Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume the following list of prices (quoted in ticks) for U.S. Treasury bonds is available on January 15th 2013 and use this information to

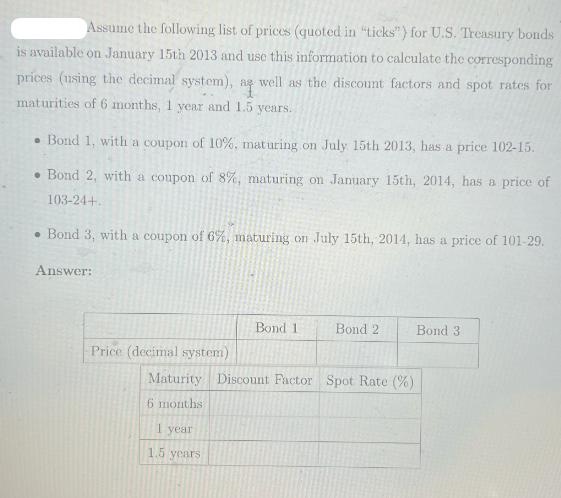

Assume the following list of prices (quoted in "ticks") for U.S. Treasury bonds is available on January 15th 2013 and use this information to calculate the corresponding prices (using the decimal system), as well as the discount factors and spot rates for maturities of 6 months, 1 year and 1.5 years. Bond 1, with a coupon of 10%, maturing on July 15th 2013, has a price 102-15. Bond 2, with a coupon of 8%, maturing on January 15th, 2014, has a price of 103-24+. Bond 3, with a coupon of 6%, maturing on July 15th, 2014, has a price of 101-29. Answer: Price (decimal system) Bond 11 1 year 1.5 years Bond 2 Maturity Discount Factor Spot Rate (%) 6 months. Bond 3

Step by Step Solution

★★★★★

3.22 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

I see youve provided a question related to the pricing of US Treasury bonds and the task to find the corresponding prices in decimal form discount fac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started