Answered step by step

Verified Expert Solution

Question

1 Approved Answer

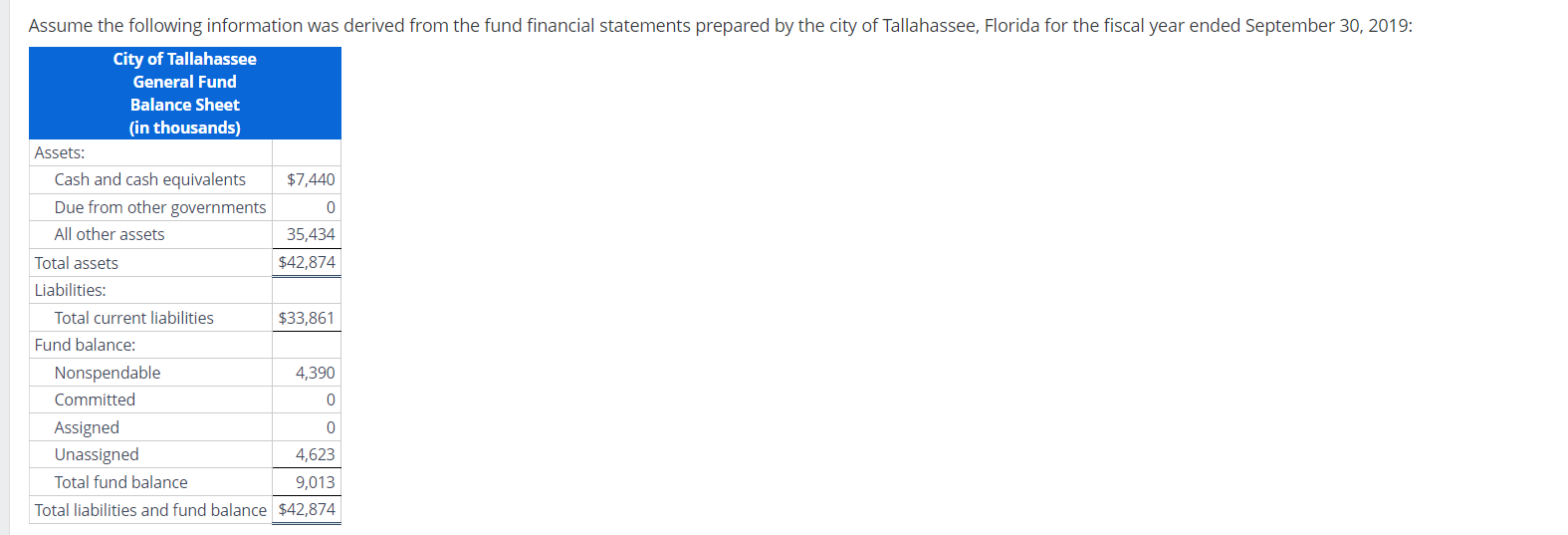

Assume the following information was derived from the fund financial statements prepared by the city of Tallahassee, Florida for the fiscal year ended September 30

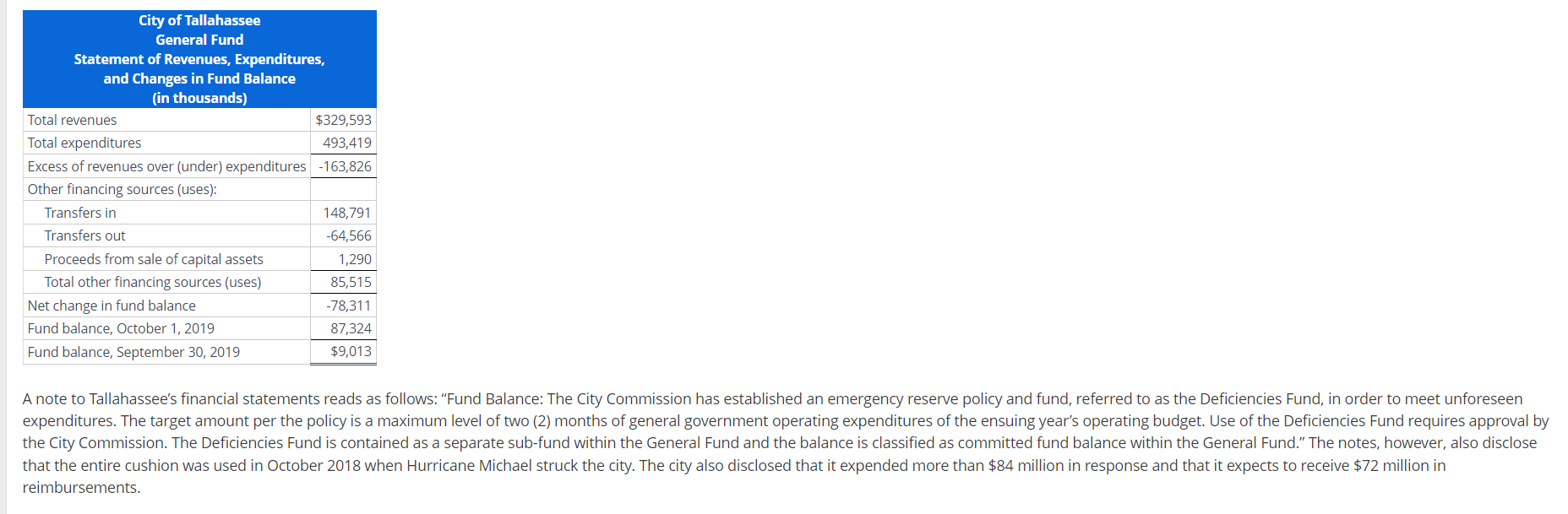

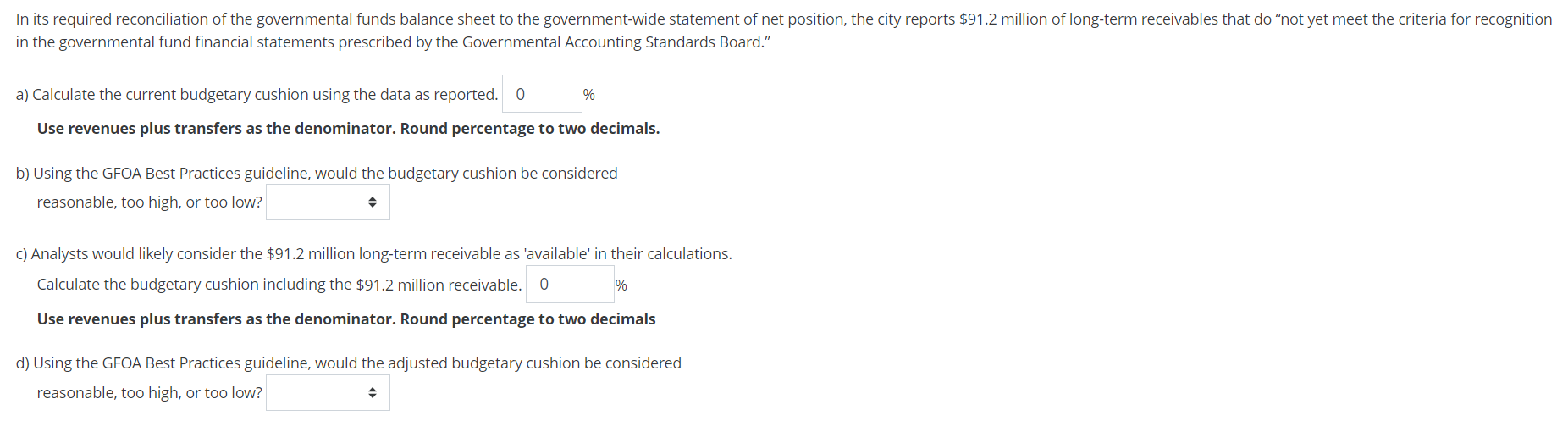

Assume the following information was derived from the fund financial statements prepared by the city of Tallahassee, Florida for the fiscal year ended September 30 , 2019: \begin{tabular}{|l|r|} \hline \multicolumn{1}{|c|}{CityofTallahasseeGeneralFundBalanceSheet(inthousands)} \\ \hline Assets: \\ \hline Cash and cash equivalents & $7,440 \\ \hline Due from other governments & 0 \\ \hline All other assets & 35,434 \\ \hline Total assets & $42,874 \\ \hline Liabilities: & \\ \hline Total current liabilities & $33,861 \\ \hline Fund balance: & \\ \hline Nonspendable & 4,390 \\ \hline Committed & 0 \\ \hline Assigned & 0 \\ \hline Unassigned & 4,623 \\ \hline Total fund balance & 9,013 \\ \hline Total liabilities and fund balance & $42,874 \\ \hline \hline \end{tabular} reimbursements. in the governmental fund financial statements prescribed by the Governmental Accounting Standards Board." a) Calculate the current budgetary cushion using the data as reported. % Use revenues plus transfers as the denominator. Round percentage to two decimals. b) Using the GFOA Best Practices guideline, would the budgetary cushion be considered reasonable, too high, or too low? c) Analysts would likely consider the $91.2 million long-term receivable as 'available' in their calculations. Calculate the budgetary cushion including the $91.2 million receivable. % Use revenues plus transfers as the denominator. Round percentage to two decimals d) Using the GFOA Best Practices guideline, would the adjusted budgetary cushion be considered reasonable, too high, or too low

Assume the following information was derived from the fund financial statements prepared by the city of Tallahassee, Florida for the fiscal year ended September 30 , 2019: \begin{tabular}{|l|r|} \hline \multicolumn{1}{|c|}{CityofTallahasseeGeneralFundBalanceSheet(inthousands)} \\ \hline Assets: \\ \hline Cash and cash equivalents & $7,440 \\ \hline Due from other governments & 0 \\ \hline All other assets & 35,434 \\ \hline Total assets & $42,874 \\ \hline Liabilities: & \\ \hline Total current liabilities & $33,861 \\ \hline Fund balance: & \\ \hline Nonspendable & 4,390 \\ \hline Committed & 0 \\ \hline Assigned & 0 \\ \hline Unassigned & 4,623 \\ \hline Total fund balance & 9,013 \\ \hline Total liabilities and fund balance & $42,874 \\ \hline \hline \end{tabular} reimbursements. in the governmental fund financial statements prescribed by the Governmental Accounting Standards Board." a) Calculate the current budgetary cushion using the data as reported. % Use revenues plus transfers as the denominator. Round percentage to two decimals. b) Using the GFOA Best Practices guideline, would the budgetary cushion be considered reasonable, too high, or too low? c) Analysts would likely consider the $91.2 million long-term receivable as 'available' in their calculations. Calculate the budgetary cushion including the $91.2 million receivable. % Use revenues plus transfers as the denominator. Round percentage to two decimals d) Using the GFOA Best Practices guideline, would the adjusted budgetary cushion be considered reasonable, too high, or too low Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started