Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that your company, which is just being formed, will require the purchase of $ 4 , 0 0 0 , 0 0 0 of

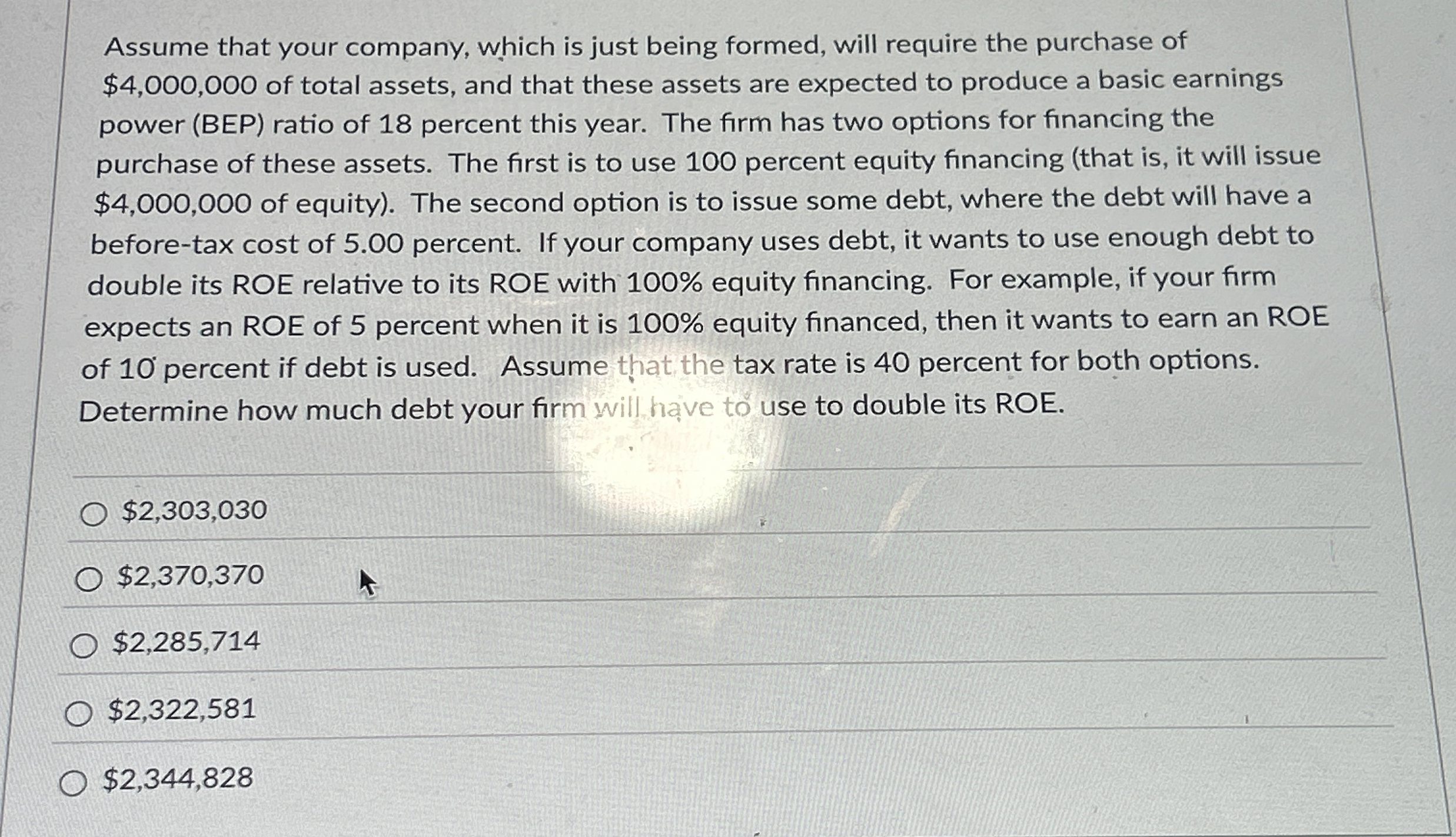

Assume that your company, which is just being formed, will require the purchase of

$ of total assets, and that these assets are expected to produce a basic earnings

power BEP ratio of percent this year. The firm has two options for financing the

purchase of these assets. The first is to use percent equity financing that is it will issue

$ of equity The second option is to issue some debt, where the debt will have a

beforetax cost of percent. If your company uses debt, it wants to use enough debt to

double its ROE relative to its ROE with equity financing. For example, if your firm

expects an ROE of percent when it is equity financed, then it wants to earn an ROE

of percent if debt is used. Assume that the tax rate is percent for both options.

Determine how much debt your firm will he to use to double its ROE.

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started