Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that your company is a 100 percent, all-equity, unlevered company with the income statement listed below. You may also assume that the firm pays

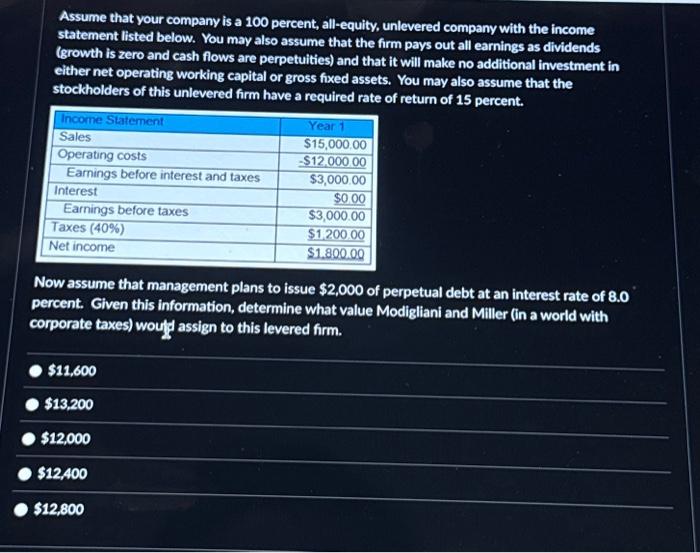

Assume that your company is a 100 percent, all-equity, unlevered company with the income statement listed below. You may also assume that the firm pays out all earnings as dividends (growth is zero and cash flows are perpetuities) and that it will make no additional investment in either net operating working capital or gross fixed assets. You may also assume that the stockholders of this unlevered firm have a required rate of return of 15 percent. Income Statement Sales Operating costs Earnings before interest and taxes Interest Earnings before taxes Taxes (40%) Net income Now assume that management plans to issue $2,000 of perpetual debt at an interest rate of 8.0 percent. Given this information, determine what value Modigliani and Miller (in a world with corporate taxes) would assign to this levered firm. $11,600 $13,200 $12,000 $12,400 Year 1 $15,000.00 -$12,000.00 $3,000.00 $0.00 $3,000.00 $1,200.00 $1.800.00 $12,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started