Answered step by step

Verified Expert Solution

Question

1 Approved Answer

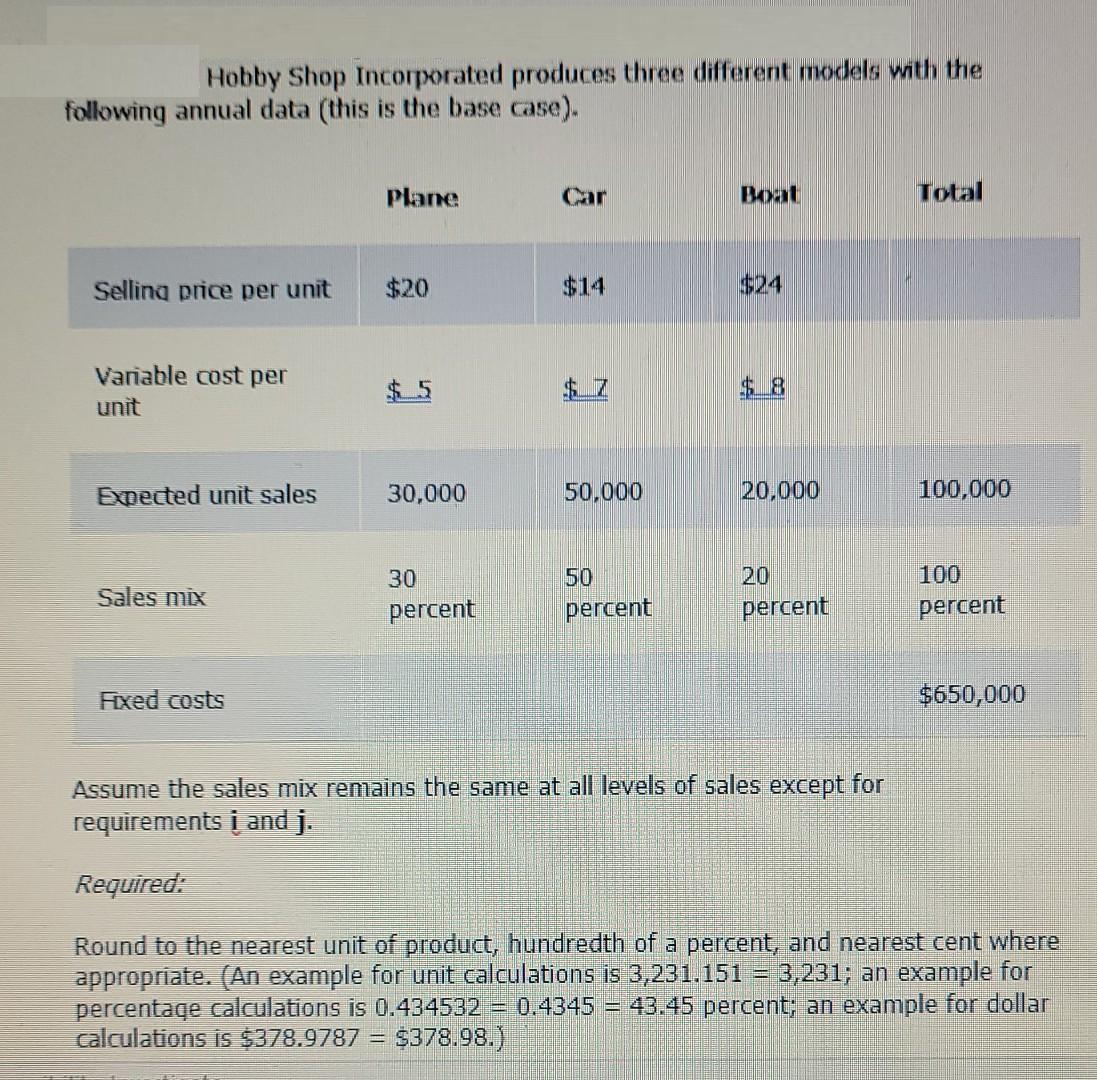

Hobby Shop Incorporated produces three different models with the following annual data (this is the base case). Selling price per unit Variable cost per

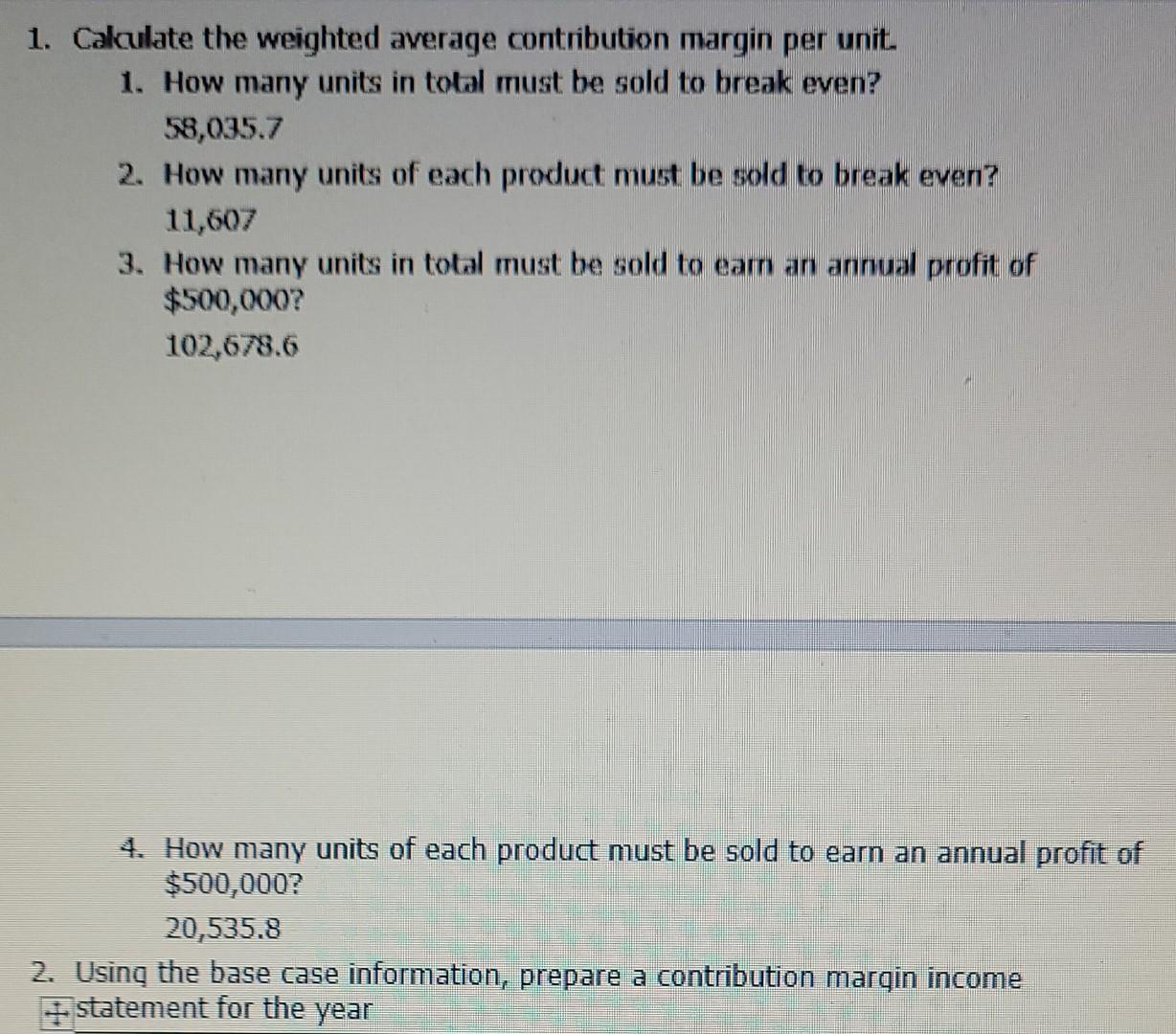

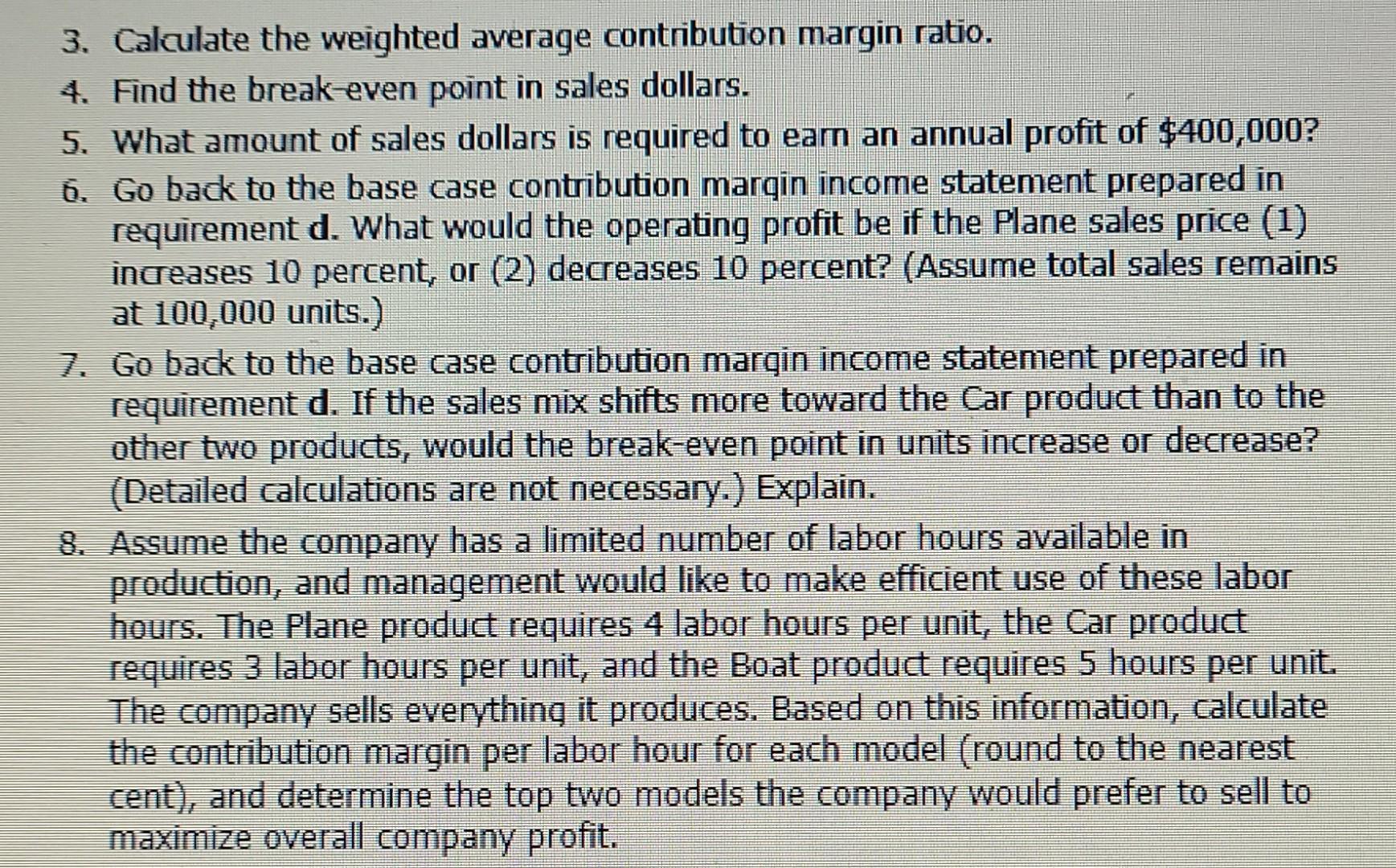

Hobby Shop Incorporated produces three different models with the following annual data (this is the base case). Selling price per unit Variable cost per unit Expected unit sales Sales mix Fixed costs Plane $20 $5 30,000 30 percent Car $14 $7 50,000 50 percent Boat $24 20,000 20 percent Total 100,000 100 percent $650,000 Assume the sales mix remains the same at all levels of sales except for requirements i and j. Required: Round to the nearest unit of product, hundredth of a percent, and nearest cent where appropriate. (An example for unit calculations is 3,231.151 = 3,231; an example for percentage calculations is 0.434532 = 0.4345 = 43.45 percent; an example for dollar calculations is $378.9787 = $378.98.) 1. Calculate the weighted average contribution margin per unit. 1. How many units in total must be sold to break even? 58,035.7 2. How many units of each product must be sold to break even? 11,607 3. How many units in total must be sold to earn an annual profit of $500,000? 102,678.6 4. How many units of each product must be sold to earn an annual profit of $500,000? 20,535.8 2. Using the base case information, prepare a contribution margin income + statement for the year 3. Calculate the weighted average contribution margin ratio. 4. Find the break-even point in sales dollars. 5. What amount of sales dollars is required to earn an annual profit of $400,000? 6. Go back to the base case contribution margin income statement prepared in requirement d. What would the operating profit be if the Plane sales price (1) increases 10 percent, or (2) decreases 10 percent? (Assume total sales remains at 100,000 units.) 7. Go back to the base case contribution margin income statement prepared in requirement d. If the sales mix shifts more toward the Car product than to the other two products, would the break-even point in units increase or decrease? (Detailed calculations are not necessary.) Explain. 8. Assume the company has a limited number of labor hours available in production, and management would like to make efficient use of these labor hours. The Plane product requires 4 labor hours per unit, the Car product requires 3 labor hours per unit, and the Boat product requires 5 hours per unit. The company sells everything it produces. Based on this information, calculate the contribution margin per labor hour for each model (round to the nearest cent), and determine the top two models the company would prefer to sell to maximize overall company profit.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Lets tackle each requirement step by step Calculate the weighted average contribution margin per unit Weighted average contribution margin per unit Contribution margin per unit of Plane Sales m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started