Answered step by step

Verified Expert Solution

Question

1 Approved Answer

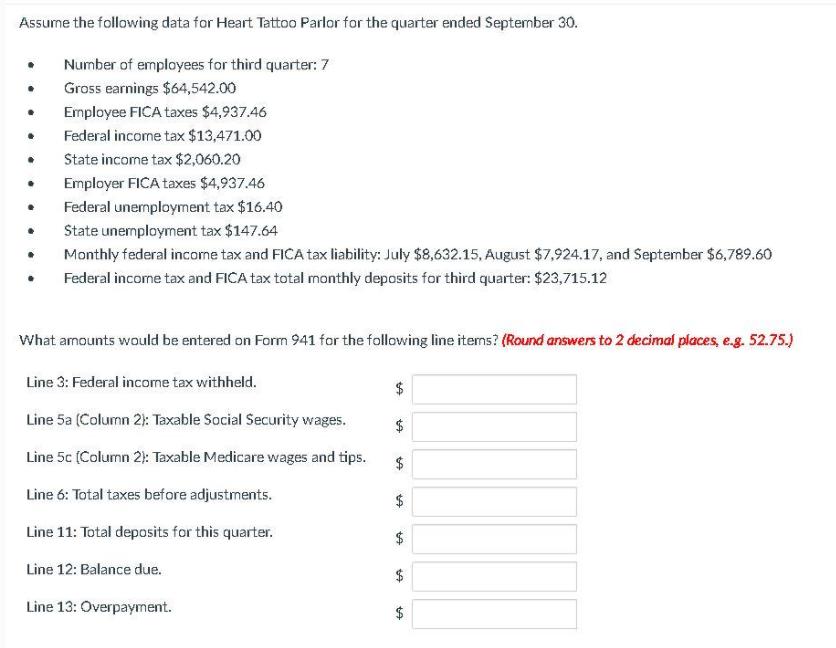

Assume the following data for Heart Tattoo Parlor for the quarter ended September 30. Number of employees for third quarter: 7 Gross earnings $64,542.00

Assume the following data for Heart Tattoo Parlor for the quarter ended September 30. Number of employees for third quarter: 7 Gross earnings $64,542.00 Employee FICA taxes $4,937.46 Federal income tax $13,471.00 State income tax $2,060.20 Employer FICA taxes $4,937.46 Federal unermployment tax $16.40 State unemployment tax $147.64 Monthly federal income tax and FICA tax liability: July $8,632.15, August $7,924.17, and September $6,789.60 Federal income tax and FICA tax total monthly deposits for third quarter: $23,715.12 What amounts would be entered on Form 941 for the following line items? (Round answers to 2 decimal places, e.g. 52.75.) Line 3: Federal income tax withheld. 24 Line 5a (Column 2): Taxable Social Security wages. Line 5c (Column 2): Taxable Medicare wages and tips. Line 6: Total taxes before adjustments. $ Line 11: Total deposits for this quarter. Line 12: Balance due. Line 13: Overpayment. %24 %24 %24 %24

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6095377f176ea_210827.pdf

180 KBs PDF File

6095377f176ea_210827.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started