Answered step by step

Verified Expert Solution

Question

1 Approved Answer

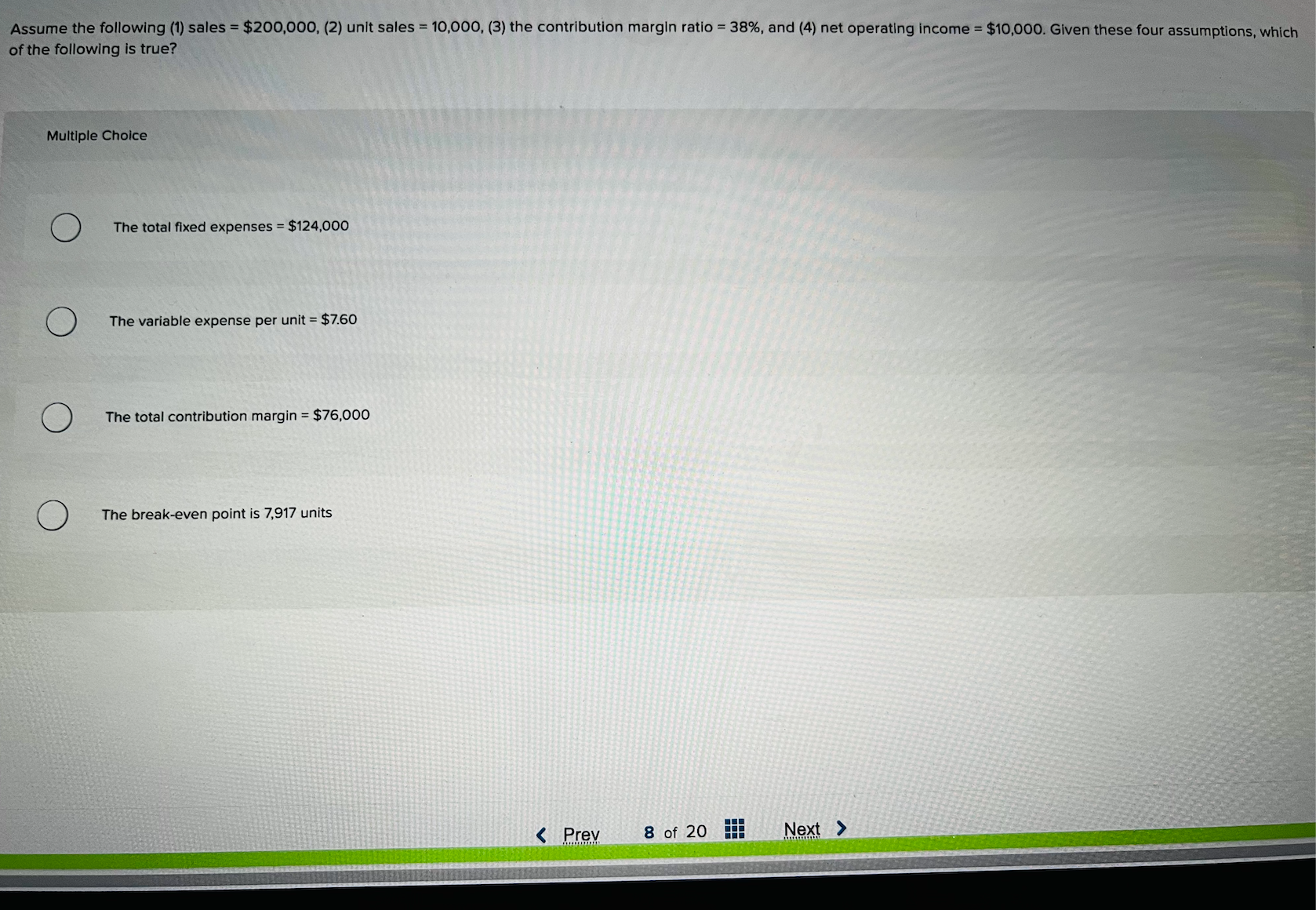

Assume the following ( 1 ) sales = $ 2 0 0 , 0 0 0 , ( 2 ) unit sales = 1 0

Assume the following sales $ unit sales the contribution margin ratio and net operating income $ Given these four assumptions, which What is the total fixed selling and administrative cost?

Multiple Choice

$

$

$ Fixed expenses are $ per month. The company is currently selling units per month.

Required:

The marketing manager has proposed a commission of $ per unit. In exchange, the sales staff would accept an overall decrease in their salaries of $ per

month. The marketing manager predicts that introducing this sales incentive would increase monthly sales by units. What should

be the overall effect on the company's monthly net operating income of this change? Required:

Compute Rehema's breakeven point in units and also in dollar sales.

A proposal is being made by management to Increase monthly advertising by $ It is estimated that this advertising will yield an

increase of $ in sales per month. Using this proposal, what will be the increase decrease in the company's monthly net

operating income?

Refer to the original data. A second alternative proposal recommends that the selling price be reduced by followed by an

increase in monthly advertising of $ This will double unit sales. Using this alternative proposal, what will be the revised net

operating income loss

Refer to the original data. A third proposal has emerged. If the company replaces its labor force with automation, variable expenses

will reduce by $ per unit. However, this automation would increase fixed expenses by $ each month.

a Compute the new breakeven point in unit sales and dollar sales.

b Assume that the company expects to sell units next month. Prepare two contribution format income statements, one

assuming that operations are not automated and one assuming that they are. Show data on a per unit and percentage basis, as

well as in total, for each alternative.

c Would you recommend that the company automate its operations Assuming that the company expects to sell units

Complete this question by entering your answers in the tabs below.

Compute the company's breakeven point in unit sales and dollar sales. Do not round

intermediate calculations.Rehema Corporation, a company located in the beautiful Paciflc NorthWest, manufactures a single product in its Tacoma Factory. Sales

have been very erratic lately, and the financlal health of the company is in jeopardy. For the most recent month, Rehema's contribution

format income statement is as follows:

Required:

Compute Rehema's breakeven point in units and also in dollar sales.

A proposal is being made by management to Increase monthly advertlsing by $ It is estimated that this advertising will yield an

increase of $ in sales per month. Using this proposal, what will be the increase decrease in the company's monthly net

operating income?

Refer to the original data. A second alternative proposal recommends that the selling price be reduced by followed by an

increase in monthly advertising of $ This will double unit sales. Using this alternative proposal, what will be the revised net

operating income loss

Refer to the original data. A third proposal has emerged. If the company replaces its labor force with automation, variable expenses

will reduce by $ per unit. However, this automation would increase fixed expenses by $ each month.

a Compute the new breakeven point in unit sales and dollar sales.

b Assume that the company expects to sell units next month. Prepare two contribution format income statements, one

assuming that operations are not automated and one assuming that they are. Show data on per unit and percentage basis, as

well as in total, for each alternative.

c Would you recommend that the company automate its operations Assuming that the

of the following is true?

Multiple Choice

The total fixed expenses $

The variable expense per unit $

The total contribution margin $

The breakeven point is units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started