Answered step by step

Verified Expert Solution

Question

1 Approved Answer

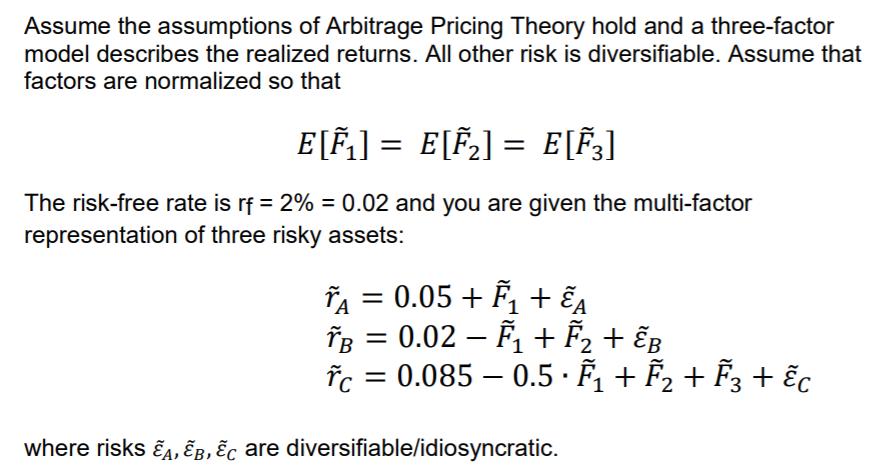

Assume the assumptions of Arbitrage Pricing Theory hold and a three-factor model describes the realized returns. All other risk is diversifiable. Assume that factors

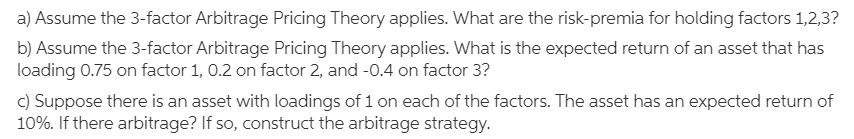

Assume the assumptions of Arbitrage Pricing Theory hold and a three-factor model describes the realized returns. All other risk is diversifiable. Assume that factors are normalized so that E[] = E[F] = E[F3] The risk-free rate is rf = 2% = 0.02 and you are given the multi-factor representation of three risky assets: TA = 0.05 + F + EA TB = 0.02 F + F + EB - rc = 0.085 0.5 + + F3 + c where risks EA, EB, EC are diversifiable/idiosyncratic. a) Assume the 3-factor Arbitrage Pricing Theory applies. What are the risk-premia for holding factors 1,2,3? b) Assume the 3-factor Arbitrage Pricing Theory applies. What is the expected return of an asset that has loading 0.75 on factor 1, 0.2 on factor 2, and -0.4 on factor 3? c) Suppose there is an asset with loadings of 1 on each of the factors. The asset has an expected return of 10%. If there arbitrage? If so, construct the arbitrage strategy. Assume the assumptions of Arbitrage Pricing Theory hold and a three-factor model describes the realized returns. All other risk is diversifiable. Assume that factors are normalized so that E[] = E[F] = E[F3] The risk-free rate is rf = 2% = 0.02 and you are given the multi-factor representation of three risky assets: TA = 0.05 + F + EA TB = 0.02 F + F + EB - rc = 0.085 0.5 + + F3 + c where risks EA, EB, EC are diversifiable/idiosyncratic. a) Assume the 3-factor Arbitrage Pricing Theory applies. What are the risk-premia for holding factors 1,2,3? b) Assume the 3-factor Arbitrage Pricing Theory applies. What is the expected return of an asset that has loading 0.75 on factor 1, 0.2 on factor 2, and -0.4 on factor 3? c) Suppose there is an asset with loadings of 1 on each of the factors. The asset has an expected return of 10%. If there arbitrage? If so, construct the arbitrage strategy. Assume the assumptions of Arbitrage Pricing Theory hold and a three-factor model describes the realized returns. All other risk is diversifiable. Assume that factors are normalized so that E[] = E[F] = E[F3] The risk-free rate is rf = 2% = 0.02 and you are given the multi-factor representation of three risky assets: TA = 0.05 + F + EA TB = 0.02 F + F + EB - rc = 0.085 0.5 + + F3 + c where risks EA, EB, EC are diversifiable/idiosyncratic. a) Assume the 3-factor Arbitrage Pricing Theory applies. What are the risk-premia for holding factors 1,2,3? b) Assume the 3-factor Arbitrage Pricing Theory applies. What is the expected return of an asset that has loading 0.75 on factor 1, 0.2 on factor 2, and -0.4 on factor 3? c) Suppose there is an asset with loadings of 1 on each of the factors. The asset has an expected return of 10%. If there arbitrage? If so, construct the arbitrage strategy.

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a Ass ume the 3 factor Arbit rage Pricing Theory applies What are the risk prem ia for holding factors 1 2 3 ANS WER The risk prem ia for holding fact...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started