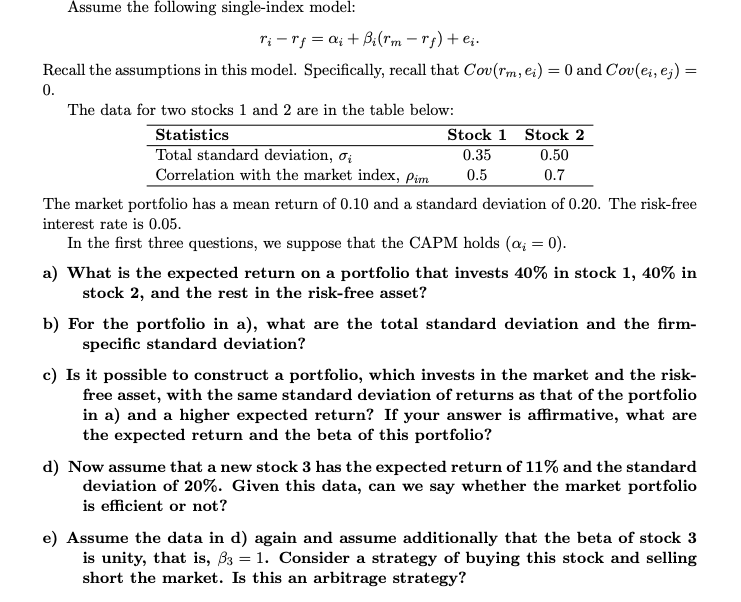

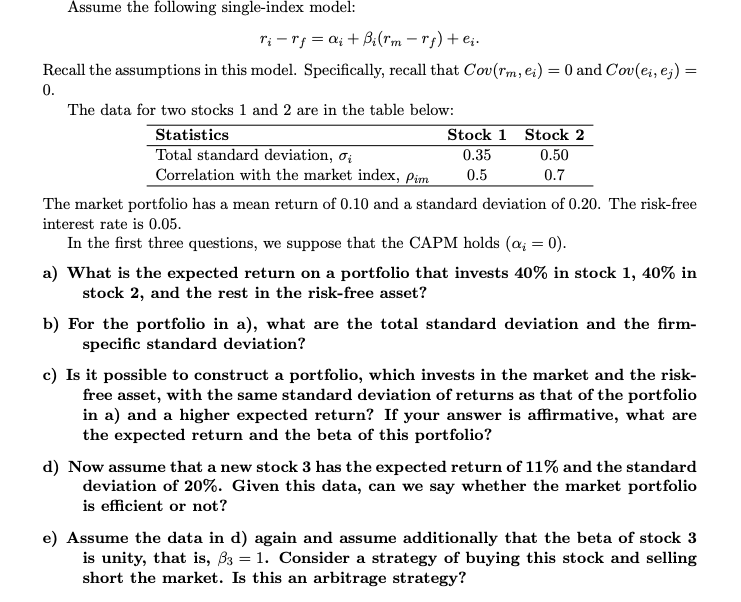

Assume the following single-index model: ri-ry= 0; + Bi(rm-ri) +e;. Recall the assumptions in this model. Specifically, recall that Courm, ei) = 0 and Coulei, ej) = 0. The data for two stocks 1 and 2 are in the table below: Statistics Stock 1 Stock 2 Total standard deviation, o 0.35 0.50 Correlation with the market index, Pim 0.5 0.7 The market portfolio has a mean return of 0.10 and a standard deviation of 0.20. The risk-free interest rate is 0.05. In the first three questions, we suppose that the CAPM holds (Q; = 0). a) What is the expected return on a portfolio that invests 40% in stock 1, 40% in stock 2, and the rest in the risk-free asset? b) For the portfolio in a), what are the total standard deviation and the firm- specific standard deviation? c) Is it possible to construct a portfolio, which invests in the market and the risk- free asset, with the same standard deviation of returns as that of the portfolio in a) and a higher expected return? If your answer is affirmative, what are the expected return and the beta of this portfolio? d) Now assume that a new stock 3 has the expected return of 11% and the standard deviation of 20%. Given this data, can we say whether the market portfolio is efficient or not? e) Assume the data in d) again and assume additionally that the beta of stock 3 is unity, that is, B3 = 1. Consider a strategy of buying this stock and selling short the market. Is this an arbitrage strategy? Assume the following single-index model: ri-ry= 0; + Bi(rm-ri) +e;. Recall the assumptions in this model. Specifically, recall that Courm, ei) = 0 and Coulei, ej) = 0. The data for two stocks 1 and 2 are in the table below: Statistics Stock 1 Stock 2 Total standard deviation, o 0.35 0.50 Correlation with the market index, Pim 0.5 0.7 The market portfolio has a mean return of 0.10 and a standard deviation of 0.20. The risk-free interest rate is 0.05. In the first three questions, we suppose that the CAPM holds (Q; = 0). a) What is the expected return on a portfolio that invests 40% in stock 1, 40% in stock 2, and the rest in the risk-free asset? b) For the portfolio in a), what are the total standard deviation and the firm- specific standard deviation? c) Is it possible to construct a portfolio, which invests in the market and the risk- free asset, with the same standard deviation of returns as that of the portfolio in a) and a higher expected return? If your answer is affirmative, what are the expected return and the beta of this portfolio? d) Now assume that a new stock 3 has the expected return of 11% and the standard deviation of 20%. Given this data, can we say whether the market portfolio is efficient or not? e) Assume the data in d) again and assume additionally that the beta of stock 3 is unity, that is, B3 = 1. Consider a strategy of buying this stock and selling short the market. Is this an arbitrage strategy