month. The owner tells you that he expects cash sales of $10,000 and credit sales of $65,000 for October. He likes to have $2000 on hand at the end of the month and is concerned about potential October ending balance. Required: a) Prepare a Cash Budget for October. b) Which individuals in an organization will you transfer the above draft budget for comments? c) Did the business meet Beckham's desired ending cash balance for October? d) Assuming that the owner has no hope of establishing a line of credit for the business, what recommendation would you give the owner for meeting the desired cash balance?

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Cash Budget for October Beginning Cash Balance 1980 Cash Collections Cash sales 10000 Credit sales Collection in October 50 65000 50 32500 Collectio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started