Question: Assume the Black-Scholes framework for options pricing. You make make the following trades today to assemble a portfolio of nondividend-paying European stock options on the

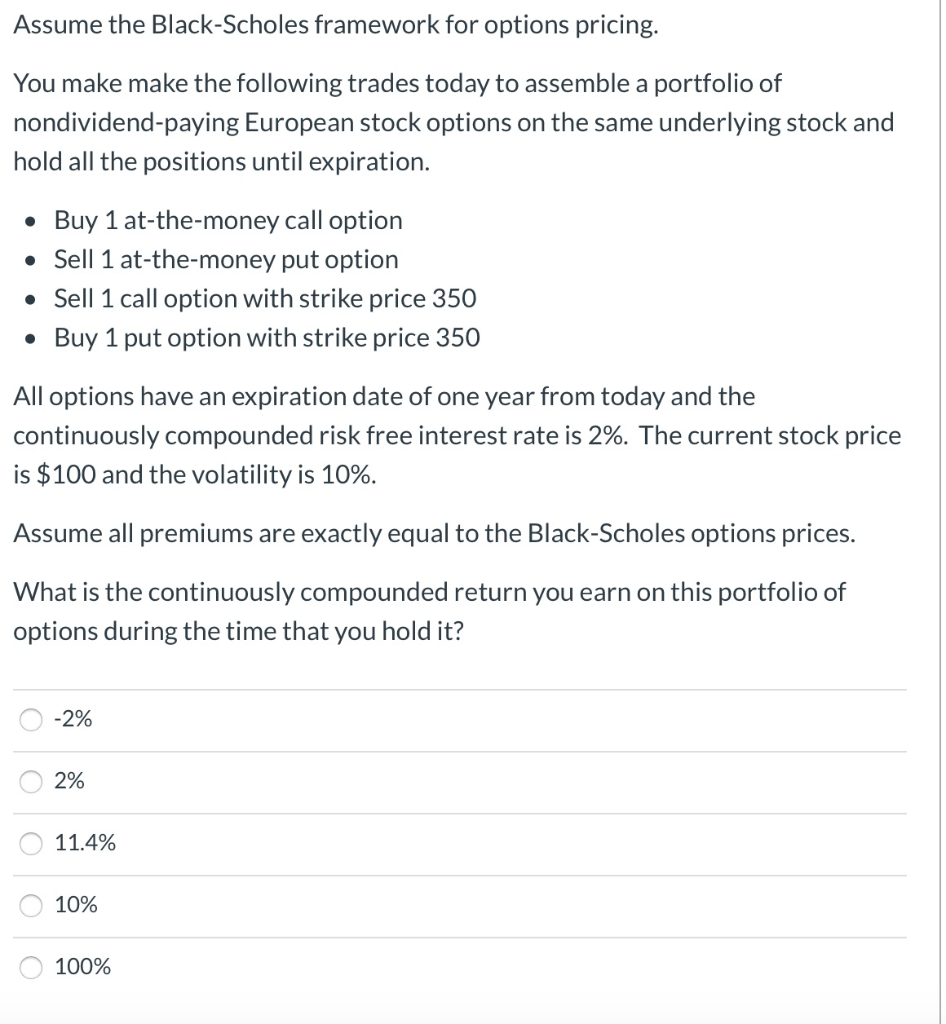

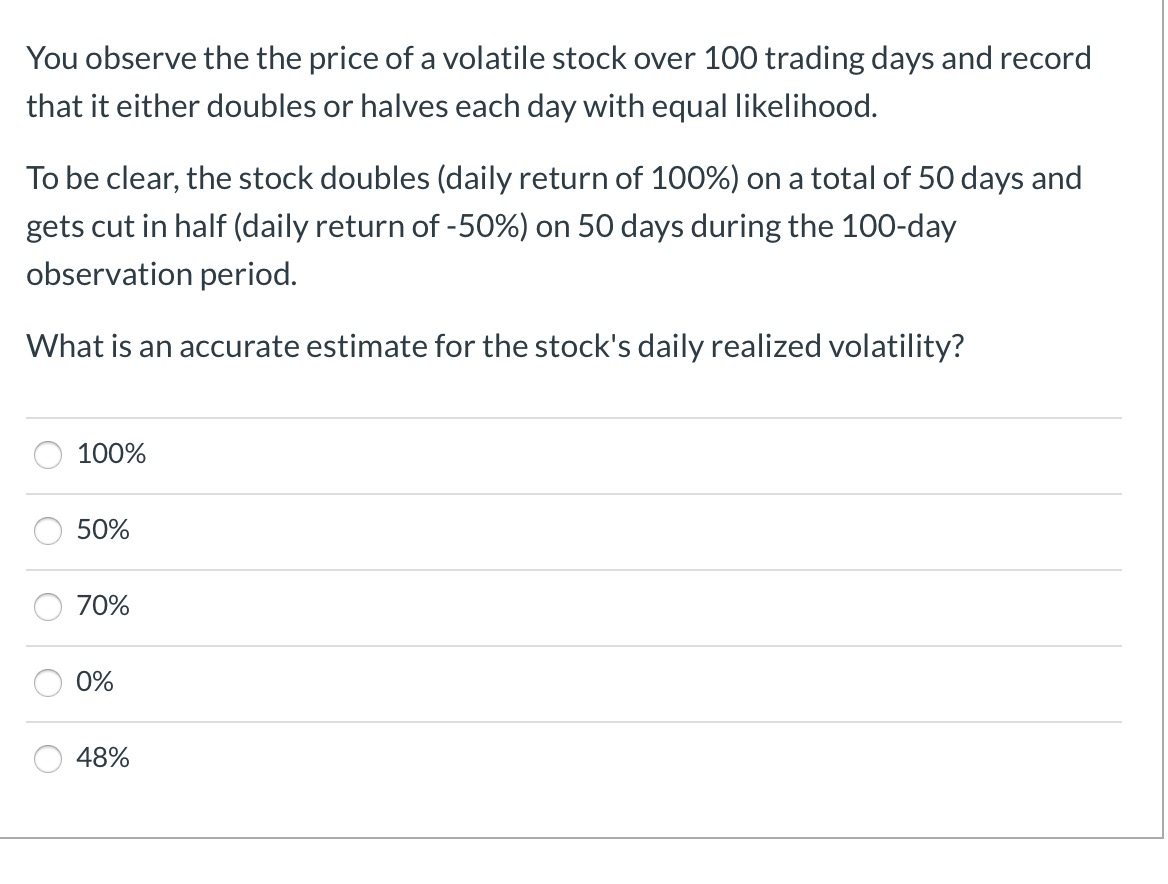

Assume the Black-Scholes framework for options pricing. You make make the following trades today to assemble a portfolio of nondividend-paying European stock options on the same underlying stock and hold all the positions until expiration. Buy 1 at-the-money call option Sell 1 at-the-money put option Sell 1 call option with strike price 350 Buy 1 put option with strike price 350 All options have an expiration date of one year from today and the continuously compounded risk free interest rate is 2%. The current stock price is $100 and the volatility is 10%. Assume all premiums are exactly equal to the Black-Scholes options prices. What is the continuously compounded return you earn on this portfolio of options during the time that you hold it? 0 -2% o 2% 11.4% O 10% 100% You observe the the price of a volatile stock over 100 trading days and record that it either doubles or halves each day with equal likelihood. To be clear, the stock doubles (daily return of 100%) on a total of 50 days and gets cut in half (daily return of -50%) on 50 days during the 100-day observation period. What is an accurate estimate for the stock's daily realized volatility? O 100% o 50% O 70% O 0% 0 48% Assume the Black-Scholes framework for options pricing. You make make the following trades today to assemble a portfolio of nondividend-paying European stock options on the same underlying stock and hold all the positions until expiration. Buy 1 at-the-money call option Sell 1 at-the-money put option Sell 1 call option with strike price 350 Buy 1 put option with strike price 350 All options have an expiration date of one year from today and the continuously compounded risk free interest rate is 2%. The current stock price is $100 and the volatility is 10%. Assume all premiums are exactly equal to the Black-Scholes options prices. What is the continuously compounded return you earn on this portfolio of options during the time that you hold it? 0 -2% o 2% 11.4% O 10% 100% You observe the the price of a volatile stock over 100 trading days and record that it either doubles or halves each day with equal likelihood. To be clear, the stock doubles (daily return of 100%) on a total of 50 days and gets cut in half (daily return of -50%) on 50 days during the 100-day observation period. What is an accurate estimate for the stock's daily realized volatility? O 100% o 50% O 70% O 0% 0 48%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts