Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that your company owns a subsidiary operating in Canudu. The subsidiary has adopted the Canadian Dollar (CAD) as its functional currency. Your parent company

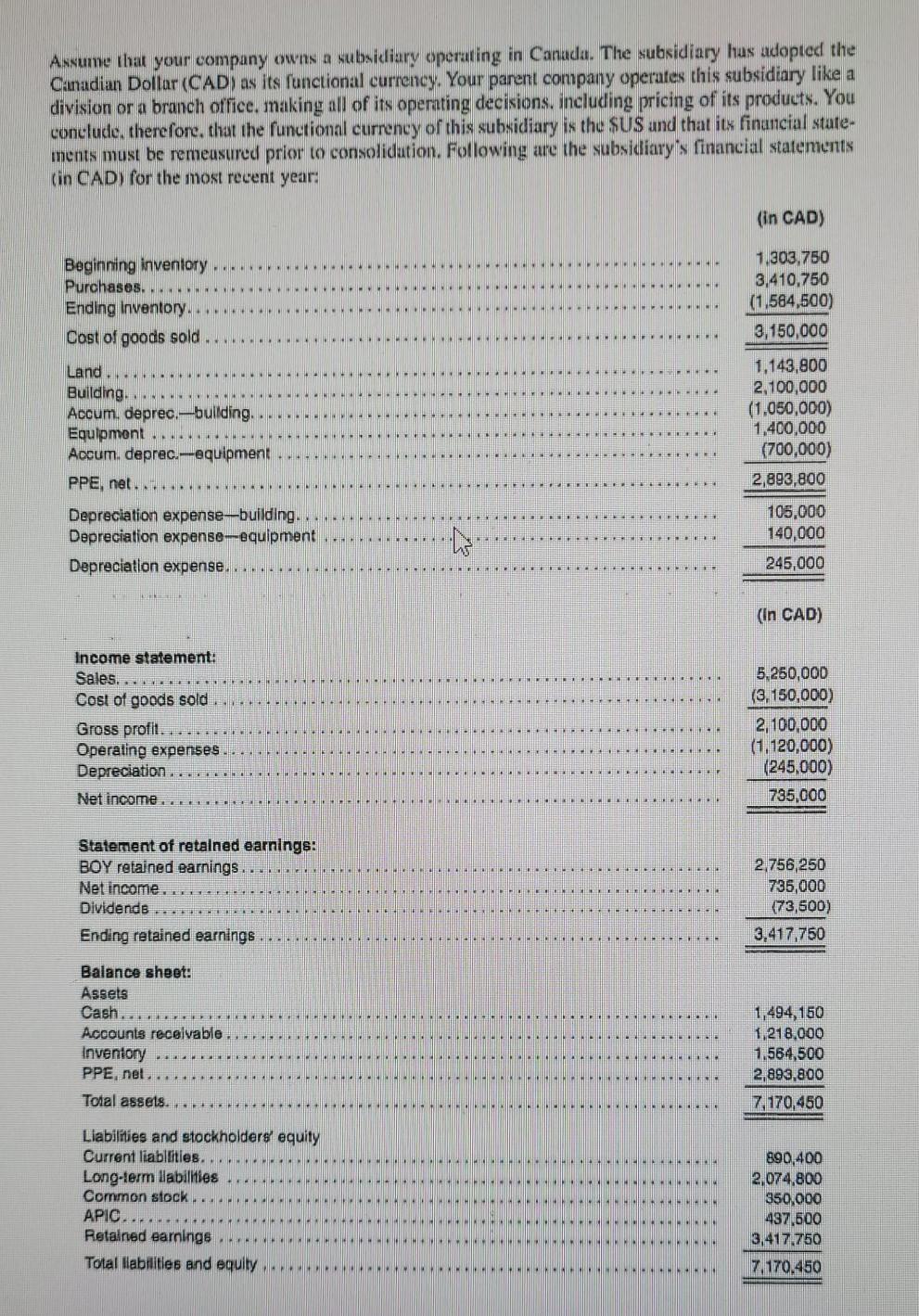

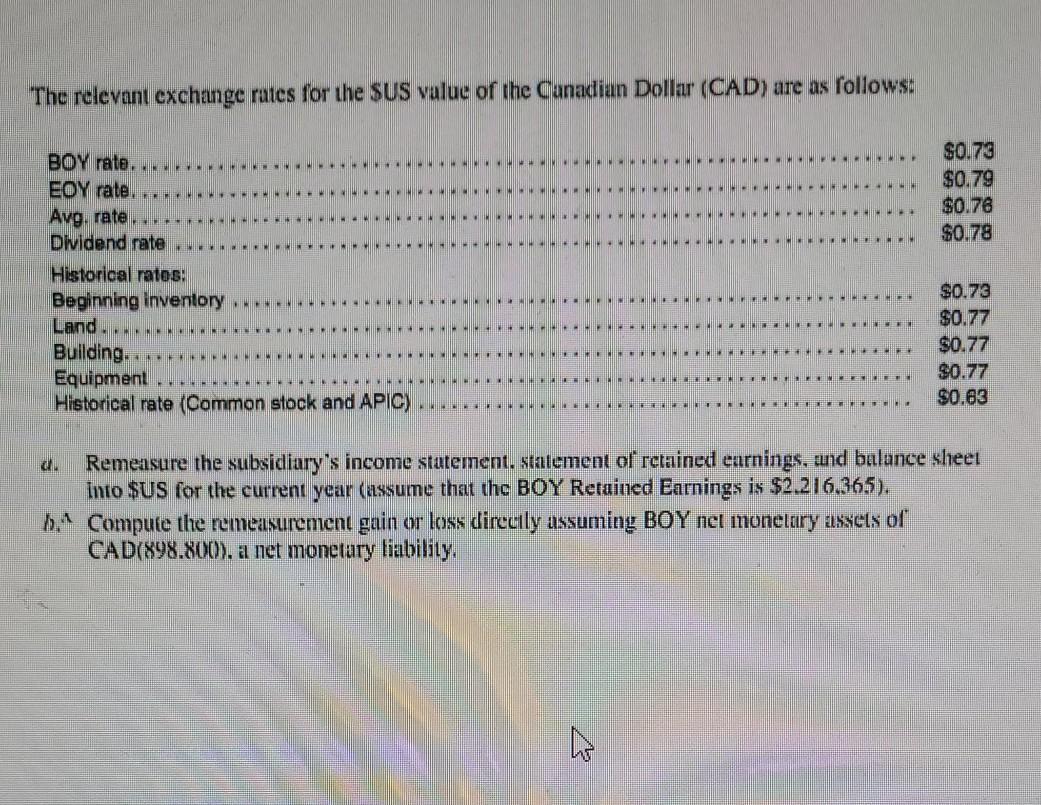

Assume that your company owns a subsidiary operating in Canudu. The subsidiary has adopted the Canadian Dollar (CAD) as its functional currency. Your parent company operates this subsidiary like a division or a branch office, making all of its operating decisions, including pricing of its products. You conclude, therefore, that the functional currency of this subsidiary is the SUS and that itx financial state- ments must be remeasured prior to consolidution. Following are the subsidiary's financial statements (in CAD) for the most recent year: (in CAD) 1.303,750 3,410,750 (1,584,500) 3,150,000 Beginning inventory Purchases...... Ending Inventory.. Cost of goods sold Land Building. Accum. deprec.-bullding. Equipment Accum. deprec.-equipment PPE, net... Depreciation expense-building.. Depreciation expense-equipment Depreciation expense.. 1,143,800 2,100,000 (1,050,000) 1,400,000 (700,000) 2,893,800 ..h 105,000 140,000 245,000 (In CAD) Income statement: Sales. Cost of goods sold Gross profit. Operating expenses Depreciation .. Net income.. 5.250,000 (3.150,000) 2,100,000 (1.120,000) (245,000) 735,000 Statement of retained earnings: BOY retained earnings Net income. Dividends .. Ending retained earnings 2.756,250 735,000 173,500) 3,417,750 Balance sheet: Assets Cash... Accounts receivable Inventory PPE, nel Total assets. 1,494,150 1,218.000 1.564,500 2,893,800 7,170,450 Liabilities and stockholders' equity Current liabllities.. Long-term abilities Common stock APIO. Retained earnings Total liabilities and equity 890,400 2,074,800 350,000 437,500 3,417.750 7.170.450 WE The relevant exchange rates for the SUS value of the Canadian Dollar (CAD) are as follows: $0.73 $0.79 $0.78 $0.78 BOY rate. EOY rate. Avg. rate.. Dividend rate Historical ratos: Beginning inventory Land. Building. Equipment Historical rate (Common stock and APIC) $0.73 $0.77 $0.77 $0.77 $0.63 MLM d. Remeasure the subsidiary's income statement. statement of retained earnings, and balance sheet into $US for the current year (assume that the BOY Retained Earnings is $2.216.365). O.* Compute the remeasurement gain or loss directly assuming BOY net monetary assets of CAD(898.800). a net monetary liability

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started