Answered step by step

Verified Expert Solution

Question

1 Approved Answer

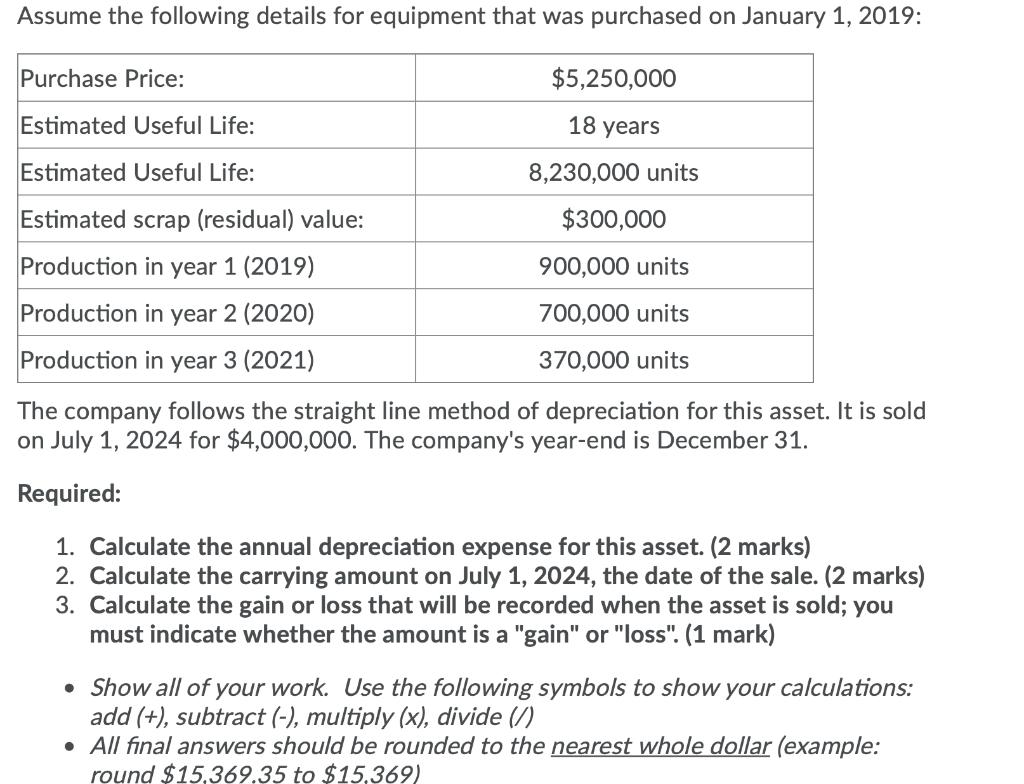

Assume the following details for equipment that was purchased on January 1, 2019: Purchase Price: Estimated Useful Life: Estimated Useful Life: Estimated scrap (residual)

Assume the following details for equipment that was purchased on January 1, 2019: Purchase Price: Estimated Useful Life: Estimated Useful Life: Estimated scrap (residual) value: Production in year 1 (2019) Production in year 2 (2020) Production in year 3 (2021) $5,250,000 18 years 8,230,000 units $300,000 900,000 units 700,000 units 370,000 units The company follows the straight line method of depreciation for this asset. It is sold on July 1, 2024 for $4,000,000. The company's year-end is December 31. Required: 1. Calculate the annual depreciation expense for this asset. (2 marks) 2. Calculate the carrying amount on July 1, 2024, the date of the sale. (2 marks) 3. Calculate the gain or loss that will be recorded when the asset is sold; you must indicate whether the amount is a "gain" or "loss". (1 mark) Show all of your work. Use the following symbols to show your calculations: add (+), subtract (-), multiply (x), divide (/) All final answers should be rounded to the nearest whole dollar (example: round $15,369.35 to $15,369)

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 Under the straight line method depreciation is calculated by the following formula Depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started