Question

Assume that your firm is successful in gaining the audit of Air New Zealand Limited. You are asked by the audit engagement partner to plan

Assume that your firm is successful in gaining the audit of Air New Zealand Limited. You are asked by the audit engagement partner to plan the audit, in particular determine areas of risk, materiality and assertions to be examined. As always you wish to keep your detection risk to a minimum.

NOTE: You are not expected to assess control risks as this would require having access to this entity, which is not permitted for the purposes of this presentation workshop.

Questions to be addressed by those presenting (and for those not presenting, in bullet-point summaries) are:

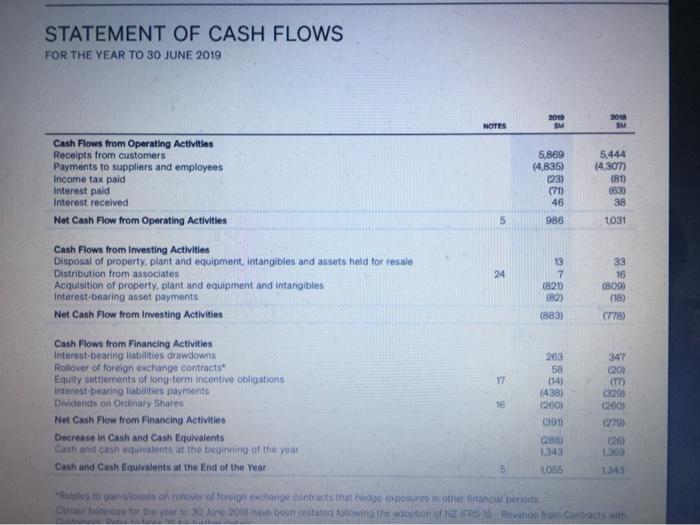

a) Carry out a preliminary analytical procedure to review the Air New Zealand annual financial statements as these are appropriate for the client. Explain the reason for choosing selected ratios, what you found and, how the results will influence your planning of the audit.

b) Based on the ‘business risk’ and ‘industry risk’ identified (in workshop 1) for Air New Zealand, what assertions over account balances and other disclosures in the financial statements will these risks impact and how? Identify key assertions that you think need to be tested and explain the audit objective behind these tests.

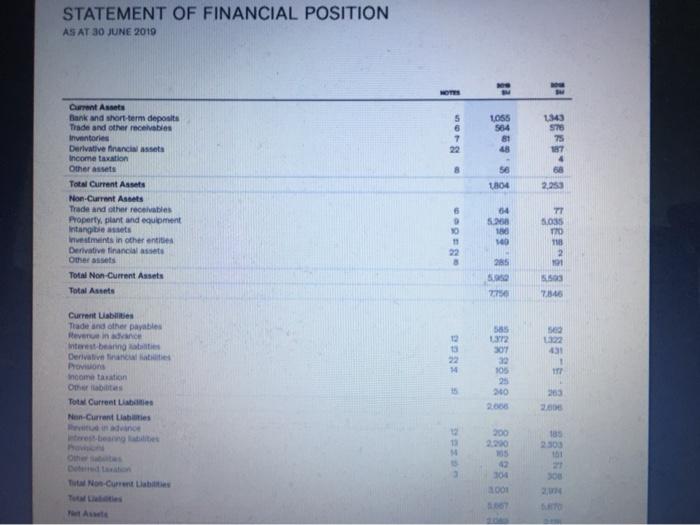

c) Using your judgment, identify a ‘base’ and select a materiality level for Air New Zealand’s (Group) balance sheet. Justify y o u r decision. Allocate that amount to the balance sheet accounts in proportion to their $ size and assess the results. Consider what would have occurred if you had chosen a larger or a smaller ‘materiality’ amount, or if you had allocated them differently

Please answer the questions which you are able to answer.

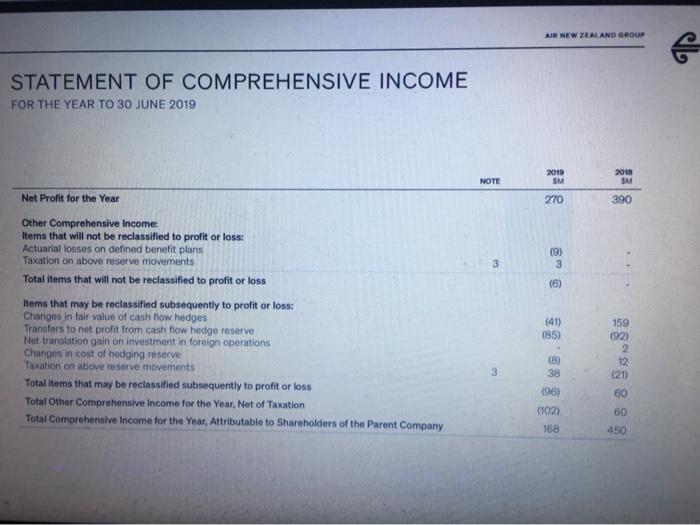

AIR NEW ZEALAND GROUP STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR TO 30 JUNE 2019 2019 SM 2018 NOTE Net Profit for the Year 270 390 Other Comprehensive Income: Items that will not be reclassified to profit or loss: Actuarial losses on defined benefit plans Taxation on above reserve movements (9) 3. 3. Total items that will not be reclassified to profit or loss (6) Items that may be reclassified subsequently to profit or loss: Changes in fair value of cash flow hedges Transfers to net profit from cash flow hedge reserve Net translation gain on investment in foreign operations Changes in cost of hedging reserve Taxation on above reserve movements (41) (85) 159 (92) (8) 38 12 3. (21) Total items that may be reclassified subsequently to profit or loss Total Other Comprehensive Income for the Year, Net of Taxation Total Comprehensive Income for the Year, Attributable to Shareholders of the Parent Company (96) 60 (102) 60 168 450

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

AGross Profit Margin Gross profit x 100 NZ000 Revenue 2019 251890 x 100 266361 x 100 276183 x 100 409372 425593 445348 6153 625 62 Return on Equity Ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started