Answered step by step

Verified Expert Solution

Question

1 Approved Answer

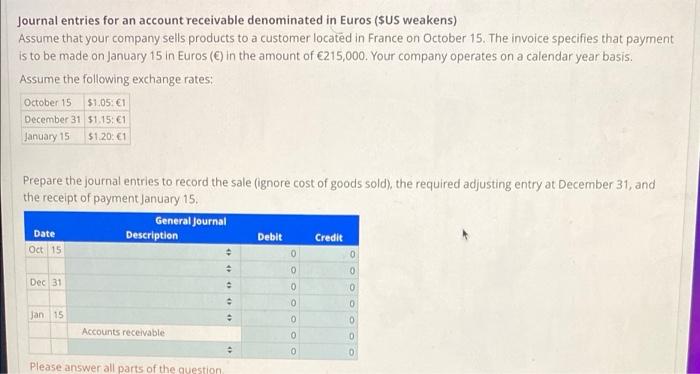

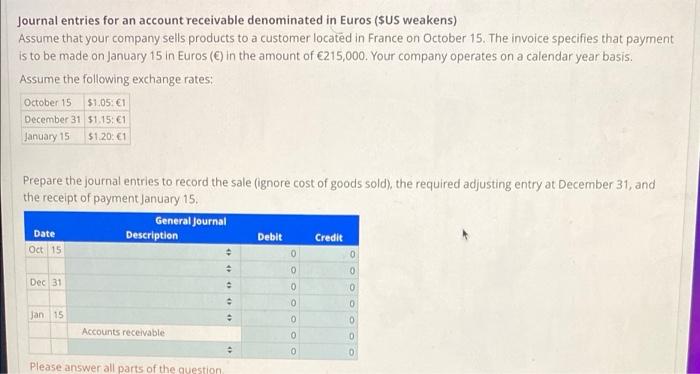

Assume that your company sells products to a customer located in France on October 15. The invoice specifies that payment is to be made on

Assume that your company sells products to a customer located in France on October 15. The invoice specifies that payment is to be made on January 15 in Euros () in the amount of 215,000. Your company operates on a calendar year basis

Journal entries for an account receivable denominated in Euros ($US weakens) Assume that your company sells products to a customer located in France on October 15. The invoice specifies that payment is to be made on January 15 in Euros (C) in the amount of 215,000. Your company operates on a calendar year basis. Assume the following exchange rates: $1.05 1 December 31 $1.15: 1 $1.201 October 15 January 15 Prepare the journal entries to record the sale (ignore cost of goods sold), the required adjusting entry at December 31, and the receipt of payment January 15. General Journal Description Debit Date Oct 15 Credit 0 0 0 Dec 31 0 0 0 0 0 Jan 15 0 Accounts receivable 0 0 0 2 0 0 Please answer all parts of the Prepare the journal entries to record the sale (ignore cost of goods sold) , the required adjusting entry at December 31, and the receipt of payment January 15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started