Answered step by step

Verified Expert Solution

Question

1 Approved Answer

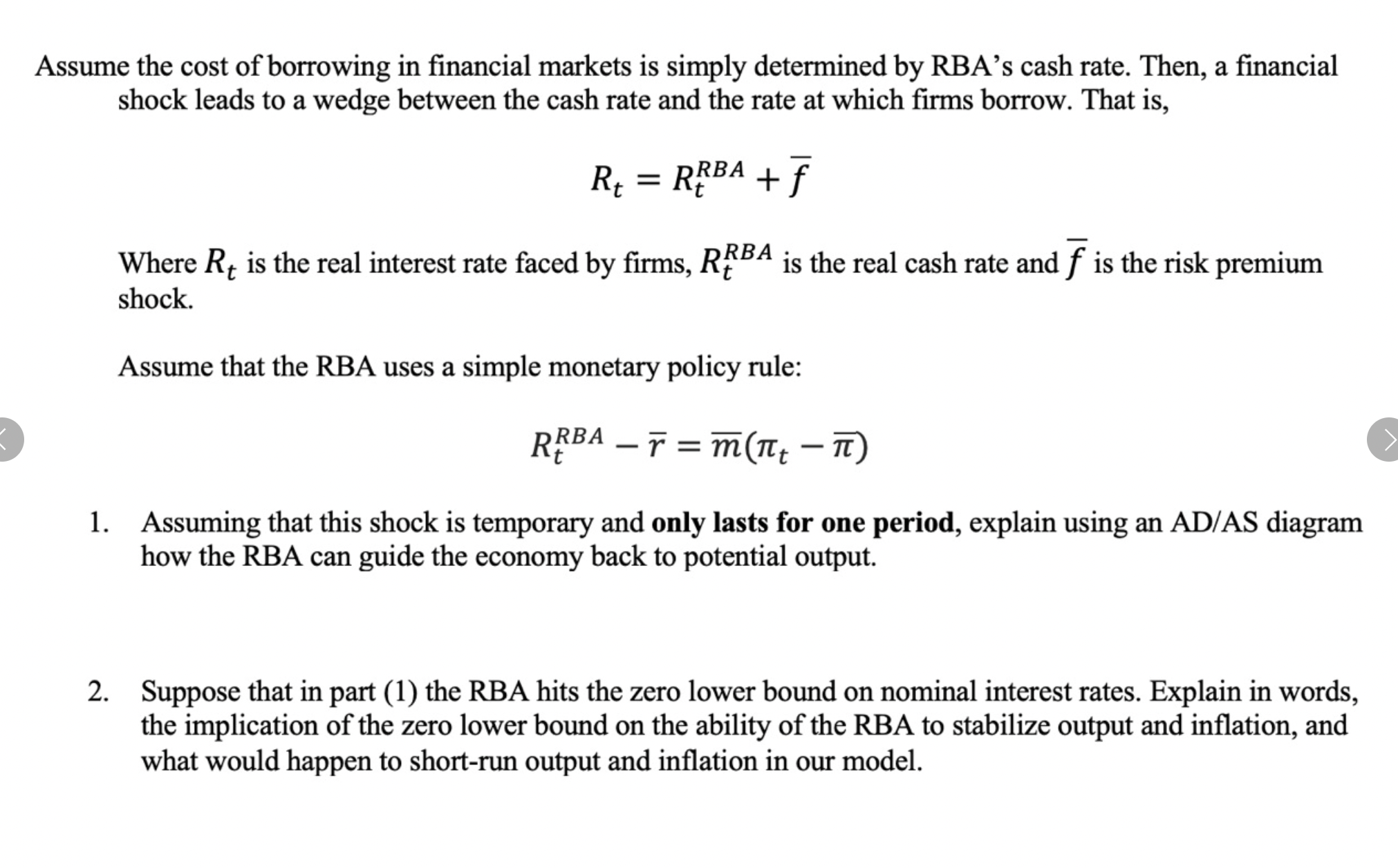

Assume the cost of borrowing in financial markets is simply determined by RBA's cash rate. Then, a financial shock leads to a wedge between

Assume the cost of borrowing in financial markets is simply determined by RBA's cash rate. Then, a financial shock leads to a wedge between the cash rate and the rate at which firms borrow. That is, R = RRBA + f Where Rt is the real interest rate faced by firms, RRBA is the real cash rate and f is the risk premium shock. Assume that the RBA uses a simple monetary policy rule: RRBAT = m( - ) 1. Assuming that this shock is temporary and only lasts for one period, explain using an AD/AS diagram how the RBA can guide the economy back to potential output. 2. Suppose that in part (1) the RBA hits the zero lower bound on nominal interest rates. Explain in words, the implication of the zero lower bound on the ability of the RBA to stabilize output and inflation, and what would happen to short-run output and inflation in our model.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 In the case of a temporary shock that causes a wedge between the cash rate and the borrowing rate the RBA can employ monetary policy to guide the ec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started