Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume the existence of a financial asset whose current (spot) price is St. This asset pays no dividends. A forward contract on this asset

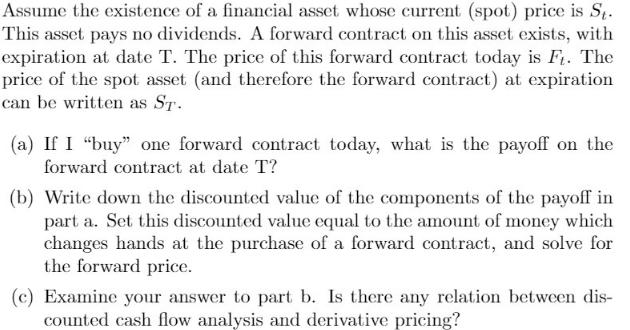

Assume the existence of a financial asset whose current (spot) price is St. This asset pays no dividends. A forward contract on this asset exists, with expiration at date T. The price of this forward contract today is Ft. The price of the spot asset (and therefore the forward contract) at expiration can be written as ST. (a) If I "buy" one forward contract today, what is the payoff on the forward contract at date T? (b) Write down the discounted value of the components of the payoff in part a. Set this discounted value equal to the amount of money which changes hands at the purchase of a forward contract, and solve for the forward price. (c) Examine your answer to part b. Is there any relation between dis- counted cash flow analysis and derivative pricing?

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a The payoff on the forward contract at date T depends on the spot price at expiration ST and the fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started