Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that Z - CUT Ltd which was registered as a Private Limited Company in 2 0 2 1 has been operating with no debt

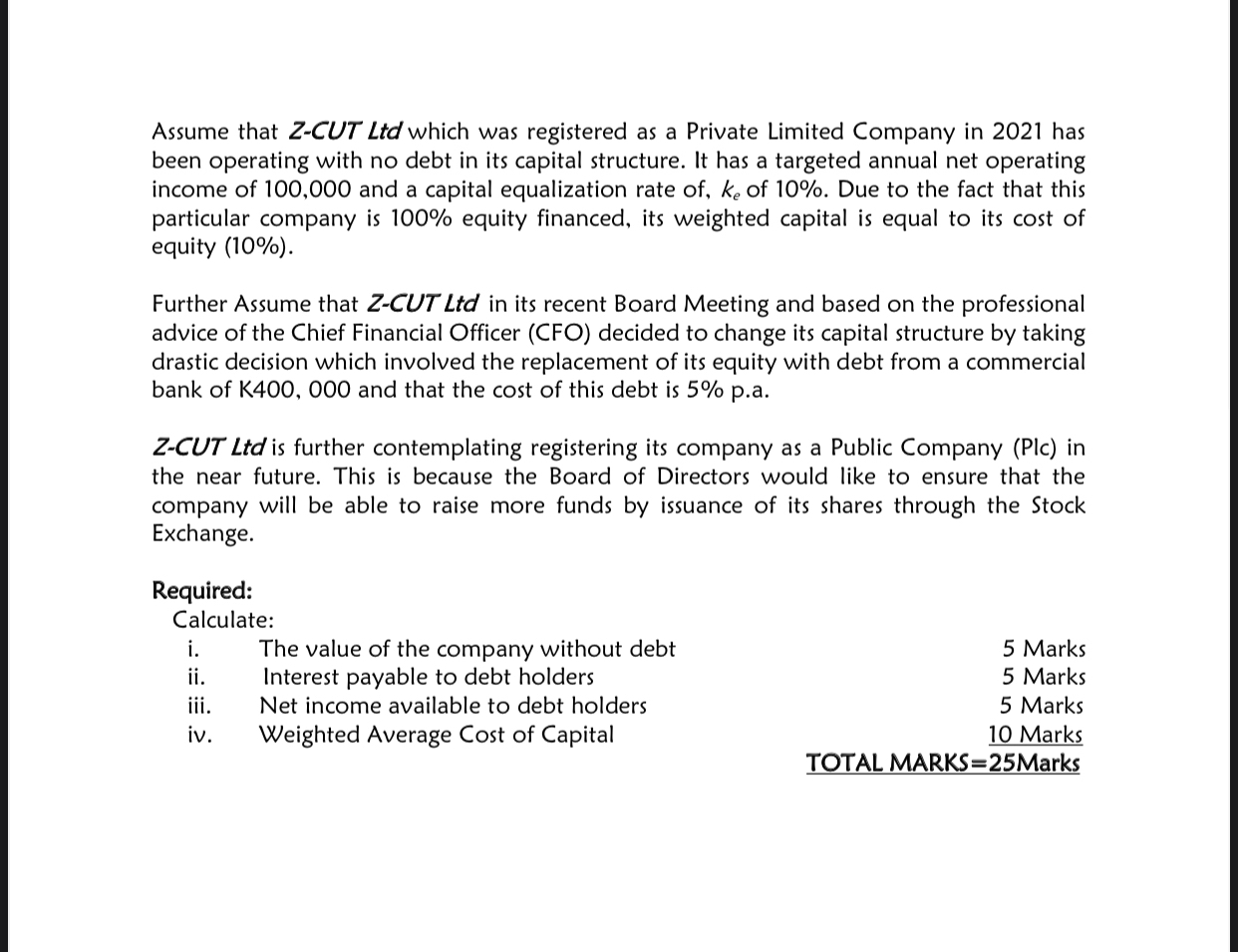

Assume that ZCUT Ltd which was registered as a Private Limited Company in has been operating with no debt in its capital structure. It has a targeted annual net operating income of and a capital equalization rate of of Due to the fact that this particular company is equity financed, its weighted capital is equal to its cost of equity

Further Assume that ZCUT Ltd in its recent Board Meeting and based on the professional advice of the Chief Financial Officer CFO decided to change its capital structure by taking drastic decision which involved the replacement of its equity with debt from a commercial bank of K and that the cost of this debt is pa

ZCUT Ltd is further contemplating registering its company as a Public Company Plc in the near future. This is because the Board of Directors would like to ensure that the company will be able to raise more funds by issuance of its shares through the Stock Exchange.

Required:

Calculate:

i The value of the company without debt

Marks

ii Interest payable to debt holders

Marks

iii. Net income available to debt holders

Marks

iv Weighted Average Cost of Capital

Marks

TOTAL MARKS Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started