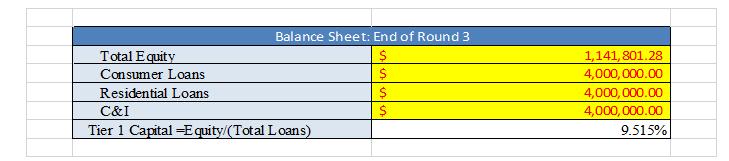

Assume that your bank is not obligated to pay taxes. Calculate your bank's 1) ROA, 2) ROE, and 3) its ratio of bank assets to

Assume that your bank is not obligated to pay taxes. Calculate your bank's 1) ROA, 2) ROE, and 3) its ratio of bank assets to bank capital. Show your calculations for each of these three measures

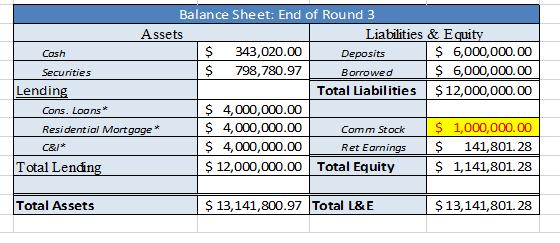

Cash Securities Lending Cons. Loans* Residential Mortgage" C&I* Total Lending Total Assets Balance Sheet: End of Round 3 Assets $ $ 343,020.00 798,780.97 Liabilities & Equity Deposits Borrowed Total Liabilities $ 4,000,000.00 $ 4,000,000.00 Comm Stock $ 4,000,000.00 Ret Earnings $ 12,000,000.00 Total Equity $ 13,141,800.97 Total L&E $ 6,000,000.00 $ 6,000,000.00 $ 12,000,000.00 $ 1,000,000.00 $ 141,801.28 $ 1,141,801.28 $13,141,801.28

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate your banks financial performance measures well use the following formulas 1 Return on A...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started