John citizen arrives in Australia on 21 July 2022 from Canada on a working visa, which allows him to work in Australia for two

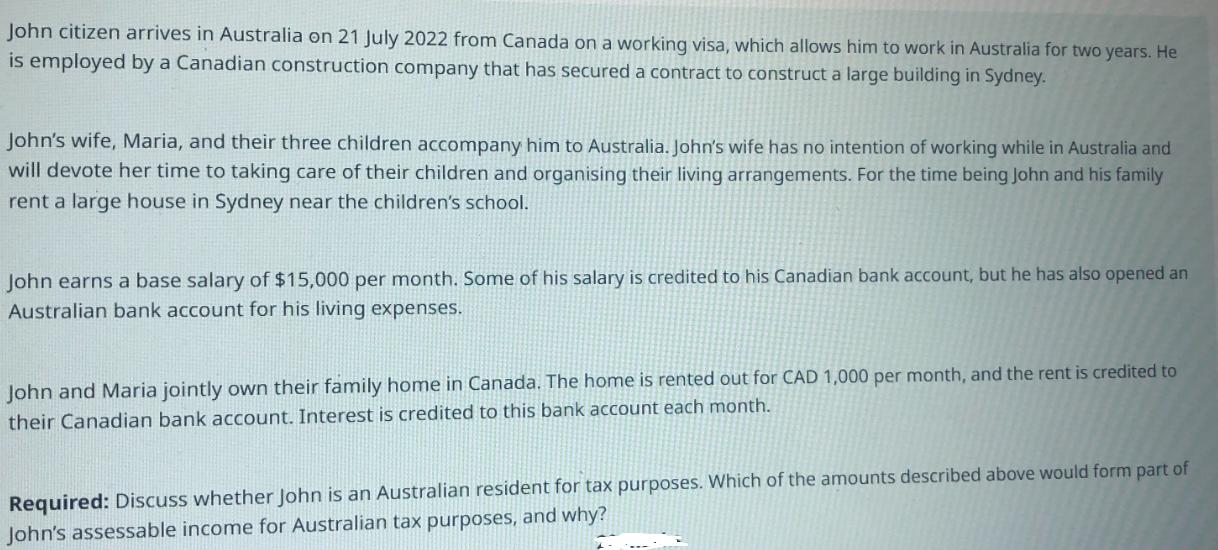

John citizen arrives in Australia on 21 July 2022 from Canada on a working visa, which allows him to work in Australia for two years. He is employed by a Canadian construction company that has secured a contract to construct a large building in Sydney. John's wife, Maria, and their three children accompany him to Australia. John's wife has no intention of working while in Australia and will devote her time to taking care of their children and organising their living arrangements. For the time being John and his family rent a large house in Sydney near the children's school. John earns a base salary of $15,000 per month. Some of his salary is credited to his Canadian bank account, but he has also opened an Australian bank account for his living expenses. John and Maria jointly own their family home in Canada. The home is rented out for CAD 1,000 per month, and the rent is credited to their Canadian bank account. Interest is credited to this bank account each month. Required: Discuss whether John is an Australian resident for tax purposes. Which of the amounts described above would form part of John's assessable income for Australian tax purposes, and why?

Step by Step Solution

3.27 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Whether John is considered an Australian resident for tax purposes depends on his residency status as determined by the Australian tax rules The key f...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started