Answered step by step

Verified Expert Solution

Question

1 Approved Answer

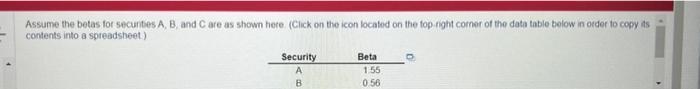

Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top right corner of

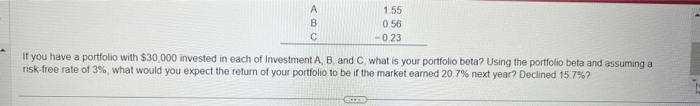

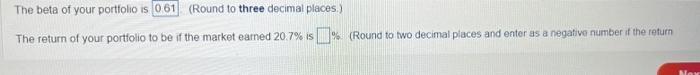

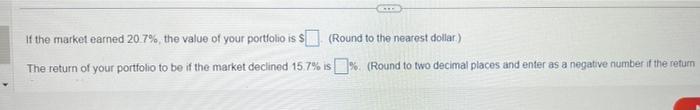

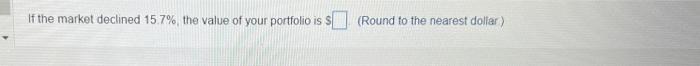

Assume the betas for securities A, B, and C are as shown here. (Click on the icon located on the top right corner of the data table below in order to copy its contents into a spreadsheet) Security A B Beta 1:55 0.56 1.55 0.56 -0.23 If you have a portfolio with $30,000 invested in each of Investment A, B, and C, what is your portfolio beta? Using the portfolio beta and assuming a risk-free rate of 3%, what would you expect the return of your portfolio to be if the market earned 20,7% next year? Declined 15.7%? The beta of your portfolio is 0.61 (Round to three decimal places.) The return of your portfolio to be if the market earned 20.7% is% (Round to two decimal places and enter as a negative number if the return If the market earned 20.7%, the value of your portfolio is $ (Round to the nearest dollar) The return of your portfolio to be if the market declined 15.7% is%. (Round to two decimal places and enter as a negative number if the return If the market declined 15.7%, the value of your portfolio is S (Round to the nearest dollar)

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

You invested equal sum in all three securities So the beta of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started